Form 5049 Michigan Explanation 2013

What is the Form 5049 Michigan Explanation

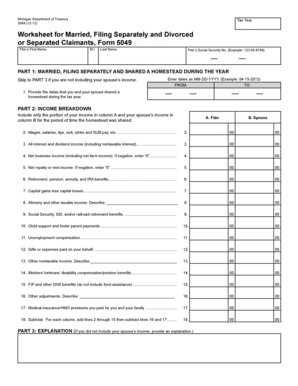

The Form 5049, commonly referred to as the Michigan Form 5049, is a document used primarily for tax purposes within the state of Michigan. This form is essential for reporting specific financial transactions, particularly those related to property transfers or other taxable events. Understanding the purpose of the form is crucial for compliance with state tax regulations. Properly completing the Form 5049 ensures that taxpayers accurately report their financial activities, which can help avoid potential penalties or issues with the Michigan Department of Treasury.

Steps to Complete the Form 5049 Michigan Explanation

Completing the Form 5049 requires careful attention to detail. Here are the essential steps to follow:

- Gather Required Information: Collect all necessary documents, including previous tax returns, property deeds, and any relevant financial records.

- Fill Out Personal Information: Include your name, address, and Social Security number or taxpayer identification number at the top of the form.

- Detail Financial Transactions: Clearly outline the specific transactions that necessitate the use of the form. This may include property sales or transfers.

- Sign and Date the Form: Ensure that you sign and date the form to validate it. Unsigned forms may be rejected.

- Review for Accuracy: Double-check all information for accuracy to prevent any errors that could lead to delays or penalties.

Legal Use of the Form 5049 Michigan Explanation

The legal use of the Form 5049 is governed by Michigan state tax laws. This form must be completed accurately to ensure compliance with regulations set forth by the Michigan Department of Treasury. Failure to submit the form or submitting incorrect information can result in fines or legal repercussions. It is essential for taxpayers to understand their obligations and to use the form in accordance with state guidelines to maintain legal standing.

Form Submission Methods

Submitting the Form 5049 can be done through various methods, allowing for flexibility based on individual preferences. The primary submission methods include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Michigan Department of Treasury's online portal, ensuring a faster processing time.

- Mail Submission: The completed form can also be printed and mailed to the appropriate state office. Ensure that it is sent to the correct address to avoid delays.

- In-Person Submission: Individuals may choose to deliver the form in person at designated state offices for immediate processing.

Key Elements of the Form 5049 Michigan Explanation

Understanding the key elements of the Form 5049 is vital for accurate completion. Important components include:

- Personal Information: This section requires the taxpayer's identifying information.

- Transaction Details: Descriptions of the financial transactions that necessitate the form.

- Signature: A valid signature is required to authenticate the form.

- Submission Date: The date on which the form is completed and submitted is critical for compliance with deadlines.

Examples of Using the Form 5049 Michigan Explanation

There are various scenarios in which the Form 5049 is applicable. Common examples include:

- Property Sales: When a property is sold, the seller must report the transaction using the Form 5049.

- Inheritance Transfers: If property is transferred as part of an inheritance, this form is necessary to document the change in ownership.

- Gift Transfers: Gifts of property exceeding a certain value may also require the completion of the Form 5049 for tax purposes.

Quick guide on how to complete form 5049 michigan explanation

Accomplish Form 5049 Michigan Explanation effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form 5049 Michigan Explanation on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and electronically sign Form 5049 Michigan Explanation seamlessly

- Obtain Form 5049 Michigan Explanation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Edit and electronically sign Form 5049 Michigan Explanation and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5049 michigan explanation

Create this form in 5 minutes!

How to create an eSignature for the form 5049 michigan explanation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 5049 and how is it used in airSlate SignNow?

A form 5049 is a document used in various business applications for processing and signing. With airSlate SignNow, you can easily create, send, and eSign form 5049, ensuring all parties involved can efficiently manage their documentation needs.

-

How does airSlate SignNow ensure the security of my form 5049?

airSlate SignNow prioritizes your document security with industry-standard encryption and robust authentication methods. When you deal with a form 5049, you can rest assured that your sensitive data is protected from unauthorized access and bsignNowes.

-

Can I customize my form 5049 template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your form 5049 templates to fit your unique business requirements. You can add fields, logos, and specific instructions to streamline the signing process and enhance accessibility for all users.

-

What are the pricing options for using airSlate SignNow with form 5049?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Depending on the plan you choose, you can efficiently send and eSign form 5049 documents at a competitive rate with access to various features.

-

Does airSlate SignNow integrate with other applications for managing form 5049?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications, allowing you to manage your form 5049 alongside your existing tools. This integration streamlines your workflow by connecting with CRM systems, cloud storage, and more.

-

How long does it take to eSign a form 5049 using airSlate SignNow?

Completing the eSigning process for a form 5049 using airSlate SignNow is quick and efficient. Typically, it takes just a few minutes for all parties to review and sign, dramatically reducing the time required for document processing.

-

What features does airSlate SignNow offer for efficiently handling form 5049?

airSlate SignNow includes a variety of features tailored for handling form 5049, such as customizable templates, real-time tracking, and automated reminders. These tools help improve productivity and ensure timely document completion.

Get more for Form 5049 Michigan Explanation

- The church historically traced form

- Affidavit of service by mail new york form

- F248 036 000 form

- Webcheck request form

- School bus discipline referral form

- Candy bouquet pre order form center for disability services

- Op 6 iep progress report doc form

- Gas 1201q motor fuels claim for refund tax paid form

Find out other Form 5049 Michigan Explanation

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple