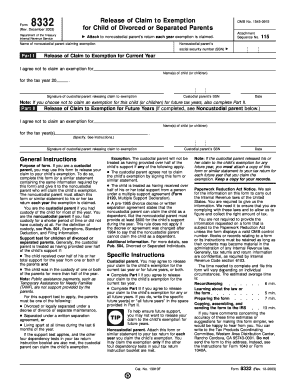

F8332 Tax Form

What is the F8332 Tax Form

The F8332 tax form is an IRS document used by custodial parents to release a child's dependency exemption to the non-custodial parent. This form is essential for tax purposes, as it allows the non-custodial parent to claim the child as a dependent on their tax return. The form must be completed and signed by the custodial parent, indicating their consent for the non-custodial parent to claim the exemption.

How to use the F8332 Tax Form

To effectively use the F8332 tax form, the custodial parent must fill out the required information accurately. This includes the names and Social Security numbers of both parents and the child. Once completed, the form should be provided to the non-custodial parent, who will submit it with their tax return. It is important to ensure that the form is signed and dated to validate the release of the dependency exemption.

Steps to complete the F8332 Tax Form

Completing the F8332 tax form involves several key steps:

- Obtain the F8332 form from the IRS website or a tax professional.

- Fill in the names and Social Security numbers of both parents and the child.

- Indicate the tax year for which the exemption is being released.

- Sign and date the form to confirm consent.

- Provide the completed form to the non-custodial parent for their tax filing.

Legal use of the F8332 Tax Form

The F8332 tax form is legally binding when properly completed and signed. It is crucial for both parents to understand that the custodial parent's signature is necessary for the non-custodial parent to claim the dependency exemption. Failure to adhere to the legal requirements can result in complications during tax filing, including potential audits or penalties.

Filing Deadlines / Important Dates

When using the F8332 tax form, it is important to be aware of key filing deadlines. The form should be completed and provided to the non-custodial parent before they file their annual tax return, typically due on April fifteenth. Ensuring timely submission helps prevent issues with tax claims and maintains compliance with IRS regulations.

Required Documents

To complete the F8332 tax form, certain documents may be necessary:

- Proof of custody arrangement, if applicable.

- Social Security numbers for both parents and the child.

- Any previous tax returns that may provide context for the dependency exemption.

Penalties for Non-Compliance

Failure to comply with the requirements of the F8332 tax form can lead to significant penalties. If the non-custodial parent claims the exemption without proper documentation, they may face audits, fines, and the potential for having to repay any tax benefits received. It is essential for both parents to understand the implications of not following the correct procedures.

Quick guide on how to complete f8332 tax form

Complete F8332 Tax Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents swiftly without delays. Manage F8332 Tax Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign F8332 Tax Form without any hassle

- Locate F8332 Tax Form and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign F8332 Tax Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8332 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the F8332 tax form?

The F8332 tax form is used to release a claim to an exemption for a child by the custodial parent, allowing the non-custodial parent to claim the child as a dependent on their tax return. Understanding the F8332 tax form is essential for parents looking to optimize their tax benefits efficiently.

-

How can airSlate SignNow help me with the F8332 tax form?

airSlate SignNow allows you to easily eSign and send the F8332 tax form securely, ensuring that communication between both parents is streamlined and efficient. Our platform offers a user-friendly interface that simplifies the completion and signing process for necessary documents like the F8332 tax form.

-

Is there a cost associated with using airSlate SignNow for the F8332 tax form?

While airSlate SignNow offers various pricing plans, the basic plan is cost-effective and provides ample features for managing documents, including the F8332 tax form. You can choose a plan that suits your needs without overspending on additional features you may not require.

-

Are there any integrations available for the F8332 tax form with airSlate SignNow?

Yes, airSlate SignNow offers integrations with numerous software applications, enhancing your workflow when dealing with the F8332 tax form. This includes popular accounting software, document storage solutions, and productivity tools, making it easier to manage all your paperwork.

-

What features does airSlate SignNow offer for managing the F8332 tax form?

AirSlate SignNow provides features such as templates, real-time tracking, and secure document storage, all of which are beneficial when handling the F8332 tax form. These features ensure that your documents are organized, accessible, and compliant with necessary regulations.

-

How does airSlate SignNow ensure the security of the F8332 tax form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents such as the F8332 tax form. We implement advanced encryption and compliance measures to safeguard your data from unauthorized access, providing peace of mind throughout your eSigning process.

-

Can I make edits to the F8332 tax form after sending it for signature?

Once the F8332 tax form is sent for signature, you cannot make changes until it has been fully signed and completed. However, you can create a new template based on the original document if adjustments are necessary, ensuring that the final version meets all requirements.

Get more for F8332 Tax Form

Find out other F8332 Tax Form

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament