Form 8995 a Qualified Business Income Deduction 2024

Understanding IRS Form 8995: Qualified Business Income Deduction

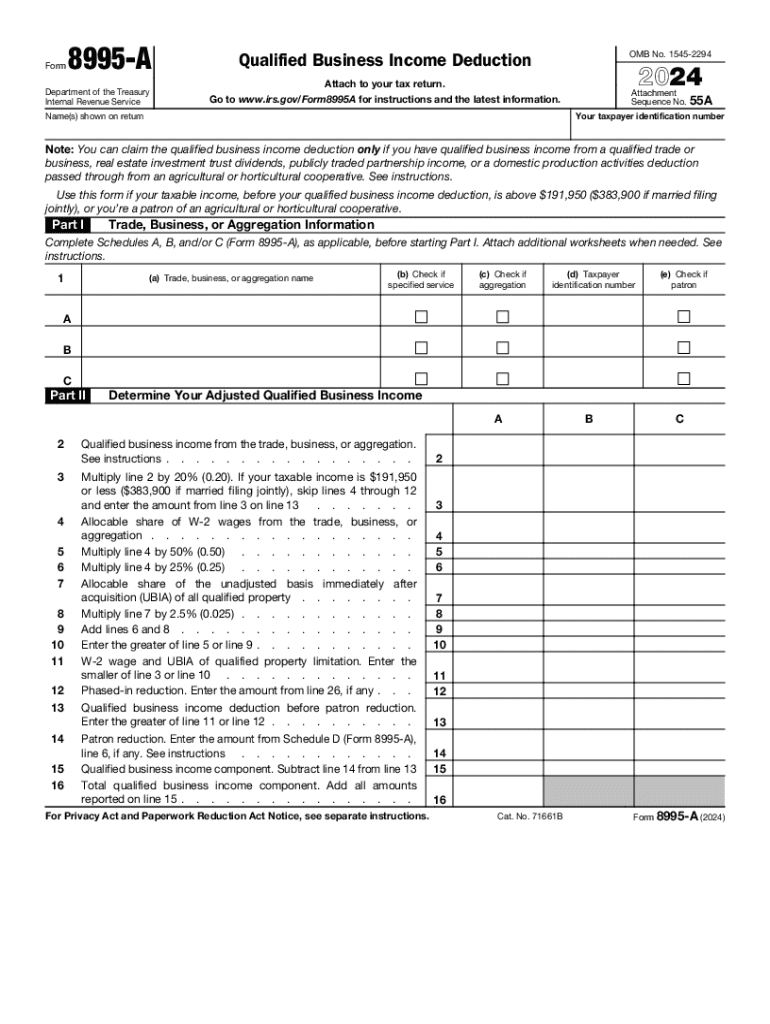

IRS Form 8995 is designed for individuals claiming the Qualified Business Income (QBI) deduction. This deduction allows eligible taxpayers to deduct up to twenty percent of their qualified business income from their taxable income. The form is primarily used by sole proprietors, partnerships, S corporations, and some trusts and estates. It simplifies the process of calculating the QBI deduction, making it accessible for those who qualify.

Steps to Complete IRS Form 8995

Completing IRS Form 8995 involves several key steps:

- Gather necessary documents, including income statements and details of any qualified business activities.

- Fill out the top section with your identifying information, such as your name and Social Security number.

- Calculate your qualified business income by reporting income, deductions, and losses from your business.

- Determine your QBI deduction amount using the provided calculations on the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for IRS Form 8995

To be eligible to use IRS Form 8995, taxpayers must meet specific criteria. These include:

- Being a sole proprietor, partner in a partnership, or shareholder in an S corporation.

- Having qualified business income from a domestic business operated as a pass-through entity.

- Meeting income thresholds that determine the applicability of the deduction.

Required Documents for Filing IRS Form 8995

When filing IRS Form 8995, it is essential to have the following documents ready:

- Income statements from your business, such as profit and loss statements.

- Records of any business expenses that may affect your qualified business income.

- Documentation supporting your business structure and operations.

Filing Deadlines for IRS Form 8995

IRS Form 8995 must be filed along with your annual tax return. The typical deadline for individual tax returns is April fifteenth, although extensions may apply. If you are unable to file by this date, consider applying for an extension to avoid penalties.

IRS Guidelines for Using Form 8995

The IRS provides specific guidelines for completing and submitting Form 8995. It is important to follow these instructions carefully to ensure compliance. Key points include:

- Review IRS publications related to the QBI deduction for detailed information.

- Consult with a tax professional if you have questions about your eligibility or the filing process.

- Keep copies of all submitted forms and supporting documents for your records.

Create this form in 5 minutes or less

Find and fill out the correct form 8995 a qualified business income deduction 771468778

Create this form in 5 minutes!

How to create an eSignature for the form 8995 a qualified business income deduction 771468778

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8995?

IRS Form 8995 is a tax form used to calculate the Qualified Business Income Deduction for eligible taxpayers. This form helps individuals and businesses determine their deduction amount based on their qualified business income. Understanding how to fill out IRS Form 8995 correctly can signNowly impact your tax savings.

-

How can airSlate SignNow help with IRS Form 8995?

airSlate SignNow provides a seamless platform for electronically signing and sending IRS Form 8995 and other tax documents. With our user-friendly interface, you can easily manage your forms and ensure they are signed and submitted on time. This efficiency can help streamline your tax preparation process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8995?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, allowing you to manage IRS Form 8995 and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for IRS Form 8995?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage for IRS Form 8995. These features ensure that your documents are not only easy to manage but also secure and compliant with legal standards. This makes it easier to handle your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for IRS Form 8995?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for IRS Form 8995. You can connect with popular accounting and tax software to streamline your document management process. This integration helps ensure that your tax filings are accurate and timely.

-

What are the benefits of using airSlate SignNow for IRS Form 8995?

Using airSlate SignNow for IRS Form 8995 provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform allows you to complete and sign documents quickly, reducing the risk of errors. Additionally, your documents are stored securely, giving you peace of mind.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 8995?

Yes, airSlate SignNow is compliant with IRS regulations, ensuring that your use of IRS Form 8995 meets all legal requirements. Our platform adheres to industry standards for electronic signatures and document management. This compliance helps you avoid potential issues during tax season.

Get more for Form 8995 A Qualified Business Income Deduction

- Program completion report form c 2 teacher form oregon oregon

- Application forms xls

- Pharmacy ownership form legal entity membership information

- Child custody recommending counseling information sheet

- Mad civ 005 form

- Service name civil division form

- Mad juv 001 form

- Solano courts ca gov crdept0220200605notice of continued hearing solano county superior court form

Find out other Form 8995 A Qualified Business Income Deduction

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free