Form IRS 990 Schedule H Fill Online, Printable 2024

What is the Form IRS 990 Schedule H?

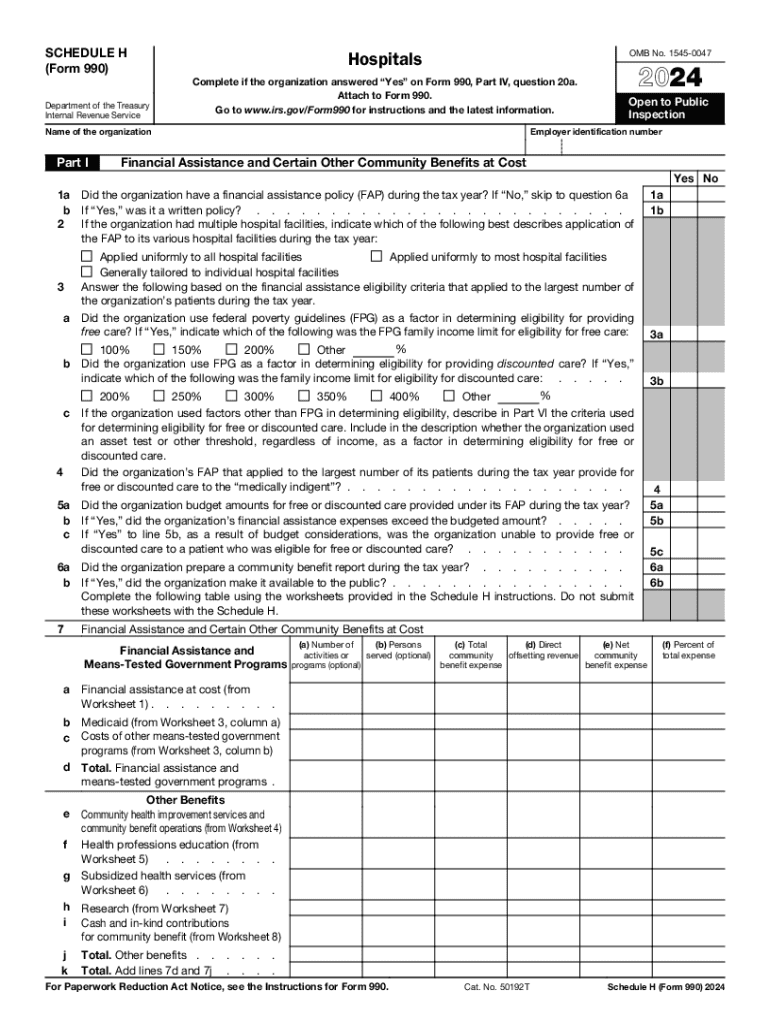

The Form IRS 990 Schedule H is a supplemental form that certain hospitals must file with their annual IRS Form 990. This form provides detailed information about a hospital's community benefit activities, including charity care, financial assistance policies, and how the hospital addresses the health needs of the community it serves. It is essential for non-profit hospitals to demonstrate compliance with federal regulations and to maintain their tax-exempt status.

Key Elements of the Form IRS 990 Schedule H

The Schedule H includes several critical components that hospitals must complete:

- Part I: Community Benefit Reporting — This section outlines the hospital's community benefit activities, including charity care and outreach programs.

- Part II: Financial Assistance Policy — Hospitals must describe their policies regarding financial assistance for patients who cannot afford care.

- Part III: Bad Debt — This part details how the hospital handles bad debt and its impact on community benefit reporting.

- Part IV: Community Health Needs Assessment — Hospitals must report on their assessments of community health needs and how they plan to address them.

Steps to Complete the Form IRS 990 Schedule H

Completing the Form IRS 990 Schedule H involves several steps:

- Gather necessary documentation related to community benefits, financial assistance policies, and health needs assessments.

- Complete each part of the form, ensuring all information is accurate and comprehensive.

- Review the completed form for compliance with IRS guidelines and ensure all required signatures are included.

- Submit the form along with the main IRS Form 990 by the designated deadline.

Filing Deadlines for the Form IRS 990 Schedule H

The filing deadline for the Form IRS 990 Schedule H coincides with the deadline for the main Form 990. Typically, this is the fifteenth day of the fifth month after the end of the hospital's fiscal year. Hospitals must ensure timely submission to avoid penalties and maintain compliance with IRS regulations.

Legal Use of the Form IRS 990 Schedule H

The Form IRS 990 Schedule H is legally required for non-profit hospitals to demonstrate their commitment to community health. Proper completion and submission of this form are crucial for maintaining tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Failure to comply with the filing requirements can result in penalties and jeopardize the hospital's tax-exempt status.

Examples of Using the Form IRS 990 Schedule H

Hospitals may use the Form IRS 990 Schedule H in various scenarios, such as:

- Documenting community outreach programs aimed at improving public health.

- Reporting financial assistance provided to low-income patients who are unable to pay for services.

- Detailing partnerships with local organizations to address specific health needs identified in community health assessments.

Create this form in 5 minutes or less

Find and fill out the correct form irs 990 schedule h fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form irs 990 schedule h fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 2017 990 hospitals and how do they relate to airSlate SignNow?

2017 990 hospitals refer to healthcare facilities that filed Form 990 in 2017, providing financial information to the IRS. airSlate SignNow can help these hospitals streamline their document management processes, ensuring compliance and efficiency in handling sensitive information.

-

How can airSlate SignNow benefit 2017 990 hospitals?

airSlate SignNow offers 2017 990 hospitals a cost-effective solution for sending and eSigning documents. This not only saves time but also enhances security and compliance, allowing hospitals to focus on patient care rather than paperwork.

-

What features does airSlate SignNow offer for 2017 990 hospitals?

For 2017 990 hospitals, airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document status. These features help hospitals manage their documentation efficiently while maintaining compliance with regulatory standards.

-

Is airSlate SignNow affordable for 2017 990 hospitals?

Yes, airSlate SignNow is designed to be a cost-effective solution for 2017 990 hospitals. With flexible pricing plans, hospitals can choose the option that best fits their budget while still benefiting from advanced document management capabilities.

-

Can airSlate SignNow integrate with other systems used by 2017 990 hospitals?

Absolutely! airSlate SignNow offers seamless integrations with various healthcare management systems commonly used by 2017 990 hospitals. This ensures that hospitals can easily incorporate eSigning into their existing workflows without disruption.

-

How does airSlate SignNow ensure the security of documents for 2017 990 hospitals?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with HIPAA regulations. This is particularly important for 2017 990 hospitals, as they handle sensitive patient information that requires robust protection.

-

What support does airSlate SignNow provide for 2017 990 hospitals?

airSlate SignNow offers dedicated customer support to assist 2017 990 hospitals with any questions or issues they may encounter. This includes access to resources, tutorials, and a responsive support team to ensure a smooth experience.

Get more for Form IRS 990 Schedule H Fill Online, Printable

- Notice of motion illinois form

- Sbir funding agreement certification sbir funding agreement certification grants nih form

- Residential exclusive management form

- Screening questionnaire and bconsent formb for adult immunization

- Newspape final form

- Fall risk assessment amp screening tool frast missoula county co missoula mt form

- Christine radogno form

- Lend money to family contract template form

Find out other Form IRS 990 Schedule H Fill Online, Printable

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word