Self Assessment Tax Returns Deadlines 2023-2026

What is the Self Assessment Tax Returns Deadlines

The Self Assessment Tax Return deadlines are critical dates set by the Internal Revenue Service (IRS) for individuals and businesses to file their tax returns. For the tax year 2024, the deadline for submitting your Self Assessment Tax Return is typically April 15, 2025. However, if you are filing online, you may have until October 15, 2025, to complete your submission. Understanding these deadlines is essential to avoid penalties and ensure compliance with tax regulations.

Steps to complete the Self Assessment Tax Returns Deadlines

Completing your Self Assessment Tax Return involves several key steps. First, gather all necessary documentation, including income statements, receipts for expenses, and any relevant financial records. Next, determine your tax liability by calculating your total income and allowable deductions. Once you have this information, you can fill out the SA105 form accurately. After completing the form, review it for any errors before submission. Finally, file your return either online or by mail, ensuring it is submitted before the deadline to avoid penalties.

Legal use of the Self Assessment Tax Returns Deadlines

Legal compliance with the Self Assessment Tax Return deadlines is crucial for all taxpayers. The IRS enforces strict regulations regarding the timely filing of tax returns. Failure to meet the deadlines can result in penalties, interest on unpaid taxes, and potential audits. It is important to keep records of your submissions and any correspondence with the IRS to protect yourself in case of disputes. Utilizing reliable electronic filing methods can also help ensure that your submission is received on time and securely.

Filing Deadlines / Important Dates

For the 2024 tax year, the following important dates are crucial for Self Assessment Tax Returns:

- January 1, 2024: Start of the tax year

- April 15, 2025: Deadline for paper submissions

- October 15, 2025: Deadline for online submissions

Being aware of these dates helps taxpayers plan their finances and avoid last-minute filing issues.

Required Documents

To complete the Self Assessment Tax Return, several documents are necessary. These include:

- Income statements (W-2s, 1099s)

- Records of expenses and deductions

- Bank statements

- Investment income documentation

Having these documents organized and readily available can streamline the filing process and ensure accuracy.

Penalties for Non-Compliance

Non-compliance with the Self Assessment Tax Return deadlines can lead to significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, interest will accrue on any unpaid taxes, increasing the total amount owed. In severe cases, repeated non-compliance may trigger audits or further legal action. It is essential to adhere to the deadlines to avoid these consequences.

Quick guide on how to complete self assessment tax returns deadlines

Easily Prepare Self Assessment Tax Returns Deadlines on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Manage Self Assessment Tax Returns Deadlines on any device using the airSlate SignNow apps available for Android or iOS, and enhance any document-driven process today.

The Most Efficient Way to Modify and eSign Self Assessment Tax Returns Deadlines Effortlessly

- Locate Self Assessment Tax Returns Deadlines and click on Get Form to initiate the process.

- Utilize the tools at your disposal to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your updates.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that necessitate reprinting document copies. airSlate SignNow fulfills all your document management requirements within a few clicks from any selected device. Edit and eSign Self Assessment Tax Returns Deadlines to guarantee exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self assessment tax returns deadlines

Create this form in 5 minutes!

How to create an eSignature for the self assessment tax returns deadlines

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

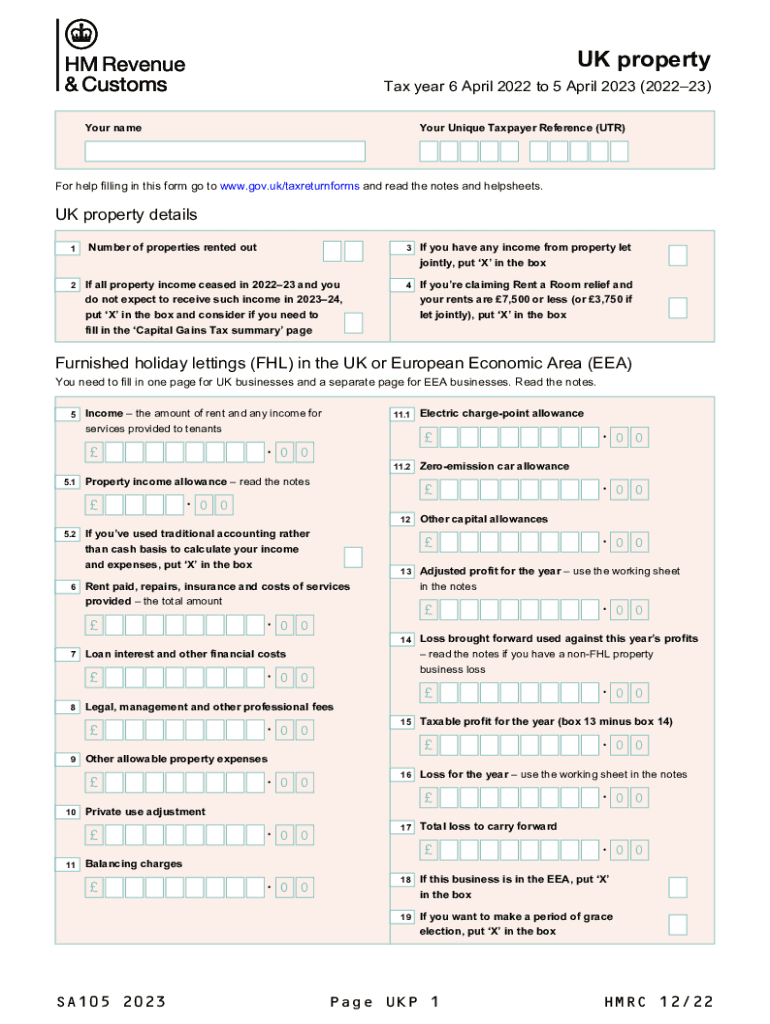

What is the SA105 form 2024 and why is it important?

The SA105 form 2024 is a crucial tax document used for reporting UK property income. It's essential for individuals who receive rental income to ensure compliance with HM Revenue and Customs (HMRC) regulations. Downloading the SA105 form 2024 PDF allows users to easily complete their tax filings.

-

How can I obtain the SA105 form 2024 PDF download?

You can easily obtain the SA105 form 2024 PDF download through the airSlate SignNow platform. Our intuitive interface allows users to access and download various forms, including the SA105, for seamless document management and completion.

-

Is airSlate SignNow free to use for downloading the SA105 form 2024?

While airSlate SignNow offers a range of features for free, some advanced functionalities may require a subscription. However, downloading the SA105 form 2024 PDF is accessible, making it easy for users to get started without additional costs.

-

What features does airSlate SignNow offer for managing the SA105 form 2024?

airSlate SignNow provides features like secure eSigning, document sharing, and cloud storage which streamline the process of managing the SA105 form 2024. Users can collaborate with tax professionals and clients efficiently and ensure all signatures are captured securely.

-

Can I integrate airSlate SignNow with other applications for better efficiency?

Yes, airSlate SignNow supports integration with a variety of applications including CRM systems and document management tools. This allows for seamless data transfer and enhances the efficiency of processes, including those involving the SA105 form 2024 PDF.

-

What are the benefits of using airSlate SignNow for the SA105 form 2024?

Using airSlate SignNow for the SA105 form 2024 simplifies the eSigning and document management process. You benefit from a user-friendly interface, efficient tracking of document status, and the ability to maintain compliance with tax regulations, making it a smart choice for property owners.

-

Is the SA105 form 2024 PDF download available in multiple languages?

Currently, the SA105 form 2024 PDF download is primarily available in English. However, airSlate SignNow is continually updating its resources to accommodate a diverse user base, so check back frequently for additional language options.

Get more for Self Assessment Tax Returns Deadlines

- Choctaw nation divorce papers form

- Hmsa precertification form

- Opticare medicaid gci order form

- Driving test pass certificate download form

- Pip template form

- Sportsbet certified documents form

- Financial assistance application ymca of coastal georgia form

- Commercial new app arkansas contractors licensing board aclb arkansas form

Find out other Self Assessment Tax Returns Deadlines

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later