Form 11386

What is the Form 11386

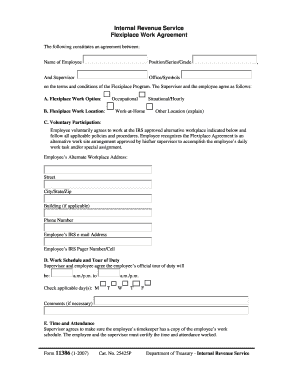

The Form 11386, also known as the IRS Form 11386, is a document used by taxpayers to report specific information related to their financial activities. This form is particularly relevant for individuals and businesses who need to disclose certain financial details to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the Form 11386

Using Form 11386 involves several steps to ensure that all required information is accurately reported. Taxpayers should first gather all necessary financial documents that pertain to the information being reported. Once the relevant data is collected, the form can be filled out, ensuring that all fields are completed accurately. After completing the form, it should be submitted to the IRS according to the specified guidelines, which may include online submission or mailing the form directly.

Steps to complete the Form 11386

Completing Form 11386 requires careful attention to detail. Follow these steps for effective completion:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form to the IRS by the designated deadline.

Legal use of the Form 11386

The legal use of Form 11386 is governed by IRS regulations, which dictate how the form must be completed and submitted. It is essential for taxpayers to adhere to these guidelines to ensure that their submissions are valid. Proper use of the form can help avoid legal issues and ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 11386 vary depending on the taxpayer's specific circumstances. Generally, it is important to submit the form by the tax filing deadline to avoid penalties. Taxpayers should be aware of any changes to deadlines that may occur due to special circumstances or IRS announcements. Keeping track of these dates is crucial for maintaining compliance.

Required Documents

To complete Form 11386, several documents may be required. These typically include:

- Income statements, such as W-2s or 1099s.

- Expense reports that detail deductible costs.

- Any additional documentation that supports the information being reported on the form.

Form Submission Methods (Online / Mail / In-Person)

Form 11386 can be submitted through various methods. Taxpayers have the option to file the form online, which is often the quickest method, or they can choose to mail it directly to the IRS. In some cases, in-person submissions may be possible at designated IRS offices. Each method has its own guidelines and requirements, so it is important to choose the one that best fits the taxpayer's needs.

Quick guide on how to complete form 11386

Finalize Form 11386 effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers a great eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle Form 11386 on any platform using airSlate SignNow apps for Android or iOS and streamline any document-driven process today.

How to alter and eSign Form 11386 with ease

- Locate Form 11386 and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 11386 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 11386

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 11386 and why is it important?

The form 11386 is a critical document required for various regulatory and compliance purposes. Understanding its requirements and proper submission is essential for businesses to avoid penalties and ensure smooth operations. Using airSlate SignNow simplifies the process of completing and sending the form 11386.

-

How can airSlate SignNow help with the completion of form 11386?

airSlate SignNow provides a user-friendly platform to fill out and eSign form 11386 efficiently. The software allows users to collaborate in real-time, ensuring that all necessary parties can review and sign the document. With airSlate SignNow, you can manage form 11386 with ease and reduce turnaround times.

-

Is there a cost to use airSlate SignNow for form 11386?

Yes, airSlate SignNow offers competitive pricing plans based on your business needs. While there is a fee for using the platform, the cost is generally offset by the time saved and increased efficiency in managing documents like form 11386. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing form 11386?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and document tracking, specifically useful for managing form 11386. These tools enhance the user experience and streamline the entire document management process. You can also automate reminders for signers to ensure timely compliance.

-

Can I integrate airSlate SignNow with other tools for form 11386?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making the handling of form 11386 even easier. Whether you use CRM systems, cloud storage, or other productivity tools, our integrations ensure that you can work efficiently across platforms.

-

What are the benefits of using airSlate SignNow for form 11386 submissions?

Using airSlate SignNow for submitting form 11386 provides several advantages, including reduced processing times and increased security for your sensitive documents. The platform’s ease of use allows for quick onboarding and a smooth transition from paper-based processes. Additionally, eSigning ensures that all submissions are legally binding and compliant.

-

How does airSlate SignNow ensure the security of form 11386?

airSlate SignNow prioritizes the security of all documents, including form 11386, with industry-standard encryption and compliance with various regulatory requirements. Our platform provides audit trails and secure access controls, protecting your sensitive information from unauthorized access. You can trust that your completed forms are safe with us.

Get more for Form 11386

Find out other Form 11386

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself