Application for Refund Pennsylvania Realty Transfer Tax REV 1651 2019

What is the Application For Refund Pennsylvania Realty Transfer Tax REV 1651

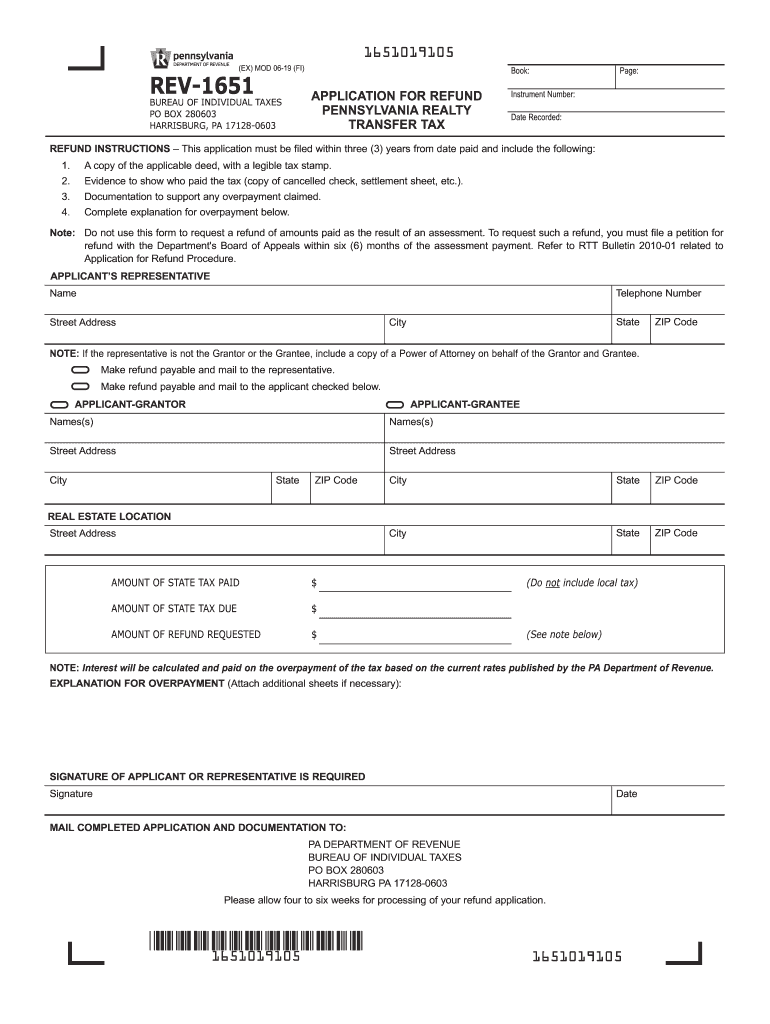

The Application For Refund Pennsylvania Realty Transfer Tax REV 1651 is a form used by individuals or entities seeking a refund of the Realty Transfer Tax paid during real estate transactions in Pennsylvania. This tax is levied on the transfer of real property and is typically paid at the time of sale. The form serves as a formal request to the Pennsylvania Department of Revenue for a reimbursement of this tax under specific circumstances, such as overpayment or exemptions that may apply to the transaction.

How to use the Application For Refund Pennsylvania Realty Transfer Tax REV 1651

To effectively use the Application For Refund Pennsylvania Realty Transfer Tax REV 1651, individuals should first ensure they meet the eligibility criteria for a refund. Once confirmed, the form must be completed with accurate information regarding the property transaction, including details of the transfer, the amount of tax paid, and the reason for the refund request. After filling out the form, it should be submitted to the appropriate state department, either online or via mail, depending on the submission method chosen.

Steps to complete the Application For Refund Pennsylvania Realty Transfer Tax REV 1651

Completing the Application For Refund Pennsylvania Realty Transfer Tax REV 1651 involves several key steps:

- Gather necessary documents related to the property transfer, including the original deed and proof of tax payment.

- Download the form from the Pennsylvania Department of Revenue website or obtain a physical copy.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Attach any supporting documentation that justifies the refund request.

- Review the completed form for accuracy before submission.

- Submit the form via the chosen method, either electronically or by mail.

Required Documents

When submitting the Application For Refund Pennsylvania Realty Transfer Tax REV 1651, certain documents must accompany the form to support the refund request. These typically include:

- A copy of the original deed showing the property transfer.

- Proof of payment of the Realty Transfer Tax, such as a receipt or tax statement.

- Any additional documentation that demonstrates eligibility for the refund, such as exemption certificates if applicable.

Eligibility Criteria

To qualify for a refund using the Application For Refund Pennsylvania Realty Transfer Tax REV 1651, applicants must meet specific eligibility criteria. Common reasons for eligibility include:

- Overpayment of the Realty Transfer Tax due to clerical errors.

- Transactions that qualify for exemptions under Pennsylvania law.

- Transfers that did not occur as originally intended, leading to tax payments that should not have been made.

Form Submission Methods (Online / Mail / In-Person)

The Application For Refund Pennsylvania Realty Transfer Tax REV 1651 can be submitted through various methods, providing flexibility for applicants. Options include:

- Online Submission: If available, applicants may submit the form electronically through the Pennsylvania Department of Revenue’s online portal.

- Mail Submission: The completed form and supporting documents can be mailed to the designated address provided on the form.

- In-Person Submission: Applicants may also choose to deliver the form directly to a local Pennsylvania Department of Revenue office, if applicable.

Quick guide on how to complete application for refund pennsylvania realty transfer tax rev 1651

Effortlessly Complete Application For Refund Pennsylvania Realty Transfer Tax REV 1651 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Application For Refund Pennsylvania Realty Transfer Tax REV 1651 on any device using airSlate SignNow’s Android or iOS applications and streamline any document-centric process today.

How to Edit and eSign Application For Refund Pennsylvania Realty Transfer Tax REV 1651 with Ease

- Locate Application For Refund Pennsylvania Realty Transfer Tax REV 1651 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specially offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Application For Refund Pennsylvania Realty Transfer Tax REV 1651 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for refund pennsylvania realty transfer tax rev 1651

Create this form in 5 minutes!

How to create an eSignature for the application for refund pennsylvania realty transfer tax rev 1651

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

The Application For Refund Pennsylvania Realty Transfer Tax REV 1651 is a form used to request a refund of the Pennsylvania Realty Transfer Tax. This application is essential for individuals or businesses who have overpaid this tax during real estate transactions. Completing this form accurately ensures that you can reclaim the funds owed to you.

-

How can airSlate SignNow assist with the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

airSlate SignNow provides a streamlined platform for completing and eSigning the Application For Refund Pennsylvania Realty Transfer Tax REV 1651. Our user-friendly interface allows you to fill out the form digitally, ensuring accuracy and efficiency. Additionally, you can securely send the completed application to the relevant authorities.

-

What are the benefits of using airSlate SignNow for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

Using airSlate SignNow for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651 offers several benefits, including time savings and enhanced security. Our platform allows for quick document preparation and eSigning, reducing the time spent on paperwork. Furthermore, your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible, allowing you to choose the one that best fits your needs. The investment in our service can lead to signNow time and cost savings in managing your Application For Refund Pennsylvania Realty Transfer Tax REV 1651.

-

Can I integrate airSlate SignNow with other applications for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when handling the Application For Refund Pennsylvania Realty Transfer Tax REV 1651. You can connect with CRM systems, cloud storage services, and more, making it easier to manage your documents and data seamlessly.

-

What features does airSlate SignNow offer for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

airSlate SignNow includes features such as customizable templates, eSigning, and document tracking for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651. These features help ensure that your application is completed correctly and submitted on time. Additionally, you can collaborate with team members in real-time.

-

How secure is airSlate SignNow when handling the Application For Refund Pennsylvania Realty Transfer Tax REV 1651?

Security is a top priority at airSlate SignNow. When handling the Application For Refund Pennsylvania Realty Transfer Tax REV 1651, your data is protected with advanced encryption and secure cloud storage. We comply with industry standards to ensure that your sensitive information remains confidential and secure.

Get more for Application For Refund Pennsylvania Realty Transfer Tax REV 1651

- Notice of current address form florida

- Forms florida motion to dismiss temporary injunction

- Affidavit of diligent search fillable 2000 form

- Ha1 form railroad disibility

- Kitsap county guardian ad litem registry form

- The florida bar fillable complaint form

- Piopac claims form

- Arizona affidavit of financial information

Find out other Application For Refund Pennsylvania Realty Transfer Tax REV 1651

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe