Solar Market Development Income Tax Credit Claim Form 2009

What is the Solar Market Development Income Tax Credit Claim Form

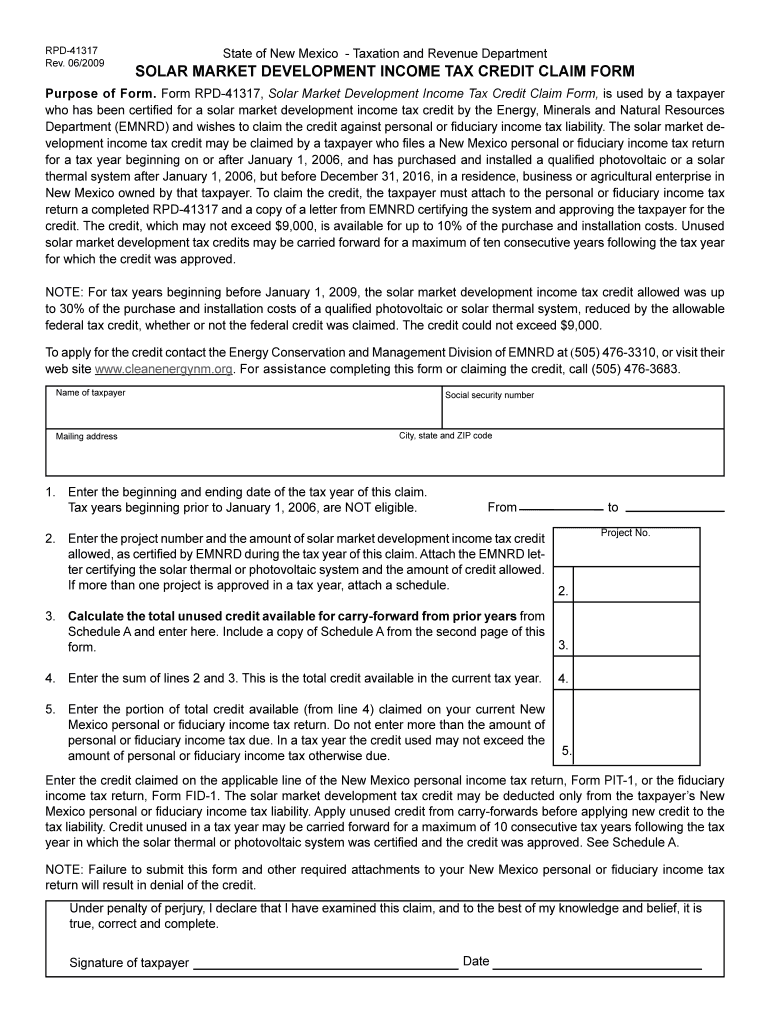

The Solar Market Development Income Tax Credit Claim Form is a specific document designed for taxpayers in the United States who wish to claim tax credits related to solar energy investments. This form allows eligible individuals and businesses to report their investments in solar energy systems and receive tax benefits. It is essential for ensuring compliance with federal tax regulations and maximizing available credits.

How to use the Solar Market Development Income Tax Credit Claim Form

Using the Solar Market Development Income Tax Credit Claim Form involves several straightforward steps. First, gather all necessary information regarding your solar energy investment, including installation costs and any relevant documentation. Next, fill out the form accurately, ensuring all fields are completed with the required information. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. This process helps ensure that you receive the correct tax credits and avoid potential delays.

Steps to complete the Solar Market Development Income Tax Credit Claim Form

Completing the Solar Market Development Income Tax Credit Claim Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents related to your solar investment.

- Access the claim form through the appropriate tax authority's website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your solar energy system, including installation date and costs.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

- Submit the form by the designated deadline, either online or by mail.

Key elements of the Solar Market Development Income Tax Credit Claim Form

Several key elements must be included in the Solar Market Development Income Tax Credit Claim Form to ensure its validity. These elements typically include:

- Your personal identification information, such as name and address.

- Details of the solar energy system, including installation costs and dates.

- A declaration of eligibility for the tax credit.

- Signature and date, confirming the accuracy of the information provided.

Including these elements helps facilitate a smooth review process by tax authorities.

Eligibility Criteria

To qualify for the Solar Market Development Income Tax Credit, applicants must meet specific eligibility criteria. Generally, these criteria include:

- The solar energy system must be installed on property owned by the applicant.

- The system must meet certain performance and quality standards established by the IRS.

- The applicant must be a taxpayer who files a federal income tax return.

Meeting these criteria is crucial for successfully claiming the tax credit and ensuring compliance with federal regulations.

Form Submission Methods

The Solar Market Development Income Tax Credit Claim Form can be submitted through various methods, depending on your preference and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's website, which often allows for quicker processing.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if available.

Choosing the right submission method can impact the speed and efficiency of processing your claim.

Quick guide on how to complete solar market development income tax credit claim form

Your assistance manual on how to prepare your Solar Market Development Income Tax Credit Claim Form

If you’re curious about how to create and submit your Solar Market Development Income Tax Credit Claim Form, here are some brief guidelines on how to streamline tax processing.

To start, simply register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and complete your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to update information as necessary. Simplify your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Solar Market Development Income Tax Credit Claim Form in just minutes:

- Sign up for your account and begin working on PDFs in no time.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Solar Market Development Income Tax Credit Claim Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-binding eSignature (if required).

- Review your document and fix any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Leverage this guide to file your taxes online with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct solar market development income tax credit claim form

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How should I claim a foreign tax credit shown in Form 16 by the company and file an income tax return?

There are special provisions in respect to foreign taxes deducted on the foreign income. DTAA will have to be read between the 2 countries. The taxation of the income shall be done accordingly.If no DTAA exists, then the methodology of taxing the income and taking credit of the tax deducted changes.Pls contact your CA in regards to the same. Or you can contact me on dhruv@mdcoindia.com for further guidance

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

Create this form in 5 minutes!

How to create an eSignature for the solar market development income tax credit claim form

How to create an electronic signature for the Solar Market Development Income Tax Credit Claim Form in the online mode

How to generate an eSignature for the Solar Market Development Income Tax Credit Claim Form in Chrome

How to generate an electronic signature for putting it on the Solar Market Development Income Tax Credit Claim Form in Gmail

How to make an eSignature for the Solar Market Development Income Tax Credit Claim Form straight from your smartphone

How to generate an electronic signature for the Solar Market Development Income Tax Credit Claim Form on iOS

How to create an eSignature for the Solar Market Development Income Tax Credit Claim Form on Android devices

People also ask

-

What is the Solar Market Development Income Tax Credit Claim Form used for?

The Solar Market Development Income Tax Credit Claim Form is utilized by businesses and individuals to claim tax credits for solar energy installations. By accurately completing this form, you can unlock signNow financial benefits associated with your solar projects. It is crucial to understand the requirements to ensure you maximize your tax savings.

-

How can I fill out the Solar Market Development Income Tax Credit Claim Form using airSlate SignNow?

AirSlate SignNow provides an intuitive platform for filling out the Solar Market Development Income Tax Credit Claim Form quickly and efficiently. You can easily access templates and eSign documents, which streamlines the process and reduces the risk of errors. Additionally, our platform allows for real-time collaboration, ensuring all stakeholders can contribute seamlessly.

-

Are there any fees associated with using the Solar Market Development Income Tax Credit Claim Form on airSlate SignNow?

While the Solar Market Development Income Tax Credit Claim Form is available for use, airSlate SignNow operates on a subscription model with various pricing tiers. This allows you to choose a plan that fits your needs and includes features such as unlimited eSignatures and document storage. It's an affordable solution that can save you time and money in the long run.

-

What features does airSlate SignNow offer for managing the Solar Market Development Income Tax Credit Claim Form?

AirSlate SignNow offers a variety of features for managing the Solar Market Development Income Tax Credit Claim Form, including customizable templates, cloud storage, and advanced security measures. Collaboration features enable you to invite team members to review and sign documents seamlessly. All these tools are designed to enhance your experience and improve efficiency.

-

Can I track the status of my Solar Market Development Income Tax Credit Claim Form in airSlate SignNow?

Yes, airSlate SignNow provides robust tracking capabilities for the Solar Market Development Income Tax Credit Claim Form. You can monitor when the form is viewed, signed, or completed by your recipients, ensuring transparency and accountability. This feature is particularly useful for keeping all parties informed and organized during the filing process.

-

Is the Solar Market Development Income Tax Credit Claim Form editable after being signed?

Once the Solar Market Development Income Tax Credit Claim Form is signed in airSlate SignNow, it cannot be altered to maintain the integrity of the document. However, you can create a new version if changes are necessary. The platform simplifies the process of generating new forms while retaining all previous versions for your records.

-

What benefits do I gain by using airSlate SignNow for the Solar Market Development Income Tax Credit Claim Form?

Using airSlate SignNow for the Solar Market Development Income Tax Credit Claim Form offers several benefits, including enhanced efficiency and reduced paperwork. Our eSigning capabilities accelerate the approval process, allowing you to submit your claim faster. Furthermore, our built-in compliance ensures your documents adhere to legal standards, providing peace of mind.

Get more for Solar Market Development Income Tax Credit Claim Form

Find out other Solar Market Development Income Tax Credit Claim Form

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple