New Mexico Income Tax Form 2006

What is the New Mexico Income Tax Form

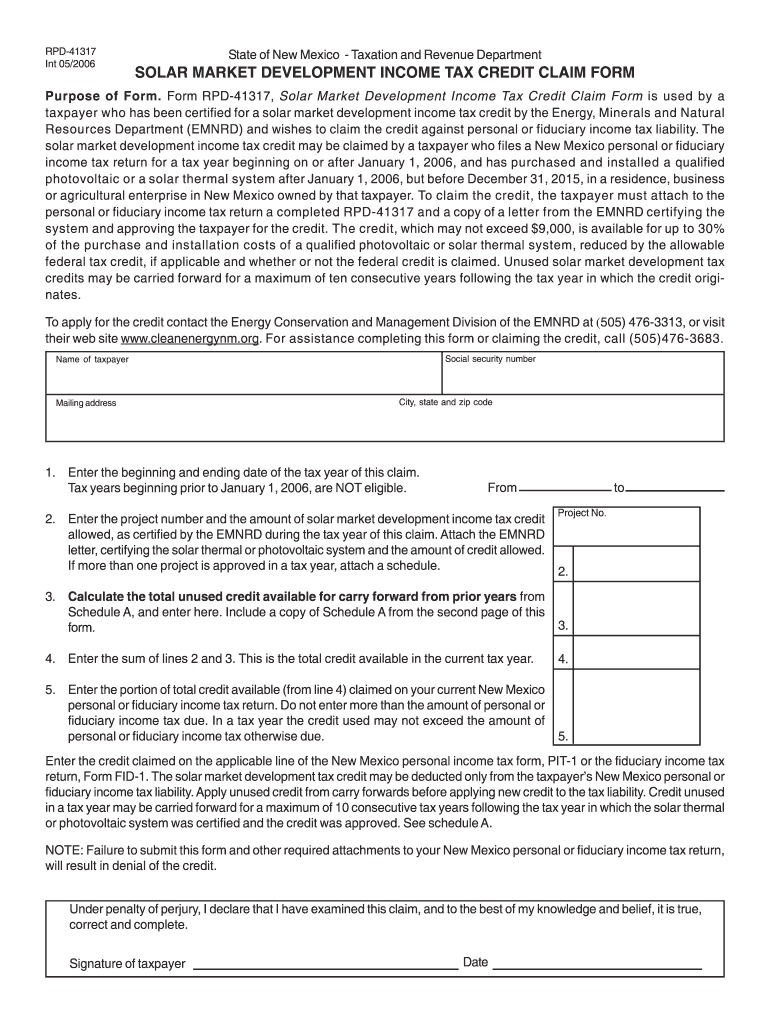

The New Mexico Income Tax Form is a document required by the New Mexico Taxation and Revenue Department for individuals and businesses to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax laws and is used to determine the amount of tax owed or the refund due. It includes sections for reporting various types of income, deductions, and credits available to taxpayers in New Mexico.

How to use the New Mexico Income Tax Form

Using the New Mexico Income Tax Form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing and dating it. Finally, submit the form either electronically or by mail, depending on your preference and the submission methods available.

Steps to complete the New Mexico Income Tax Form

Completing the New Mexico Income Tax Form requires a systematic approach. Follow these steps:

- Collect all relevant tax documents, including income statements and receipts for deductions.

- Download the latest version of the New Mexico Income Tax Form from the official website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Apply any deductions and credits you qualify for, ensuring you have documentation to support your claims.

- Calculate your total tax liability or refund based on the information provided.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the New Mexico Income Tax Form to avoid penalties. Typically, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any extensions that may apply and ensure they file accordingly to maintain compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The New Mexico Income Tax Form can be submitted through various methods. Taxpayers have the option to file electronically using approved tax software, which is often the quickest and most efficient method. Alternatively, you can print the completed form and mail it to the appropriate address provided by the New Mexico Taxation and Revenue Department. In some cases, in-person submissions may also be accepted at designated tax offices, although this is less common.

Key elements of the New Mexico Income Tax Form

The New Mexico Income Tax Form includes several key elements that taxpayers must complete. These elements typically consist of personal identification information, income reporting sections, deductions, and credits. Additionally, the form may require taxpayers to provide information about their filing status, such as single, married filing jointly, or head of household. Understanding these elements is essential for accurate completion and compliance with state tax laws.

Quick guide on how to complete 2006 new mexico income tax form

Your assistance manual on how to prepare your New Mexico Income Tax Form

If you’re curious about how to complete and submit your New Mexico Income Tax Form, here are some concise instructions on how to simplify tax submission.

To start, you just need to create your airSlate SignNow account to revolutionize your approach to handling documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, allowing for easy corrections as needed. Optimize your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to complete your New Mexico Income Tax Form in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your New Mexico Income Tax Form in our editor.

- Enter the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and fix any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can lead to return errors and delay refunds. Naturally, prior to e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2006 new mexico income tax form

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

Which income tax form should be filled out by a beautician?

As a beautician, since you are self-employed, your income would come under the source- income from business or profession. So you could either file your ITR using ITR3 (if you wish to file normally) or you can use ITR4 (if you wish to file on presumptive basis).Hope you find my answer helpfulFeel free to contact me at abhinandansethia90@gmail.com for any assistanceRegardsAbhinandan

Create this form in 5 minutes!

How to create an eSignature for the 2006 new mexico income tax form

How to generate an electronic signature for your 2006 New Mexico Income Tax Form online

How to create an electronic signature for the 2006 New Mexico Income Tax Form in Chrome

How to make an electronic signature for putting it on the 2006 New Mexico Income Tax Form in Gmail

How to create an eSignature for the 2006 New Mexico Income Tax Form from your smartphone

How to create an electronic signature for the 2006 New Mexico Income Tax Form on iOS

How to make an eSignature for the 2006 New Mexico Income Tax Form on Android devices

People also ask

-

What is the New Mexico Income Tax Form and why is it important?

The New Mexico Income Tax Form is the official document used by residents to report their annual income and calculate their tax obligations. Completing this form accurately is crucial to ensuring compliance with state tax laws and avoiding potential penalties or audits.

-

How can airSlate SignNow assist with the New Mexico Income Tax Form?

airSlate SignNow provides an efficient platform for completing and eSigning the New Mexico Income Tax Form. With its user-friendly interface, you can easily fill out your tax documents, gather required signatures, and send them securely, all in one place.

-

What are the pricing options for using airSlate SignNow for the New Mexico Income Tax Form?

airSlate SignNow offers flexible pricing plans, allowing you to choose the one that best fits your needs for managing the New Mexico Income Tax Form. Whether you need basic functionalities or advanced features, there’s a plan that provides the right level of service at a cost-effective rate.

-

Are there any features specific to handling the New Mexico Income Tax Form?

Yes, airSlate SignNow includes specific features designed to streamline the process of handling the New Mexico Income Tax Form. These features include document templates, drag-and-drop fields, and easy eSigning, making the tax filing process simpler and faster.

-

Can I integrate airSlate SignNow with other software for my New Mexico Income Tax Form?

airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage the New Mexico Income Tax Form. This includes popular accounting and tax software, allowing for smooth data transfer and improved efficiency in your tax preparation.

-

Is the New Mexico Income Tax Form secure when using airSlate SignNow?

Absolutely, the New Mexico Income Tax Form is handled with top-level security measures on airSlate SignNow. The platform utilizes advanced encryption and secure access protocols to protect your sensitive information during eSigning and document sharing.

-

What benefits do I gain by using airSlate SignNow for my New Mexico Income Tax Form?

By using airSlate SignNow for your New Mexico Income Tax Form, you gain signNow time savings and ease of use. The platform allows you to complete documents quickly, access them from anywhere, and ensure compliance with state requirements—all while maintaining exceptional security.

Get more for New Mexico Income Tax Form

Find out other New Mexico Income Tax Form

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure