Florida EServices Calendar of Electronic Payment D 2025-2026

What is the Florida EServices Calendar of Electronic Payment D?

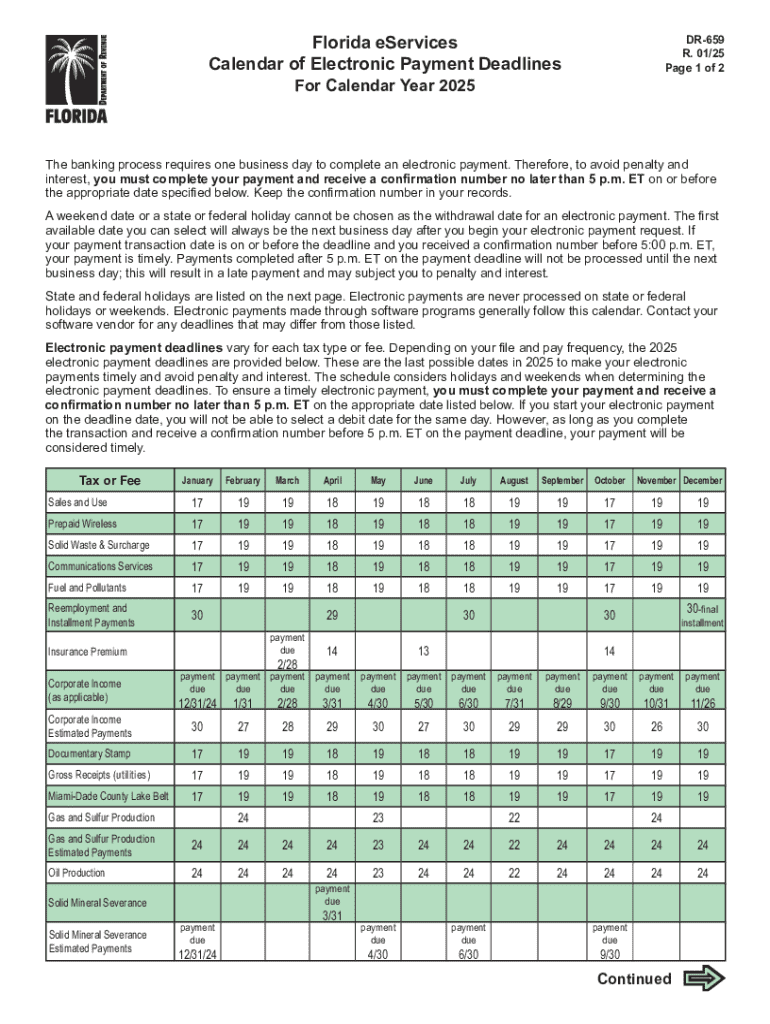

The Florida EServices Calendar of Electronic Payment D is a crucial tool for businesses and individuals in Florida to track important tax payment deadlines. This calendar outlines the due dates for various electronic payments, including sales tax, corporate income tax, and other state-mandated payments. It serves as a comprehensive guide to ensure compliance with state regulations, helping users avoid late fees and penalties associated with missed deadlines.

How to Use the Florida EServices Calendar of Electronic Payment D

Utilizing the Florida EServices Calendar of Electronic Payment D is straightforward. Users can access the calendar online, where they will find a detailed list of due dates for electronic payments. It is advisable to regularly check the calendar for updates, as deadlines may shift due to holidays or changes in state regulations. Users should mark their calendars and set reminders for each due date to ensure timely payments.

Steps to Complete the Florida EServices Calendar of Electronic Payment D

To effectively use the Florida EServices Calendar of Electronic Payment D, follow these steps:

- Access the calendar online through the Florida Department of Revenue website.

- Identify the relevant payment categories that apply to your business or personal tax obligations.

- Review the due dates for each category and note any upcoming deadlines.

- Prepare the necessary electronic payments in advance to avoid last-minute issues.

- Submit your payments through the designated electronic channels by the specified due dates.

Key Elements of the Florida EServices Calendar of Electronic Payment D

Several key elements make up the Florida EServices Calendar of Electronic Payment D:

- Payment Types: The calendar includes various payment types, such as sales tax and corporate income tax.

- Due Dates: Each payment type has specific due dates that users must adhere to.

- Electronic Payment Methods: Information on acceptable electronic payment methods is provided to facilitate compliance.

- Updates: The calendar is regularly updated to reflect any changes in tax laws or payment schedules.

Filing Deadlines / Important Dates

Filing deadlines are critical for maintaining compliance with state tax regulations. The Florida EServices Calendar of Electronic Payment D specifies important dates for various tax payments. Users should pay close attention to these deadlines to avoid penalties. Notably, the calendar also highlights any changes due to holidays or special circumstances that may affect payment schedules.

Penalties for Non-Compliance

Failure to comply with the deadlines outlined in the Florida EServices Calendar of Electronic Payment D can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from the state. It is essential for users to stay informed about their obligations and ensure timely payments to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct florida eservices calendar of electronic payment d

Create this form in 5 minutes!

How to create an eSignature for the florida eservices calendar of electronic payment d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the calendar 2025 form and how can it benefit my business?

The calendar 2025 form is a customizable document that allows businesses to plan and manage their schedules effectively. By using this form, you can streamline your planning processes, ensuring that all important dates and deadlines are clearly outlined. This can enhance productivity and help teams stay organized throughout the year.

-

How do I create a calendar 2025 form using airSlate SignNow?

Creating a calendar 2025 form with airSlate SignNow is simple and intuitive. You can start by selecting a template or designing your own from scratch. The platform provides easy drag-and-drop features, allowing you to add fields, dates, and other necessary elements to tailor the form to your specific needs.

-

Is there a cost associated with using the calendar 2025 form on airSlate SignNow?

Yes, there are various pricing plans available for using the calendar 2025 form on airSlate SignNow. Each plan is designed to cater to different business sizes and needs, ensuring that you can find a cost-effective solution that fits your budget. You can explore our pricing page for detailed information on the options available.

-

Can I integrate the calendar 2025 form with other applications?

Absolutely! airSlate SignNow allows seamless integration with various applications, enhancing the functionality of your calendar 2025 form. You can connect it with tools like Google Calendar, CRM systems, and other productivity apps to ensure all your scheduling needs are met in one place.

-

What features does the calendar 2025 form offer?

The calendar 2025 form comes with a range of features designed to simplify your scheduling tasks. These include customizable fields, automated reminders, eSignature capabilities, and the ability to share the form with team members. This ensures that everyone stays informed and aligned on important dates.

-

How secure is the calendar 2025 form on airSlate SignNow?

Security is a top priority at airSlate SignNow. The calendar 2025 form is protected with advanced encryption and compliance measures to ensure that your data remains safe and confidential. You can confidently use our platform knowing that your information is secure.

-

Can I access the calendar 2025 form on mobile devices?

Yes, the calendar 2025 form is fully accessible on mobile devices. This means you can manage your schedules and sign documents on the go, ensuring that you never miss an important date or deadline. The mobile-friendly design makes it easy to use from anywhere.

Get more for Florida EServices Calendar Of Electronic Payment D

- Fillable online personal income tax forms state of rhode

- 2014 form irs 14039 sp fill online printable fillable

- Taxrigovforms2020discharge of estate tax lien state of rhode island

- Instructions for form 2290 rev july 2021 instructions for form 2290 heavy highway vehicle use tax return

- Fw2 attention you may file forms w 2 and w 3 electronically

- Wwwirsgovforms pubsabout form 8879 cabout form 8879 c irs e file signature authorization for

- 2021 form 5498 ira contribution information

- Updated internal revenue service irs contact information

Find out other Florida EServices Calendar Of Electronic Payment D

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online