Ia 1040 Form

What is the IA 1040 Form

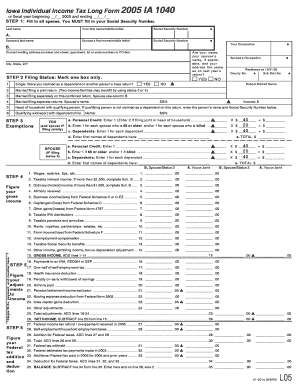

The IA 1040 form is the individual income tax return used by residents of Iowa to report their income and calculate their state tax liability. This form is essential for taxpayers in Iowa as it ensures compliance with state tax laws. The IA 1040 form includes various sections where individuals must provide information about their income, deductions, and credits, which ultimately determine the amount of tax owed or the refund due.

How to Use the IA 1040 Form

Using the IA 1040 form involves several steps to ensure accurate reporting of income and tax obligations. Taxpayers should first gather all necessary documents, such as W-2s, 1099s, and any other relevant income statements. Next, individuals should complete the form by entering their personal information, income details, and any applicable deductions or credits. It is important to double-check all entries for accuracy before submission to avoid delays or penalties.

Steps to Complete the IA 1040 Form

Completing the IA 1040 form requires a systematic approach:

- Gather all necessary tax documents, including income statements and receipts for deductions.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim deductions and credits that apply to your situation.

- Calculate your total tax liability or refund amount.

- Review the form for accuracy and completeness.

- Submit the completed form by the state’s deadline.

Legal Use of the IA 1040 Form

The IA 1040 form is legally binding when completed and submitted according to Iowa state tax laws. It is crucial for taxpayers to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be signed and dated by the taxpayer to validate its authenticity, and electronic signatures are accepted under applicable eSignature laws.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the IA 1040 form. Typically, the deadline for submitting the form is April 30 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents

To accurately complete the IA 1040 form, taxpayers need to gather several documents:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Form Submission Methods

The IA 1040 form can be submitted in various ways to accommodate different preferences:

- Online submission through the Iowa Department of Revenue’s e-filing system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated state tax offices.

Quick guide on how to complete ia 1040 form

Complete Ia 1040 Form seamlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Ia 1040 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to modify and eSign Ia 1040 Form with ease

- Locate Ia 1040 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing fresh copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Ia 1040 Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1040 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ia 1040 form?

The ia 1040 form is the state individual income tax return form used in Iowa. It is essential for residents who need to report their annual income and calculate any state tax due. Understanding the ia 1040 form process is crucial for ensuring compliance with Iowa tax regulations.

-

How can airSlate SignNow help with the ia 1040 form?

airSlate SignNow allows users to eSign and send the ia 1040 form quickly and securely. With our easy-to-use platform, you can fill out the form electronically and ensure it meets all state requirements effortlessly. This streamlines the filing process, saving you time and reducing errors.

-

What pricing options does airSlate SignNow offer for document signing?

airSlate SignNow offers a variety of pricing plans to fit different needs. Whether you're a solo individual preparing your ia 1040 form or a business managing multiple documents, there’s a plan for you. Our cost-effective solution allows for easy eSigning without breaking the bank.

-

Are there any features specifically for tax forms like the ia 1040 form?

Yes, airSlate SignNow includes features tailored for tax documents, including the ia 1040 form. Users can utilize templates to pre-fill data for recurring tax filings and track document status in real time. This dedicated feature set simplifies the signing process for tax-related documents.

-

What are the benefits of using airSlate SignNow for the ia 1040 form?

Using airSlate SignNow for the ia 1040 form offers numerous benefits, including increased efficiency and security. Our platform provides a streamlined experience that minimizes time spent on paperwork. Additionally, your data is safely encrypted, ensuring peace of mind when handling sensitive information.

-

Can I integrate airSlate SignNow with my existing software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various tax preparation software, making it easy to manage the ia 1040 form alongside your other documents. This integration capability enhances your workflow, allowing you to eSign and manage your forms effortlessly.

-

Is airSlate SignNow compliant with legal and tax regulations for the ia 1040 form?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring that all eSigned ia 1040 forms are legally binding. We follow industry regulations to protect users, allowing you to file your tax documents with confidence and compliance.

Get more for Ia 1040 Form

- Massachusetts form m 3 fillable

- Murdoch clarke mortgage fund form

- Dip form 2 51662647

- Aviva termination form

- Parent consent form visa pakistan los angeles

- Bryce resort mountain bike park release 2docx form

- Dsbpc data collection forms pasco county schools

- Superior fireworks wholesale shipping information

Find out other Ia 1040 Form

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast