Inclusion Amount Calculator Form

What is the inclusion amount calculator?

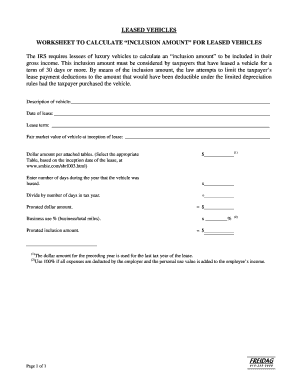

The inclusion amount calculator is a tool designed to help individuals and businesses determine the taxable amount associated with the personal use of a leased vehicle. This calculation is essential for accurately reporting income and ensuring compliance with IRS regulations. The inclusion amount reflects the portion of the vehicle's value that must be reported as income when the vehicle is used for personal purposes, rather than solely for business. Understanding this concept is crucial for both tax preparation and financial planning.

How to use the inclusion amount calculator

Using the inclusion amount calculator involves several straightforward steps. First, gather the necessary information about the leased vehicle, including its fair market value, the lease term, and the percentage of personal use. Input these details into the calculator. The tool will then compute the inclusion amount based on IRS guidelines, providing you with a clear figure to report on your tax return. This process simplifies what can otherwise be a complex calculation, ensuring accuracy and compliance.

Steps to complete the inclusion amount calculator

To effectively complete the inclusion amount calculator, follow these steps:

- Gather information about the leased vehicle, including its fair market value and lease term.

- Determine the percentage of the vehicle's use that is for personal purposes.

- Input the gathered data into the calculator.

- Review the calculated inclusion amount to ensure it aligns with your expectations.

- Document the inclusion amount for your tax records.

These steps provide a clear pathway to accurately calculating the inclusion amount for a leased vehicle.

IRS guidelines

The IRS provides specific guidelines regarding the inclusion amount for leased vehicles. According to IRS regulations, the inclusion amount is based on the fair market value of the vehicle and the percentage of personal use. It is important to refer to IRS publications, such as Publication 463, which outlines the rules for vehicle use and the associated tax implications. Staying informed about these guidelines ensures compliance and helps avoid potential penalties during tax filing.

Required documents

When calculating the inclusion amount for a leased vehicle, certain documents are essential. These include:

- The lease agreement, which outlines the terms and conditions of the lease.

- Documentation of the vehicle's fair market value, which may include dealership appraisals or online valuation tools.

- Records of vehicle usage, detailing the percentage of personal versus business use.

Having these documents readily available will facilitate a smooth calculation process and ensure accuracy in reporting.

Examples of using the inclusion amount calculator

Examples can help clarify how to use the inclusion amount calculator effectively. For instance, if a vehicle has a fair market value of thirty thousand dollars and is leased for three years, with fifty percent personal use, the calculator will factor these elements to determine the inclusion amount. Another example might involve a vehicle valued at twenty-five thousand dollars, used seventy percent for personal purposes. By inputting these figures into the calculator, users can see how varying values and usage percentages affect the inclusion amount, aiding in better financial planning.

Quick guide on how to complete inclusion amount calculator

Effortlessly prepare Inclusion Amount Calculator on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Inclusion Amount Calculator on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign Inclusion Amount Calculator seamlessly

- Obtain Inclusion Amount Calculator and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Inclusion Amount Calculator and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inclusion amount calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an inclusion amount calculator?

An inclusion amount calculator is a tool designed to help users determine the taxable amount of various financial transactions. By inputting specific data, the inclusion amount calculator provides accurate calculations, enabling businesses to make informed decisions regarding their financial obligations. It streamlines the process, ensuring compliance with tax regulations.

-

How can the inclusion amount calculator benefit my business?

Utilizing an inclusion amount calculator can save your business time and reduce errors in tax calculations. It ensures that you accurately assess the inclusion amounts, helping you maintain compliance and avoid costly penalties. Furthermore, it simplifies financial planning by providing clarity on potential tax liabilities.

-

Is the inclusion amount calculator easy to use?

Yes, the inclusion amount calculator is designed to be user-friendly and intuitive. With a simple interface, users can quickly input necessary data and receive instant results without needing advanced technical knowledge. This accessibility allows businesses of all sizes to benefit from accurate calculations.

-

Are there any costs associated with using the inclusion amount calculator?

The inclusion amount calculator may be available for free or as part of a subscription based on the service provider. For airSlate SignNow users, access to this feature is included within our comprehensive suite of document management tools. By investing in our platform, you gain access to the inclusion amount calculator and additional valuable resources.

-

Can the inclusion amount calculator integrate with other financial software?

Yes, our inclusion amount calculator can seamlessly integrate with various financial and accounting software. This compatibility ensures that your financial data remains synchronized across platforms, enhancing your overall workflow. Streamlined integration helps businesses maintain accurate records and simplifies the calculation process.

-

What types of calculations can I perform with the inclusion amount calculator?

The inclusion amount calculator is capable of handling a variety of calculations related to financial transactions, such as capital gains, rental income, and dividends. It allows you to input different types of data to generate tailored results that meet your specific needs. This versatility makes it an essential tool for effective financial management.

-

Is customer support available for assistance with the inclusion amount calculator?

Yes, our dedicated customer support team is available to assist users with any questions regarding the inclusion amount calculator. Whether you need help with calculations or troubleshooting, we provide resources and guidance to ensure you maximize your use of the tool. We're committed to empowering our users with effective solutions.

Get more for Inclusion Amount Calculator

Find out other Inclusion Amount Calculator

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement