Colorado S Corporations Forms Availability Intuit 2016

Understanding the Colorado S Corporations Forms

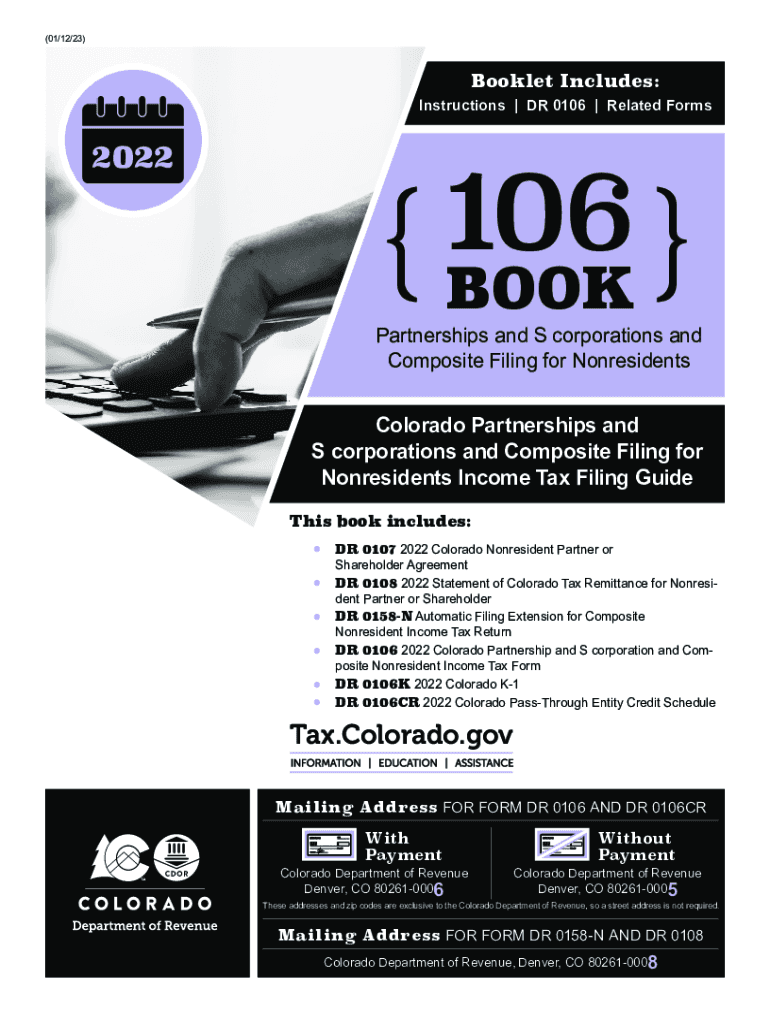

The Colorado S Corporations forms, including the 106 tax form, are essential for businesses operating as S Corporations in Colorado. These forms are used to report income, deductions, and credits, ensuring compliance with state tax regulations. The 106 form specifically caters to S Corporations, allowing them to file their Colorado tax returns accurately. Understanding the purpose and requirements of these forms is crucial for maintaining good standing with the Colorado Department of Revenue.

Steps to Complete the Colorado S Corporations Forms

Filling out the Colorado S Corporations forms requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather necessary financial documents, including income statements and expense reports.

- Obtain the correct version of the 106 form from the Colorado Department of Revenue.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Filing Deadlines and Important Dates

Timely filing of the Colorado S Corporations forms is essential to avoid penalties. The standard deadline for submitting the 106 form is the fifteenth day of the fourth month following the end of the tax year. For most S Corporations, this means the due date is April 15. However, if the deadline falls on a weekend or holiday, it is extended to the next business day. It is important to stay informed about any changes to these dates that may occur annually.

Required Documents for Filing

When preparing to file the Colorado S Corporations forms, certain documents are necessary to ensure accurate reporting. These include:

- Federal tax return (Form 1120S) for the S Corporation.

- Financial statements detailing income and expenses.

- Records of any deductions or credits claimed.

- Supporting documents for any adjustments made to income.

Form Submission Methods

Submitting the Colorado S Corporations forms can be done through various methods. Businesses have the option to file online using the Colorado Department of Revenue's e-filing system, which is often the fastest and most efficient method. Alternatively, forms can be mailed to the appropriate address provided by the Colorado Department of Revenue. In-person submissions are also accepted at designated locations, although this may require scheduling an appointment.

Penalties for Non-Compliance

Failure to file the Colorado S Corporations forms on time or inaccuracies in reporting can lead to significant penalties. Common penalties include fines based on the amount of tax owed or a percentage of the unpaid tax. Additionally, late filings may incur interest charges on any taxes due. It is crucial for S Corporations to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete colorado s corporations forms availability intuit

Effortlessly Prepare Colorado S Corporations Forms Availability Intuit on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily find the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Colorado S Corporations Forms Availability Intuit on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign Colorado S Corporations Forms Availability Intuit effortlessly

- Find Colorado S Corporations Forms Availability Intuit and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Colorado S Corporations Forms Availability Intuit and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado s corporations forms availability intuit

Create this form in 5 minutes!

How to create an eSignature for the colorado s corporations forms availability intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 106 2020?

airSlate SignNow is a powerful eSignature solution that enables businesses to send, sign, and manage documents seamlessly. The reference to 106 2020 highlights its compliance with regulations and standards set in 2020, ensuring that your electronic signature needs are met accurately and securely.

-

What are the key features of airSlate SignNow that support 106 2020 compliance?

airSlate SignNow offers features such as secure electronic signatures, document management, and real-time tracking, all designed to support 106 2020 compliance. These features not only enhance productivity but also ensure that all your documents are handled according to the latest legal standards.

-

How much does airSlate SignNow cost, especially when considering 106 2020 requirements?

The pricing for airSlate SignNow is competitive and offers various plans tailored to different business needs, while fully aligning with 106 2020 requirements. Whether you are a small business or a large enterprise, you can find a plan that fits your budget and offers the necessary features for compliant eSigning.

-

Can I integrate airSlate SignNow with other applications while meeting 106 2020 standards?

Yes, airSlate SignNow integrates seamlessly with various applications such as Salesforce, Google Drive, and others while ensuring compliance with 106 2020. This flexibility allows you to streamline your workflow and maintain compliance without hassle.

-

What benefits does airSlate SignNow provide related to 106 2020 for businesses?

With airSlate SignNow, businesses gain the advantage of faster transaction times and reduced paper waste while adhering to 106 2020 standards. The platform not only optimizes processes but also enhances your brand’s credibility through compliant eSignature practices.

-

How can airSlate SignNow help improve document security under 106 2020 guidelines?

airSlate SignNow employs bank-level encryption and robust authentication methods to ensure document security in line with 106 2020 guidelines. This ensures that your sensitive information remains protected throughout the signing process, mitigating risks associated with digital document management.

-

Is airSlate SignNow user-friendly for those unfamiliar with 106 2020 eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for anyone, regardless of their familiarity with 106 2020 or electronic signatures. With a simple interface and easy-to-follow instructions, users can quickly adapt and start eSigning in no time.

Get more for Colorado S Corporations Forms Availability Intuit

- Solicitud de beca primera vez uvm campus quer taro queretaro uvmnet form

- Professional development request form 2018 19

- Lim college 1098 t form

- Colfax school district form

- Springdale high school transcript request form

- Children s center payment receipt inside jjay cuny form

- Nido qubein scholarship form

- Substitutionrequirementwaiverformdoc lasell

Find out other Colorado S Corporations Forms Availability Intuit

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast