C1201 Form

What is the C1201 Form

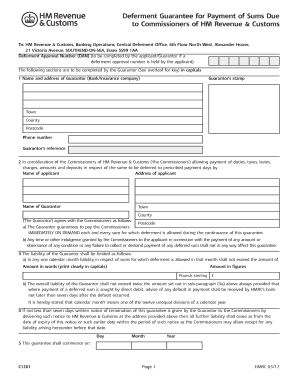

The C1201 form is a document used in the context of customs and excise in the United Kingdom. It is specifically associated with the Majesty's Revenue and Customs (HMRC) and is utilized for deferment payments. This form enables businesses to defer the payment of customs duties and VAT on imported goods, allowing for improved cash flow management. Understanding the purpose and function of the C1201 form is essential for businesses engaged in international trade.

How to use the C1201 Form

Using the C1201 form involves several key steps. First, businesses must ensure they qualify for deferment, which typically requires a good compliance record with HMRC. Once eligibility is confirmed, the form can be completed with necessary details such as the business name, address, and the specific customs duties being deferred. It's important to submit the form accurately to avoid delays in processing. The completed C1201 form should then be sent to HMRC for approval.

Steps to complete the C1201 Form

Completing the C1201 form requires attention to detail. Follow these steps:

- Gather necessary information, including your business details and customs duty information.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form to HMRC through the appropriate channels, ensuring you keep a copy for your records.

Legal use of the C1201 Form

The C1201 form is legally binding when completed and submitted according to HMRC regulations. It is important to comply with all legal requirements to ensure that the deferment is recognized by HMRC. Failure to adhere to the guidelines can result in penalties or denial of deferment. Businesses should maintain accurate records of all transactions related to the C1201 form to support compliance and audit requirements.

Key elements of the C1201 Form

Several key elements must be included in the C1201 form for it to be valid. These include:

- Business Information: Name, address, and contact details of the business.

- Customs Duty Details: Specific duties being deferred, including amounts and relevant dates.

- Signature: An authorized signature from the business owner or representative is required.

Form Submission Methods

The C1201 form can be submitted to HMRC through various methods. Businesses may choose to send the form via mail or submit it electronically, depending on their preference and the specific requirements set by HMRC. Electronic submission can expedite processing times, while mailed forms may take longer to be acknowledged. It's advisable to check the latest guidance from HMRC regarding submission methods to ensure compliance.

Quick guide on how to complete c1201 form 22561200

Complete C1201 Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and digitally sign your documents swiftly without interruptions. Handle C1201 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and digitally sign C1201 Form with ease

- Obtain C1201 Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or conceal sensitive data using the tools available at airSlate SignNow specifically for that purpose.

- Generate your digital signature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you'd like to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and digitally sign C1201 Form to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c1201 form 22561200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to UK Majesty Revenue Customs?

airSlate SignNow is a leading eSignature solution that enables businesses to send and eSign documents efficiently and securely. It provides an easy-to-use platform that complies with regulations, making it ideal for businesses interacting with the UK Majesty Revenue Customs.

-

How can airSlate SignNow help with compliance for UK Majesty Revenue Customs?

Using airSlate SignNow ensures that your eSigned documents comply with legal standards required by the UK Majesty Revenue Customs. Our solution maintains a secure audit trail and certification, which is crucial for any documents submitted to the customs authority.

-

What are the pricing options for airSlate SignNow when dealing with UK Majesty Revenue Customs documentation?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing documents related to UK Majesty Revenue Customs. Detailed plans can be found on our pricing page, ensuring you can choose the option that fits your needs best.

-

What features does airSlate SignNow offer to facilitate paperwork with UK Majesty Revenue Customs?

airSlate SignNow provides an array of features, such as custom workflows, templates, and integrations that streamline the handling of documents related to UK Majesty Revenue Customs. These tools help you manage and track your paperwork efficiently.

-

Can I integrate airSlate SignNow with other software for UK Majesty Revenue Customs submissions?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow when dealing with UK Majesty Revenue Customs submissions. This allows for automated document processing, reducing time and improving accuracy.

-

What are the benefits of using airSlate SignNow for businesses working with UK Majesty Revenue Customs?

By using airSlate SignNow, businesses can enjoy a faster and more efficient process for eSigning documents required by UK Majesty Revenue Customs. Our platform improves collaboration, reduces paper usage, and cuts down processing times signNowly.

-

How secure is airSlate SignNow for document transactions related to UK Majesty Revenue Customs?

Security is a top priority at airSlate SignNow. Our platform complies with industry standards and encrypts all documents, ensuring that any information related to UK Majesty Revenue Customs is protected throughout the signing process.

Get more for C1201 Form

- Mdc property closing form

- Fillable ct cert 126 form

- 1065stepupforstudents form

- Third grade summer reading ellis island worksheet docx stcatharineschool form

- Application for extraordinary direct assistance form

- Maintenance service level agreement template form

- Managed it service agreement template form

- Makeup artist service agreement template form

Find out other C1201 Form

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking