Tn Form Ss 4241

What is the Tn Form Ss 4241

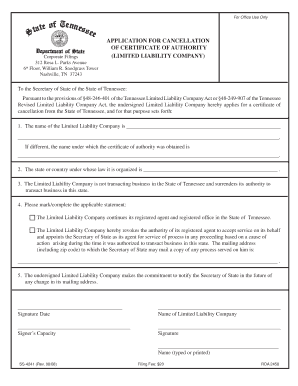

The Tn Form Ss 4241 is a specific document used in the state of Tennessee, primarily for reporting and documenting certain financial or legal information. This form is often utilized by individuals or entities to provide necessary details for various administrative purposes. Understanding the context and requirements of this form is essential for accurate completion and compliance with state regulations.

How to Obtain the Tn Form Ss 4241

The Tn Form Ss 4241 can typically be obtained through the official Tennessee state government website or relevant state agencies. It is essential to ensure that you are accessing the most current version of the form to avoid any issues during submission. Additionally, some local offices may provide printed copies of the form upon request.

Steps to Complete the Tn Form Ss 4241

Completing the Tn Form Ss 4241 involves several key steps to ensure accuracy and compliance. First, gather all necessary information and documentation required for the form. Next, carefully fill out each section of the form, ensuring that all details are correct and complete. After completing the form, review it for any errors or omissions before submission. Finally, submit the form as per the instructions provided, whether online, by mail, or in person.

Legal Use of the Tn Form Ss 4241

The Tn Form Ss 4241 holds legal significance, as it may be required for compliance with state laws and regulations. Proper execution of this form is crucial, as it can impact legal standing or financial obligations. It is important to understand the legal implications of the information provided on the form and to ensure that it is completed in accordance with applicable laws.

Key Elements of the Tn Form Ss 4241

Key elements of the Tn Form Ss 4241 include personal or business identification details, specific financial information, and any relevant signatures. Each section of the form is designed to capture essential data that may be necessary for processing or legal verification. It is important to pay close attention to these elements to ensure that the form is filled out correctly.

Form Submission Methods

The Tn Form Ss 4241 can be submitted through various methods, including online submission via designated state portals, mailing a physical copy to the appropriate office, or delivering it in person. Each method may have specific requirements regarding documentation and deadlines, so it is advisable to check the guidelines associated with your chosen submission method.

Penalties for Non-Compliance

Failing to properly complete or submit the Tn Form Ss 4241 can result in penalties, including fines or legal repercussions. It is essential to be aware of the compliance requirements associated with this form to avoid any potential issues. Understanding the consequences of non-compliance can help ensure that all necessary steps are taken to meet legal obligations.

Quick guide on how to complete tn form ss 4241

Easily Prepare Tn Form Ss 4241 on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-conscious alternative to conventional printed and signed documents, as you can easily locate the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Tn Form Ss 4241 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to Edit and Electronically Sign Tn Form Ss 4241 Effortlessly

- Locate Tn Form Ss 4241 and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Tn Form Ss 4241 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn form ss 4241

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable SS 4241 form?

The fillable SS 4241 form is a document used by businesses to report and signNow information related to certain tax obligations. With airSlate SignNow, you can easily create, fill out, and eSign this form digitally, making the process efficient and hassle-free. This ensures that your SS 4241 forms are completed accurately and submitted on time.

-

How can airSlate SignNow help me with fillable SS 4241 forms?

AirSlate SignNow provides a user-friendly platform to manage your fillable SS 4241 forms efficiently. The tool allows you to create templates, fill out required fields, and eSign documents quickly. This streamlines your workflow and minimizes the chances of errors, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for fillable SS 4241 tasks?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan based on the number of users and the features you require for handling fillable SS 4241 forms. The cost is competitive and provides signNow savings compared to traditional document management solutions.

-

What features does airSlate SignNow offer for fillable SS 4241 forms?

AirSlate SignNow provides multiple features for managing fillable SS 4241 forms, including customizable templates, real-time collaboration, and secure eSigning. Additionally, you can track the status of your documents, ensuring that everyone is informed and that deadlines are met. These features enhance efficiency and accuracy in your document workflows.

-

Can I integrate airSlate SignNow with other tools for fillable SS 4241 processing?

Absolutely! AirSlate SignNow offers integrations with various software tools commonly used in business operations, such as CRM and project management systems. This means you can automate workflows involving fillable SS 4241 forms while leveraging your existing software stack. The integrations help streamline processes and improve overall productivity.

-

How secure is the eSigning process for fillable SS 4241 forms?

The eSigning process for fillable SS 4241 forms through airSlate SignNow is highly secure. The platform employs advanced encryption and complies with major laws such as eIDAS and ESIGN to protect your sensitive information. You can trust that your data and signatures are safe throughout the signing process.

-

Is it possible to access fillable SS 4241 forms from mobile devices?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to access and manage your fillable SS 4241 forms on the go. The mobile app provides a seamless experience, letting you fill out, review, and eSign documents from anywhere. This flexibility ensures you can complete essential tasks even while traveling or out of the office.

Get more for Tn Form Ss 4241

Find out other Tn Form Ss 4241

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online