C 95a Form

What is the C 95a?

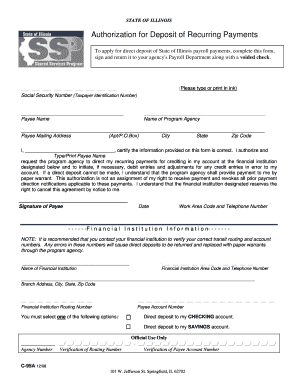

The C 95a form, officially known as the Illinois Form C 95a, is a document used primarily for reporting certain tax information to the state of Illinois. This form is essential for individuals and businesses that need to disclose specific financial details as part of their tax obligations. Understanding the purpose and requirements of the C 95a is crucial for ensuring compliance with state tax laws.

How to Use the C 95a

Using the C 95a form involves several key steps. First, gather all necessary financial information that pertains to your tax situation. This may include income statements, expense records, and any relevant documentation that supports your claims. Once you have all the information, accurately fill out the form, ensuring that all entries are complete and correct. After completing the form, it must be submitted to the appropriate state agency, either electronically or via mail, depending on your preference and the guidelines provided by the Illinois Department of Revenue.

Steps to Complete the C 95a

Completing the C 95a form requires careful attention to detail. Follow these steps for successful completion:

- Gather all required documentation, including income and expense records.

- Access the C 95a form from the Illinois Department of Revenue website or through authorized channels.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide detailed financial information as requested on the form, ensuring accuracy.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or print it for mailing, following the submission guidelines.

Legal Use of the C 95a

The C 95a form is legally binding when filled out and submitted in accordance with Illinois state laws. To ensure that your submission is valid, it is important to comply with all relevant regulations and guidelines. This includes adhering to deadlines, providing accurate information, and maintaining proper documentation that supports your claims. Failure to comply with legal requirements may result in penalties or other consequences.

State-Specific Rules for the C 95a

Illinois has specific rules governing the use of the C 95a form. These rules outline the eligibility criteria, required documentation, and filing procedures. It is essential for filers to familiarize themselves with these regulations to avoid any issues during the submission process. Additionally, staying updated on any changes to state tax laws can help ensure compliance and successful filing of the C 95a.

Form Submission Methods

The C 95a form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Illinois Department of Revenue's online portal.

- Mail: The completed form can also be printed and mailed to the appropriate address provided by the state.

- In-Person Submission: Some individuals may choose to deliver the form in person at designated state offices.

Quick guide on how to complete c 95a

Effortlessly Prepare C 95a on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle C 95a on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign C 95a effortlessly

- Locate C 95a and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign C 95a to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c 95a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the c95a Illinois form and how can airSlate SignNow assist with it?

The c95a Illinois form is a specific document required for various legal and business processes in Illinois. airSlate SignNow streamlines the process of eSigning and sending this form, ensuring compliance and speed. With user-friendly features, you can easily fill out and send the c95a Illinois form securely online.

-

What are the pricing plans for using airSlate SignNow to manage c95a Illinois documents?

airSlate SignNow offers several pricing plans that cater to different business needs, including options specifically suited for managing documents like the c95a Illinois. Plans are designed to be cost-effective while providing essential features to enhance workflow efficiency. You can choose from monthly or annual subscriptions to best fit your budget.

-

How does airSlate SignNow ensure the security of my c95a Illinois documents?

Security is a top priority for airSlate SignNow, especially when handling important documents like the c95a Illinois. The platform employs advanced encryption protocols, ensuring that your data remains confidential and secure during transmission. Additionally, robust authentication methods prevent unauthorized access to your documents.

-

Can I integrate airSlate SignNow with other software for managing c95a Illinois forms?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software and applications, making it easy to manage your c95a Illinois forms. Whether you use CRM systems or document storage services, integration helps you streamline workflows. This ensures that all your tools work together efficiently without losing access to your important documents.

-

What are the key features of airSlate SignNow for processing c95a Illinois?

airSlate SignNow provides a range of features designed to simplify the processing of c95a Illinois documents. With electronic signatures, templates, and automated workflows, you can expedite document management. The platform also allows for easy tracking of documents, ensuring you never miss an important update.

-

How can airSlate SignNow benefit my business when handling c95a Illinois?

Using airSlate SignNow to handle c95a Illinois documents can signNowly enhance your business efficiency. By streamlining the signing process and reducing paper use, your team can focus on more strategic activities. Moreover, the ability to send and receive documents instantly improves turnaround times and customer satisfaction.

-

Is airSlate SignNow mobile-friendly for managing c95a Illinois documents?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to manage your c95a Illinois documents on the go. You can access, sign, and send your documents from any mobile device, ensuring that you can handle important tasks even when you're away from your desk. This flexibility supports productivity in today’s fast-paced business environment.

Get more for C 95a

- Doj form bp a0564

- 10 5345 r 663 form

- Notice of pesticide application canyons school district canyonsdistrict form

- Military leave of absence form

- Equipment preventative maintenance form

- Mod 21 rfi portuguese chamber of commerce form

- Florida eservices calendar of electronic payment d form

- Florida corporate incomefranchise tax return f 11 form

Find out other C 95a

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now