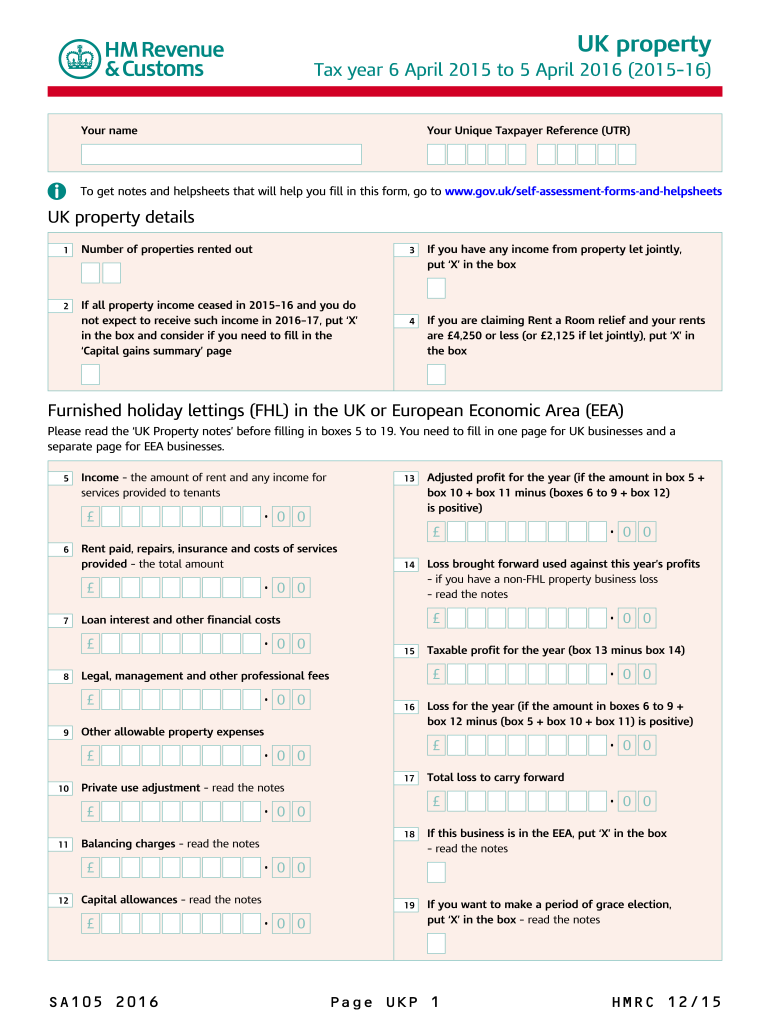

Sa105 Form 2016

What is the HMRC Form SA105

The HMRC Form SA105 is a tax form used by self-employed individuals in the United Kingdom to report their income and expenses for a specific tax year. This form is essential for those who need to complete their Self Assessment tax return, allowing HMRC to assess the amount of tax owed based on the individual's earnings. The SA105 form focuses on income from self-employment, including details about business profits, allowable expenses, and other relevant financial information.

How to Use the HMRC Form SA105

Using the HMRC Form SA105 involves several steps to ensure accurate reporting of income and expenses. First, gather all necessary financial documents, including invoices, receipts, and bank statements. Next, fill out the form with your business details, including your unique taxpayer reference (UTR) and the accounting period you are reporting for. Be sure to provide accurate figures for your income and allowable expenses, as this will affect your overall tax liability. Once completed, the form can be submitted online or by mail, depending on your preference.

Steps to Complete the HMRC Form SA105

Completing the HMRC Form SA105 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and expense receipts.

- Access the form through the HMRC website or your tax software.

- Fill in your personal information, including your UTR and business name.

- Report your total income from self-employment.

- List your allowable business expenses, ensuring you have documentation for each.

- Calculate your taxable profit by subtracting your expenses from your income.

- Review the form for accuracy before submission.

Legal Use of the HMRC Form SA105

The HMRC Form SA105 is legally binding when completed accurately and submitted on time. It is crucial to ensure that all information provided is truthful and supported by documentation. Failing to comply with tax regulations can lead to penalties or audits. Therefore, understanding the legal implications of the information reported on the SA105 is essential for self-employed individuals.

Required Documents for the HMRC Form SA105

To complete the HMRC Form SA105, several documents are required to support the information provided. These include:

- Invoices and receipts for income received.

- Records of business expenses, such as receipts for supplies, travel, and utilities.

- Bank statements showing business transactions.

- Any previous correspondence with HMRC related to your self-employment.

Filing Deadlines for the HMRC Form SA105

It is important to be aware of the filing deadlines for the HMRC Form SA105 to avoid penalties. Typically, the deadline for submitting your Self Assessment tax return, including the SA105 form, is January 31 following the end of the tax year. For example, for the tax year ending April 5, the form must be submitted by January 31 of the following year. Early submission is encouraged to allow time for any potential issues.

Quick guide on how to complete sa105 form

Complete Sa105 Form effortlessly on any device

Online document management has gained traction with both organizations and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Sa105 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Sa105 Form without hassle

- Find Sa105 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Sa105 Form to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa105 form

Create this form in 5 minutes!

How to create an eSignature for the sa105 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HMRC Form SA105 used for?

The HMRC Form SA105 is specifically designed for individuals who have income from self-employment. It allows users to declare their business earnings and calculate their taxable profit. When filling out this form, it is important to ensure that all income and expenses are accurately reported.

-

How can I fill out the HMRC Form SA105 using airSlate SignNow?

With airSlate SignNow, you can easily fill out the HMRC Form SA105 online. Our platform offers intuitive document editing tools that allow you to complete the form efficiently. Once filled out, you can securely eSign and send it directly to HMRC.

-

Is there a cost to use airSlate SignNow for HMRC Form SA105?

airSlate SignNow offers a variety of pricing plans to suit different needs. While there is a minimal subscription fee, using airSlate SignNow can ultimately save you time and reduce hassles associated with managing documents like the HMRC Form SA105. Explore our pricing page for more details.

-

What features does airSlate SignNow provide for managing the HMRC Form SA105?

airSlate SignNow includes a range of features that enhance your experience with the HMRC Form SA105. These features include customizable templates, secure eSigning, and real-time tracking of document status. Our user-friendly interface simplifies the process of filling out and submitting important forms.

-

Can I integrate airSlate SignNow with my accounting software for HMRC Form SA105?

Yes, airSlate SignNow offers integrations with various accounting software platforms. This allows you to streamline your workflow when dealing with the HMRC Form SA105, ensuring that your financial information is accurate and up-to-date. Connecting these systems enhances efficiency in managing your tax documentation.

-

What are the benefits of using airSlate SignNow for HMRC Form SA105 submission?

Using airSlate SignNow for your HMRC Form SA105 submission provides signNow benefits such as time savings and enhanced document security. Our platform allows for easy eSigning and ensures compliance with HMRC regulations, making your tax submission process hassle-free and efficient.

-

Can I access my completed HMRC Form SA105 later using airSlate SignNow?

Absolutely! Once you complete and submit your HMRC Form SA105 through airSlate SignNow, you can easily access and retrieve it anytime from your account. Our cloud-based storage ensures that your documents are secure and readily available whenever you need them.

Get more for Sa105 Form

Find out other Sa105 Form

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation