NC 4 Web 10 23 Employee S Withholding Allowance 2023

Understanding the NC 4 Form

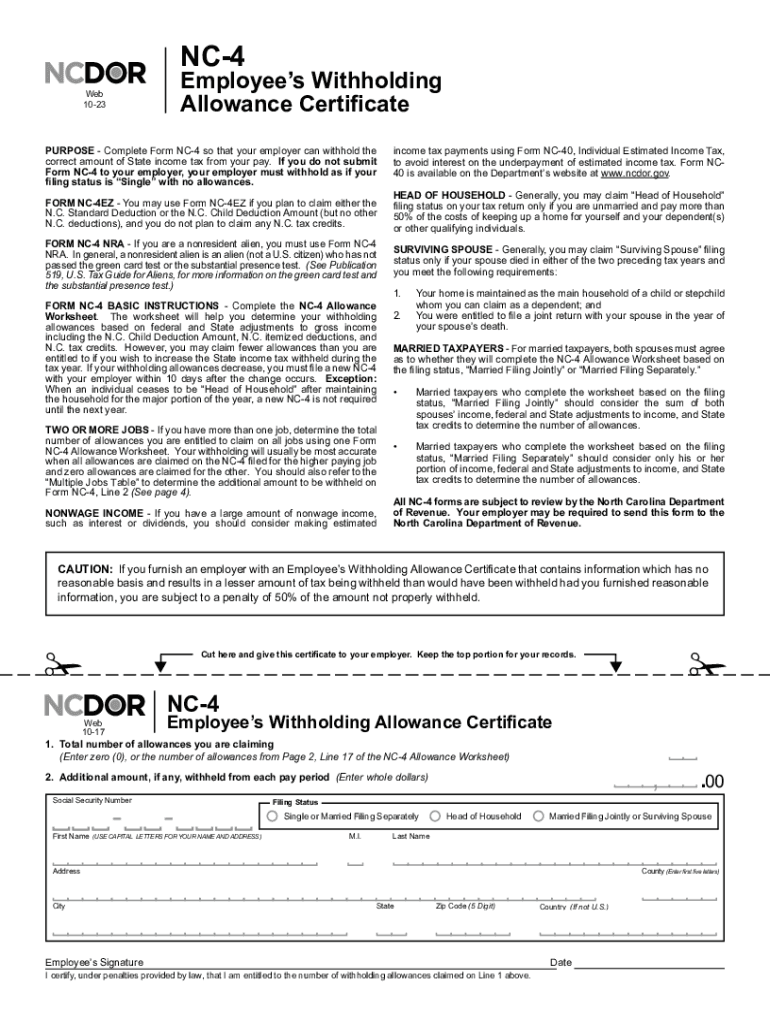

The NC 4 form, also known as the Employee’s Withholding Allowance Certificate, is essential for North Carolina employees. This form helps determine the amount of state income tax that should be withheld from an employee's paycheck. By completing the NC 4, employees can indicate their filing status and the number of allowances they claim, which directly affects their tax withholding. This ensures that the correct amount is withheld throughout the year, helping to avoid underpayment or overpayment of taxes.

Steps to Complete the NC 4 Form

Completing the NC 4 form involves several straightforward steps. First, gather necessary personal information, including your name, address, and Social Security number. Next, identify your filing status, which can be single, married, or head of household. Then, determine the number of allowances you wish to claim based on your personal circumstances, such as dependents or additional deductions. Finally, sign and date the form before submitting it to your employer. It's important to review the form for accuracy to ensure proper withholding.

Key Elements of the NC 4 Form

The NC 4 form includes several key elements that are crucial for accurate tax withholding. These elements consist of the employee's personal information, filing status, number of allowances, and any additional adjustments. Employees can also specify if they wish to have extra withholding applied to their paychecks. Understanding these components helps employees make informed decisions regarding their tax withholdings and ensures compliance with state tax regulations.

Legal Use of the NC 4 Form

The NC 4 form is legally required for employees in North Carolina to establish their state tax withholding. Employers must provide this form to their employees and ensure it is completed accurately. Failure to submit a completed NC 4 may result in the employer withholding the maximum state tax rate, which could lead to unexpected tax liabilities for employees. Therefore, it is essential for both employers and employees to understand the legal implications of this form.

Examples of Using the NC 4 Form

There are various scenarios in which the NC 4 form is utilized. For instance, a newly hired employee may need to fill out the NC 4 to establish their withholding allowances. Similarly, an employee who experiences a change in personal circumstances, such as marriage or the birth of a child, may need to update their NC 4 to reflect their new filing status and allowances. These examples highlight the importance of keeping the form current to ensure accurate tax withholding throughout the year.

IRS Guidelines for the NC 4 Form

While the NC 4 form is specific to North Carolina, it is essential to be aware of IRS guidelines regarding state tax withholding. Employees should ensure that their state withholding aligns with federal tax regulations. The IRS provides resources and guidelines that can help employees understand how their state withholding affects their overall tax liability. Familiarizing oneself with both state and federal guidelines can lead to better tax planning and compliance.

Quick guide on how to complete nc 4web10 23employees withholdingallowance

Easily prepare NC 4 Web 10 23 Employee s Withholding Allowance on any device

Online document management has gained immense popularity among businesses and individuals. It offers a seamless eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly and without hassle. Manage NC 4 Web 10 23 Employee s Withholding Allowance on any device through airSlate SignNow Android or iOS applications and simplify your document-centric tasks today.

How to edit and eSign NC 4 Web 10 23 Employee s Withholding Allowance effortlessly

- Locate NC 4 Web 10 23 Employee s Withholding Allowance and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with the specific tools that airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign NC 4 Web 10 23 Employee s Withholding Allowance and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc 4web10 23employees withholdingallowance

Create this form in 5 minutes!

How to create an eSignature for the nc 4web10 23employees withholdingallowance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2009 nc 4 and how does it relate to airSlate SignNow?

2009 nc 4 refers to a specific version of a legal document or compliance requirement. airSlate SignNow can help businesses manage these documents by providing a secure platform for eSigning and document management that meets compliance standards.

-

How much does airSlate SignNow cost for managing 2009 nc 4 documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost may vary based on the features and functionalities you need for handling documents like 2009 nc 4, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for 2009 nc 4 document processing?

With airSlate SignNow, you can create templates, automate workflows, and track document status. These features streamline the process of handling 2009 nc 4 documents, ensuring a smooth eSigning experience and efficient management.

-

Can I integrate airSlate SignNow with other tools for handling 2009 nc 4 documents?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for 2009 nc 4 documents. These integrations allow you to connect with CRM tools, cloud storage, and other software, making document management even easier.

-

What are the benefits of using airSlate SignNow for 2009 nc 4 compliance?

Using airSlate SignNow for 2009 nc 4 compliance ensures that you keep all documents secure and legally binding. The platform enhances efficiency, reduces the risk of errors, and provides a user-friendly interface for both senders and signers.

-

Is airSlate SignNow user-friendly for managing 2009 nc 4 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, allowing anyone to easily navigate the platform. This user-friendly approach is particularly beneficial when managing complex documents like 2009 nc 4.

-

How secure is airSlate SignNow when dealing with 2009 nc 4 documents?

airSlate SignNow employs top-notch security measures, including encryption and secure data storage, to protect your 2009 nc 4 documents. You can trust that your sensitive information remains confidential and complies with industry regulations.

Get more for NC 4 Web 10 23 Employee s Withholding Allowance

Find out other NC 4 Web 10 23 Employee s Withholding Allowance

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy