Tax Refund Form

What is the Tax Refund Form

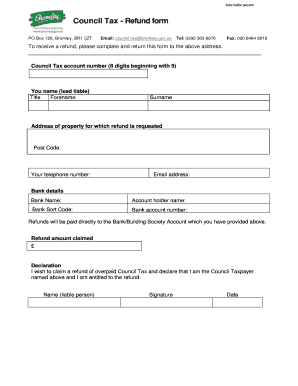

The tax refund form is an official document used to request a refund of overpaid taxes. This form is essential for individuals and businesses who have paid more tax than they owe, allowing them to reclaim the excess amount. The form typically requires detailed information about the taxpayer, including their identification details, the amount of tax paid, and the reason for the refund request. Understanding the purpose and structure of this form is crucial for ensuring accurate submission and timely processing.

How to use the Tax Refund Form

Using the tax refund form involves several steps to ensure that the request is correctly filled out and submitted. First, gather all necessary documents, including previous tax returns, proof of payments, and any relevant correspondence with tax authorities. Next, accurately fill out the form, providing all required information. It is important to double-check for any errors or omissions, as these can lead to delays or rejections. Once completed, the form can be submitted through the appropriate channels, whether online, via mail, or in person, depending on the specific guidelines for your jurisdiction.

Steps to complete the Tax Refund Form

Completing the tax refund form requires careful attention to detail. Follow these steps to ensure accuracy:

- Start by entering your personal information, including your name, address, and Social Security number.

- Provide details about the tax year for which you are requesting a refund.

- Clearly state the total amount of tax paid and the amount you believe should be refunded.

- Attach any supporting documentation that verifies your claim, such as receipts or bank statements.

- Review the form for completeness and accuracy before submission.

Required Documents

When submitting a tax refund form, certain documents are typically required to support your claim. These may include:

- Copies of previous tax returns for the relevant years.

- Proof of tax payments, such as bank statements or payment confirmations.

- Any correspondence with the tax authority regarding your tax status.

- Documentation supporting any deductions or credits claimed.

Eligibility Criteria

To qualify for a tax refund, certain eligibility criteria must be met. Generally, taxpayers must have overpaid their taxes for the year in question. This can occur due to various reasons, such as errors in withholding or estimated tax payments. Additionally, the taxpayer must be within the time limits set by tax authorities for filing a refund request, which can vary by jurisdiction. Understanding these criteria is essential for determining whether you can successfully claim a refund.

Form Submission Methods

The tax refund form can be submitted through various methods, depending on your preference and the guidelines of the tax authority. Common submission methods include:

- Online submission through the tax authority's website, which often allows for quicker processing.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, which may provide immediate assistance and confirmation.

Quick guide on how to complete tax refund form

Access Tax Refund Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Tax Refund Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Tax Refund Form with ease

- Locate Tax Refund Form and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight crucial parts of your documents or obscure sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Generate your eSignature using the Sign feature, which takes only a few seconds and has the same legal validity as a customary wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming form searches, and errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Tax Refund Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax refund form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UK council tax refund?

A UK council tax refund is a reimbursement of overpaid council tax from your local authority. If you believe you have overpaid, you can apply for a refund to recover the excess amount. Understanding the refund process can help you manage your finances better.

-

How can airSlate SignNow assist with my UK council tax refund application?

airSlate SignNow simplifies the application process for your UK council tax refund by allowing you to eSign and send necessary documents quickly. You can prepare your refund request documents using our platform, ensuring a smooth submission. This efficient process can save you time and help facilitate the refund.

-

What are the costs associated with airSlate SignNow for applying for a UK council tax refund?

airSlate SignNow offers a cost-effective solution for managing your documents, including applications for a UK council tax refund. The pricing varies based on the subscription plan you choose, which provides various features to meet your needs. Consider the potential savings from a council tax refund when evaluating the service cost.

-

Is airSlate SignNow secure for handling UK council tax refund documents?

Yes, airSlate SignNow prioritizes security to protect your documents, including those related to your UK council tax refund. Our platform uses advanced encryption and compliance measures, ensuring that your sensitive information is safe during the application process. You can trust us to handle your data responsibly.

-

Does airSlate SignNow integrate with other tools to enhance the UK council tax refund process?

Absolutely! airSlate SignNow seamlessly integrates with various applications to streamline the process for your UK council tax refund. These integrations allow you to manage your documents more effectively and track submissions. Utilizing these features can simplify your overall experience.

-

Can I track the status of my UK council tax refund through airSlate SignNow?

While airSlate SignNow facilitates the preparation and submission of documents for your UK council tax refund, tracking the status directly is typically done through your local authority's website. However, our platform keeps you updated on the document's progress until it is submitted. This level of tracking ensures you stay informed throughout the process.

-

What benefits does eSigning provide for my UK council tax refund application?

eSigning your UK council tax refund application with airSlate SignNow offers numerous benefits, including speed and convenience. It eliminates the need for printing and mailing physical documents, allowing for instant submission. This not only speeds up the process but also enhances the overall user experience.

Get more for Tax Refund Form

Find out other Tax Refund Form

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document