Room Tax Form Sint Maarten 2016-2026

What is the Room Tax Form Sint Maarten

The Room Tax Form Sint Maarten is a specific document required for the collection of room tax from guests staying in accommodations on the island. This form is essential for property owners and managers to report the taxes collected from guests to the tax administration of Sint Maarten. The room tax is typically applied to hotel stays, vacation rentals, and other lodging services, ensuring that the local government receives necessary revenue to support public services and infrastructure.

How to obtain the Room Tax Form Sint Maarten

To obtain the Room Tax Form Sint Maarten, property owners and managers can visit the official website of the Sint Maarten tax administration. The form is usually available for download in a digital format, allowing users to print it for completion. Additionally, forms may be accessible at local government offices or through authorized tax professionals who assist with tax compliance in Sint Maarten.

Steps to complete the Room Tax Form Sint Maarten

Completing the Room Tax Form Sint Maarten involves several straightforward steps:

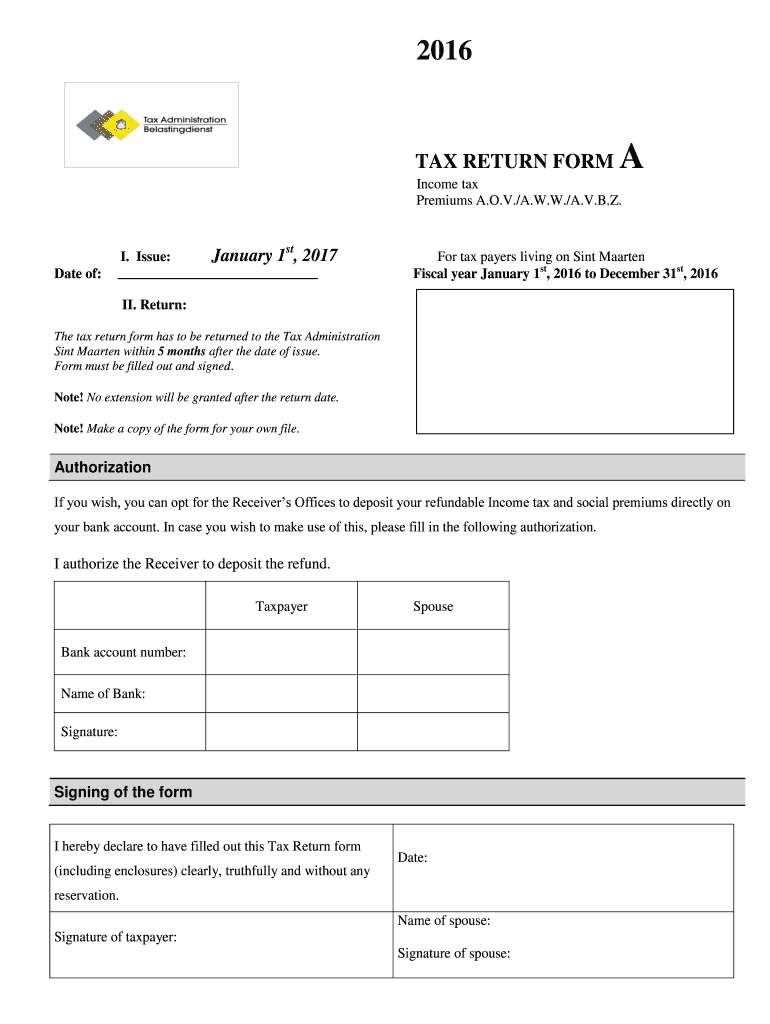

- Download the form from the Sint Maarten tax administration website or acquire it from a local office.

- Fill in the required information, including the property details, number of guests, and total room tax collected.

- Ensure all calculations are accurate to avoid discrepancies.

- Sign and date the form to validate it.

- Submit the completed form to the tax administration by the designated deadline.

Legal use of the Room Tax Form Sint Maarten

The legal use of the Room Tax Form Sint Maarten is crucial for compliance with local tax regulations. This form serves as an official record of the room tax collected by property owners and managers. Proper completion and timely submission ensure that the tax administration can accurately track tax revenues and enforce compliance. Failure to use the form correctly may result in penalties or fines, emphasizing the importance of understanding the legal requirements associated with this document.

Filing Deadlines / Important Dates

Filing deadlines for the Room Tax Form Sint Maarten are typically set by the local tax administration. It is important for property owners and managers to be aware of these dates to avoid late submissions. Generally, forms must be submitted quarterly or annually, depending on the volume of business. Keeping track of these deadlines helps ensure compliance and avoids potential penalties for late filing.

Required Documents

When completing the Room Tax Form Sint Maarten, certain documents may be required to support the information provided. These documents can include:

- Proof of occupancy for the reporting period.

- Records of room tax collected from guests.

- Any previous tax forms submitted for reference.

Having these documents ready can facilitate a smoother filing process and ensure accuracy in reporting.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Room Tax Form Sint Maarten can lead to various penalties. These may include financial fines, interest on unpaid taxes, or other legal repercussions. It is essential for property owners and managers to understand their obligations and ensure timely and accurate submissions to avoid these potential consequences.

Quick guide on how to complete room tax form sint maarten

Prepare Room Tax Form Sint Maarten seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Room Tax Form Sint Maarten on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Room Tax Form Sint Maarten effortlessly

- Obtain Room Tax Form Sint Maarten and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Room Tax Form Sint Maarten to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the room tax form sint maarten

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the sint maarten tax form used for?

The sint maarten tax form is required for residents of Sint Maarten to report their income for tax purposes. It ensures compliance with local tax laws and helps individuals properly declare their financial status. Completing this form accurately is crucial to avoid penalties and simplify the tax filing process.

-

How can airSlate SignNow help with the sint maarten tax form?

airSlate SignNow streamlines the process of signing and sending the sint maarten tax form electronically. With our easy-to-use platform, you can quickly upload documents, get them signed, and track their status. This not only saves time but also ensures that your tax forms are submitted securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the sint maarten tax form?

Yes, airSlate SignNow offers affordable pricing plans tailored to different needs. Our competitive pricing allows businesses and individuals to handle their sint maarten tax form documents without breaking the bank. Plus, the time savings and efficiency gained often outweigh the costs.

-

Can I integrate airSlate SignNow with other applications for my sint maarten tax form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive and Dropbox, making it easy to manage your sint maarten tax form documents. These integrations help streamline workflows and enhance productivity, allowing you to focus more on your business.

-

What features does airSlate SignNow offer for eSigning the sint maarten tax form?

airSlate SignNow includes powerful eSigning features that allow you to sign the sint maarten tax form electronically. You can easily invite others to sign, set signing order, and access audit trails to ensure accountability. This enhances the security and verifiability of your tax submissions.

-

How does airSlate SignNow ensure the security of my sint maarten tax form?

Your data security is a priority at airSlate SignNow. We implement advanced encryption and compliance measures, ensuring that your sint maarten tax form and personal information remain safe. Our platform adheres to industry standards, providing peace of mind when handling sensitive documents.

-

Can airSlate SignNow help track the status of my sint maarten tax form?

Yes, airSlate SignNow offers real-time tracking for your sint maarten tax form documents. You can monitor when a form is opened, signed, or completed, improving communication and reducing uncertainties during the signing process. This feature helps you stay organized and informed.

Get more for Room Tax Form Sint Maarten

- Current deferment ampamp forbearance forms ncher

- Please complete this information in full to avoid delay in registration of the patient andor receipt of the information

- Death certificates minnesota dept of healthdeath certificates minnesota dept of healthphysicians handbook on medical form

- Limited scope x ray operators form

- Fill in buy the adopted persons minnesota department of health form

- Opwdd ddro manual form

- State disability review unit fill out and sign printable pdf form

- Sealed file form

Find out other Room Tax Form Sint Maarten

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later