Irs Tax Forms 1040 Printable

What is the IRS Tax Forms 1040 Printable

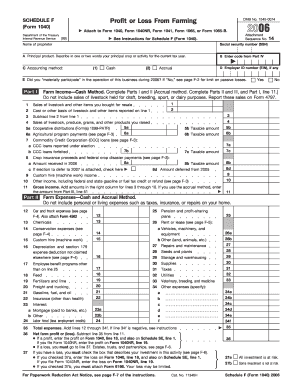

The IRS tax forms 1040 printable is a crucial document used by individuals in the United States to file their annual income tax returns. This form allows taxpayers to report their income, claim deductions, and determine their tax liability. The 1040 form is designed to accommodate various income scenarios, including wages, dividends, and self-employment income. It is essential for accurately calculating the taxes owed or the refund due to the taxpayer.

How to Use the IRS Tax Forms 1040 Printable

Using the IRS tax forms 1040 printable involves several steps. First, download the form from the IRS website or a trusted source. Next, gather all necessary documents, such as W-2s, 1099s, and receipts for deductible expenses. Fill out the form carefully, ensuring that all information is accurate and complete. Once completed, review your entries for any errors before signing the form. Finally, submit the form either electronically or by mail, depending on your preference and the submission guidelines provided by the IRS.

Steps to Complete the IRS Tax Forms 1040 Printable

Completing the IRS tax forms 1040 printable requires a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Download the latest version of Form 1040 from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income in the designated sections, ensuring accuracy.

- Claim any deductions or credits you are eligible for, following the instructions provided.

- Calculate your total tax liability or refund amount.

- Sign and date the form before submitting it.

Legal Use of the IRS Tax Forms 1040 Printable

The IRS tax forms 1040 printable is legally binding when completed and submitted according to IRS regulations. To ensure compliance, it is important to follow all instructions carefully and provide accurate information. Digital signatures are accepted under the Electronic Signatures in Global and National Commerce (ESIGN) Act, allowing taxpayers to submit their forms electronically while maintaining legal validity. Keeping a copy of the submitted form for your records is also advisable.

Filing Deadlines / Important Dates

Filing deadlines for the IRS tax forms 1040 printable are crucial for taxpayers to remember. Typically, the deadline for filing your federal income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also request an extension, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To accurately complete the IRS tax forms 1040 printable, several documents are necessary:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation for any deductions or credits claimed, including receipts and statements.

- Social Security numbers for all dependents.

Quick guide on how to complete irs tax forms 1040 printable

Complete Irs Tax Forms 1040 Printable seamlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Irs Tax Forms 1040 Printable on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centered workflow today.

The easiest way to modify and eSign Irs Tax Forms 1040 Printable effortlessly

- Find Irs Tax Forms 1040 Printable and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your files or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Tax Forms 1040 Printable and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs tax forms 1040 printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IRS 2019 tax forms 1040 printable and how can I obtain them?

IRS 2019 tax forms 1040 printable are the official income tax forms that taxpayers use to report their earnings to the IRS for the 2019 tax year. You can obtain these forms directly from the IRS website or through trusted software providers like airSlate SignNow that offer easy access and e-signature options.

-

Can I fill out IRS 2019 tax forms 1040 printable online?

Yes, you can fill out IRS 2019 tax forms 1040 printable online using various tax software services or document management platforms like airSlate SignNow. This service allows users to complete and sign their forms digitally, enhancing convenience and accuracy.

-

What are the benefits of using airSlate SignNow for IRS 2019 tax forms 1040 printable?

Using airSlate SignNow for IRS 2019 tax forms 1040 printable offers several benefits, including an easy-to-use interface, efficient e-signature capabilities, and secure document storage. This means you can complete your tax forms quickly while ensuring your data is protected.

-

Is airSlate SignNow cost-effective for managing IRS 2019 tax forms 1040 printable?

Absolutely! airSlate SignNow is designed to provide a cost-effective solution for individuals and businesses needing to manage IRS 2019 tax forms 1040 printable. With various pricing plans, users can choose an option that fits their budget while gaining access to essential document management features.

-

Can I integrate airSlate SignNow with other accounting software for IRS 2019 tax forms 1040 printable?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to manage IRS 2019 tax forms 1040 printable alongside your financial tools. This seamless integration helps streamline your workflow and enhances productivity.

-

What types of documents can I send for e-signature besides IRS 2019 tax forms 1040 printable?

In addition to IRS 2019 tax forms 1040 printable, you can send various documents for e-signature using airSlate SignNow, including contracts, agreements, and consent forms. This allows you to manage all your important documents in one place.

-

Are IRS 2019 tax forms 1040 printable necessary if I use a tax preparer?

While a tax preparer will often handle IRS 2019 tax forms 1040 printable for you, having access to these forms can help you stay informed about your tax situation and review your filings. Using airSlate SignNow can simplify the process through easy collaboration with your tax advisor.

Get more for Irs Tax Forms 1040 Printable

Find out other Irs Tax Forms 1040 Printable

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement