Form Trd 41406

What is the Form Trd 41406

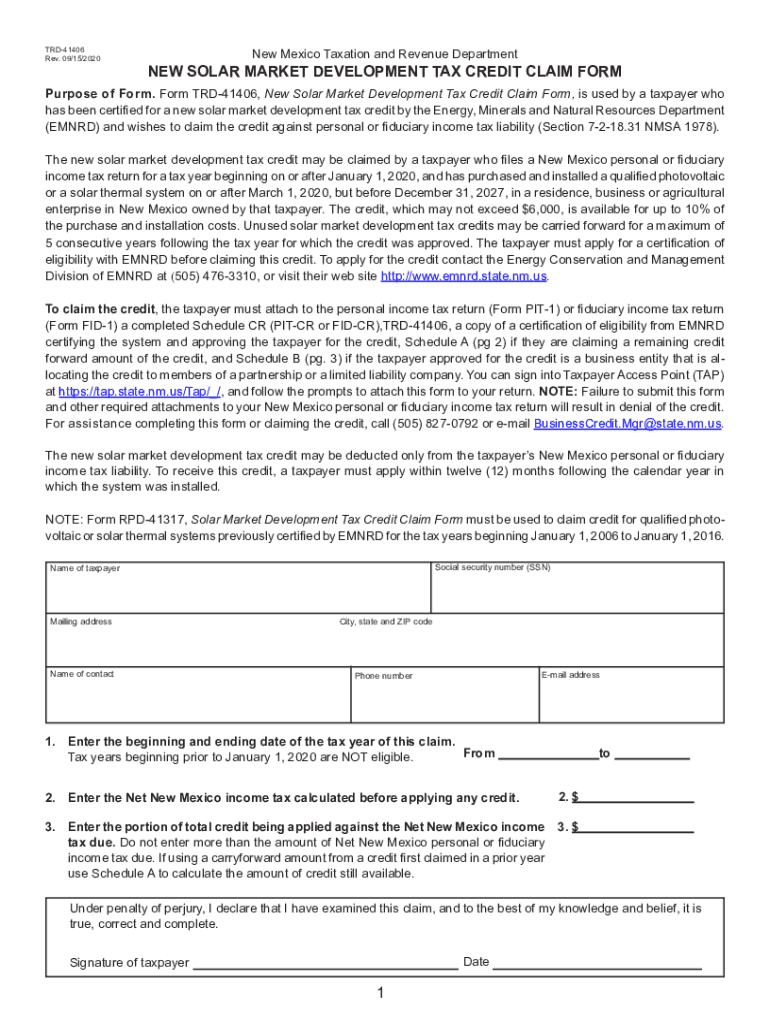

The Form Trd 41406 is the official document used to claim the New Mexico solar tax credit. This form allows taxpayers to receive a credit against their personal income tax for the installation of solar energy systems. It is essential for individuals and businesses looking to benefit from renewable energy incentives provided by the state. Understanding the purpose and requirements of this form is crucial for ensuring compliance and maximizing tax benefits.

How to use the Form Trd 41406

Using the Form Trd 41406 involves several steps to ensure accurate completion and submission. Taxpayers must first gather necessary documentation, including proof of solar system installation and any relevant receipts. Once all information is collected, the form can be filled out with details such as the taxpayer's name, address, and the specifics of the solar energy system installed. After completing the form, it should be submitted along with the state income tax return to claim the credit effectively.

Steps to complete the Form Trd 41406

Completing the Form Trd 41406 requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including installation invoices and proof of payment.

- Fill out the personal information section, ensuring accuracy in names and addresses.

- Provide details about the solar energy system, including installation date and type of system.

- Calculate the credit amount based on the installation costs and any applicable limits.

- Review the form for completeness and accuracy before submission.

Legal use of the Form Trd 41406

The legal use of the Form Trd 41406 is governed by New Mexico tax laws. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Additionally, the information provided must be truthful and substantiated by supporting documents. Failure to comply with these legal requirements may result in penalties or denial of the tax credit.

Eligibility Criteria

Eligibility for claiming the New Mexico solar tax credit using Form Trd 41406 is based on several factors. Taxpayers must have installed a qualifying solar energy system on their property. The system must meet specific performance standards and be operational during the tax year for which the credit is claimed. Furthermore, the taxpayer must be subject to New Mexico income tax to qualify for the credit.

Required Documents

When completing the Form Trd 41406, several documents are required to substantiate the claim. These typically include:

- Invoices from the solar installation company detailing the costs incurred.

- Proof of payment for the solar system installation.

- Any additional documentation that demonstrates the system's compliance with state regulations.

Form Submission Methods

The Form Trd 41406 can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the New Mexico Taxation and Revenue Department's website.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person submission at designated tax offices for those who prefer face-to-face assistance.

Quick guide on how to complete form trd 41406

Effortlessly prepare Form Trd 41406 on any device

Digital document management has become increasingly favored by both organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Form Trd 41406 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related operations today.

How to modify and eSign Form Trd 41406 with ease

- Find Form Trd 41406 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal significance as a traditional handwritten signature.

- Review the information carefully and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choosing. Alter and eSign Form Trd 41406 and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form trd 41406

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of trd 41406 in airSlate SignNow?

The trd 41406 refers to a specific integration feature in airSlate SignNow that enhances document management capabilities. This feature simplifies the signing and sending process, making it ideal for businesses looking for efficient solutions. By leveraging trd 41406, users can streamline their workflows signNowly.

-

How does airSlate SignNow pricing work for the trd 41406 feature?

airSlate SignNow offers competitive pricing plans that include the trd 41406 feature. Users can choose from various tiers to find the best fit for their business needs. This cost-effective solution ensures that businesses can utilize advanced features without straining their budgets.

-

What key features does the trd 41406 provide?

The trd 41406 feature in airSlate SignNow includes customized templates, automated workflows, and real-time collaboration tools. These features are designed to improve efficiency and maximize productivity for teams. By incorporating trd 41406, users can enhance their document management processes.

-

Can I integrate trd 41406 with other software solutions?

Yes, trd 41406 seamlessly integrates with various software applications, allowing for enhanced workflow automation. Popular integrations include CRM systems, project management tools, and cloud storage services. This flexibility ensures that businesses can tailor their document processing needs.

-

What are the benefits of using the trd 41406 feature for eSigning?

Using the trd 41406 feature for eSigning provides businesses with a secure, legally binding method to sign documents. It accelerates the signing process, reducing turnaround times signNowly. Additionally, this feature is user-friendly, making it accessible for all team members.

-

Is technical support available for users of trd 41406?

Absolutely! Users of trd 41406 in airSlate SignNow have access to comprehensive technical support. Whether you need assistance with setup, troubleshooting, or optimizing usage, our support team is ready to help. We ensure that you can maximize the benefits of trd 41406 without any issues.

-

How does trd 41406 enhance document security?

The trd 41406 feature enhances document security through encryption and audit trails. These measures help protect sensitive information and ensure compliance with legal standards. By utilizing trd 41406, users can feel confident that their documents are secure throughout the signing process.

Get more for Form Trd 41406

Find out other Form Trd 41406

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement