Form 8917 for

What is the Form 8917 For

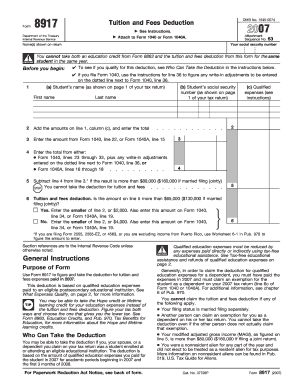

The Form 8917 is used by taxpayers in the United States to claim the Tuition and Fees Deduction. This deduction allows eligible individuals to reduce their taxable income by qualifying education expenses incurred for higher education. The form is specifically designed for those who have paid qualified tuition and related expenses for themselves, their spouses, or dependents. By completing Form 8917, taxpayers can potentially lower their tax liability, making education more affordable.

How to use the Form 8917 For

Using Form 8917 involves a few straightforward steps. First, gather all necessary documentation, including receipts for tuition and fees. Next, fill out the form by providing your personal information, including your Social Security number and the details of the educational institution. Make sure to accurately report the amounts paid for qualified expenses. After completing the form, attach it to your federal tax return when filing. It is essential to ensure that all information is correct to avoid delays or issues with your tax return.

Steps to complete the Form 8917 For

Completing Form 8917 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, such as Form 1098-T from educational institutions.

- Enter your personal information in the designated sections of the form.

- Report the total qualified tuition and fees paid during the tax year.

- Calculate the deduction amount based on the provided instructions.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 8917 For

The legal use of Form 8917 is governed by IRS guidelines, which specify the eligibility criteria for claiming the Tuition and Fees Deduction. To ensure compliance, taxpayers must retain documentation supporting their claims, such as receipts and Form 1098-T. The IRS requires that only qualified expenses be reported, and any inaccuracies could lead to penalties or disqualification from the deduction. Using digital tools to complete and submit the form can enhance security and ensure that all legal requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for Form 8917 align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file, which can provide additional time for submission. It is crucial to adhere to these deadlines to avoid penalties and ensure that the deduction is claimed in a timely manner.

Eligibility Criteria

To be eligible for the Tuition and Fees Deduction on Form 8917, taxpayers must meet specific criteria. This includes being enrolled in an eligible educational institution, such as a college or university, and having incurred qualified tuition and fees for higher education. The deduction is subject to income limitations, which may affect the amount that can be claimed. Additionally, taxpayers must not be claimed as dependents on someone else's tax return. Understanding these criteria is essential for successfully completing the form.

Quick guide on how to complete form 8917 for

Effortlessly Prepare Form 8917 For on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without hindrances. Manage Form 8917 For on any platform using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to Modify and eSign Form 8917 For with Ease

- Locate Form 8917 For and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document duplicates. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8917 For and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8917 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8917 For, and how can I use it with airSlate SignNow?

Form 8917 For is designed for calculating the tuition and fees deduction. With airSlate SignNow, users can easily prepare and eSign Form 8917, ensuring a streamlined submission process for educational tax benefits.

-

Is airSlate SignNow a cost-effective solution for sending Form 8917 For?

Yes, airSlate SignNow offers competitive pricing plans that allow users to send and eSign Form 8917 For without breaking the bank. Our pricing structure is designed to accommodate various budgets, making it a great choice for both individuals and businesses.

-

What features does airSlate SignNow offer for completing Form 8917 For?

airSlate SignNow provides features like customizable templates, easy drag-and-drop functionality, and secure eSigning, all of which enhance the experience of filling out Form 8917 For. These tools make it simple to prepare your document accurately and efficiently.

-

Are there any integrations available for airSlate SignNow that simplify the use of Form 8917 For?

Absolutely! airSlate SignNow integrates with popular apps and platforms, ensuring you can seamlessly retrieve or send data linked to Form 8917 For. This allows for a more cohesive workflow and reduces the time spent moving between different software.

-

How does airSlate SignNow ensure the security of my Form 8917 For documents?

Security is a top priority at airSlate SignNow. When working on Form 8917 For, your documents are protected with advanced encryption technologies, ensuring that your sensitive information remains confidential and secure during the signing process.

-

Can I track the status of my Form 8917 For once sent through airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Form 8917 For documents. You'll receive notifications when the document is viewed or signed, giving you peace of mind throughout the submission process.

-

Is there customer support available for questions regarding Form 8917 For?

Yes, airSlate SignNow provides excellent customer support for all users. Should you have any questions or encounter issues while preparing or submitting your Form 8917 For, our dedicated support team is ready to assist you promptly.

Get more for Form 8917 For

- Petition for change of name for adult individual form cafc401

- Solax warranty registration form

- Fingerprint destruction toronto police form

- Present simple s es ies exercises form

- Eeg documentation form abret abret

- Dermatology template prescription form

- 591 elk avenue form

- Phone 1 800 692 7392 fax 717 720 3786 departments bloomu form

Find out other Form 8917 For

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy