California Form 425

What is the California Form 425

The California Form 425 is a specific tax form used by businesses and individuals in California to report certain financial information. This form is essential for compliance with state tax regulations and is often required for various tax filings. It serves as a means to provide the California Franchise Tax Board with necessary details regarding income, deductions, and credits, ensuring accurate assessment of tax liabilities.

How to use the California Form 425

Using the California Form 425 involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to double-check calculations and entries to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements set by the California Franchise Tax Board.

Steps to complete the California Form 425

Completing the California Form 425 requires a systematic approach. Follow these steps:

- Collect all necessary financial documents, including previous tax returns.

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal and business information accurately.

- Report all income sources and applicable deductions.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal use of the California Form 425

The California Form 425 is legally binding when filled out and submitted according to state regulations. To ensure its legal validity, it must be completed with accurate information and submitted by the designated deadlines. Failure to comply with these legal requirements can result in penalties or legal repercussions. It is advisable to keep copies of submitted forms and any supporting documents for future reference and potential audits.

Key elements of the California Form 425

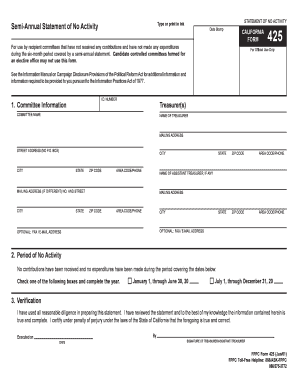

Understanding the key elements of the California Form 425 is essential for accurate completion. The form typically includes sections for:

- Taxpayer identification information, such as name and address.

- Details regarding income sources, including wages, self-employment income, and investment earnings.

- Deductions and credits that the taxpayer may qualify for, which can reduce overall tax liability.

- Signature and date fields to verify the authenticity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 425 are critical to avoid penalties. Typically, the form must be filed by the due date of the tax return, which is usually April 15 for individuals. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines or filing requirements announced by the California Franchise Tax Board.

Quick guide on how to complete california form 425

Accomplish California Form 425 smoothly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to acquire the necessary form and securely store it in the cloud. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle California Form 425 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign California Form 425 effortlessly

- Obtain California Form 425 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign California Form 425 and ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 425

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 425?

California Form 425 is a crucial document used to report income and deductions for certain California tax filings. It provides essential information for tax preparation and often needs to be submitted with other tax forms. Understanding and completing California Form 425 correctly can help ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with California Form 425?

airSlate SignNow allows users to easily send, sign, and manage California Form 425 digitally. Our platform streamlines the process by enabling electronic signatures, which can save time and reduce processing delays. By using airSlate SignNow, you can ensure that your California Form 425 is signed and submitted efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs. Whether you are a solo user or a larger organization, you can find a plan that suits your requirements for handling documents like California Form 425. The pricing is competitive, ensuring you receive a cost-effective solution for your eSignature needs.

-

Is airSlate SignNow secure for handling important documents such as California Form 425?

Yes, airSlate SignNow prioritizes security, implementing robust encryption and compliance measures to protect your documents, including California Form 425. Our platform ensures that your sensitive information remains confidential and secure during the signing process. Trust in airSlate SignNow for a secure eSigning experience.

-

Can I integrate airSlate SignNow with my existing software for California Form 425 management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular applications and tools, enhancing your workflow for managing documents such as California Form 425. This integration capability allows you to sync your data and streamline operations, making it easier to handle all your eSigning needs.

-

What features does airSlate SignNow offer for processing California Form 425?

airSlate SignNow provides a robust set of features for processing California Form 425, including customizable templates, automated workflows, and real-time tracking of document status. These features simplify the eSigning process and enhance collaboration between stakeholders, ensuring efficient handling of important documents.

-

How does using airSlate SignNow benefit my business for California Form 425 submissions?

Utilizing airSlate SignNow for California Form 425 submissions can signNowly improve efficiency by reducing the time spent on manual paperwork. Our eSigning solution helps eliminate errors and delays associated with traditional methods, allowing your business to operate more smoothly and focus on core activities. Benefitting from an easy-to-use interface enhances team productivity.

Get more for California Form 425

- Lyons contour bathtub form

- Health declaration form deped editable

- Justicecourtsjohannesburg magistrates court civil sectionhome form

- Adult full assessment form

- Daily inspections city of wildomar form

- Inedible kitchen grease transporter registration application personal use form

- Door quotation format

- Superior court of california county of kern civil fee form

Find out other California Form 425

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal