Form 709

What is the Form 709

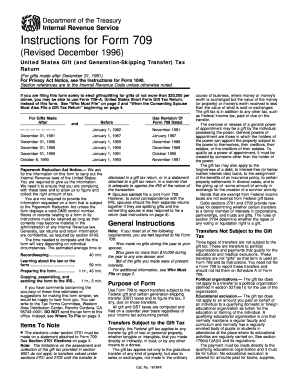

The 1996 Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a tax form used by individuals to report gifts made during the year that exceed the annual exclusion amount. This form is essential for those who wish to document their gift-giving for tax purposes, ensuring compliance with federal tax laws. The form is particularly relevant for individuals who are making substantial gifts or transferring wealth to heirs, as it helps to calculate any potential gift tax liability.

How to use the Form 709

To effectively use the 1996 Form 709, individuals must first determine if their gifts exceed the annual exclusion limit set by the IRS. If so, they should complete the form by providing detailed information about the gifts, including the recipient's name, the value of each gift, and any applicable deductions. It is important to accurately report all gifts to avoid penalties. Once completed, the form must be filed with the IRS as part of the individual's tax return.

Steps to complete the Form 709

Completing the 1996 Form 709 involves several key steps:

- Gather necessary documentation, including records of the gifts made during the tax year.

- Determine which gifts exceed the annual exclusion limit.

- Fill out the form, providing details such as the donor's information, recipient details, and the value of each gift.

- Calculate any applicable gift tax liability, if necessary.

- Review the completed form for accuracy before submission.

Once finalized, the form can be submitted to the IRS either electronically or by mail, depending on the taxpayer's preference.

Legal use of the Form 709

The legal use of the 1996 Form 709 is crucial for ensuring compliance with U.S. tax laws. By accurately reporting gifts, individuals can avoid potential legal issues, including audits and penalties. The form must be filed in accordance with IRS regulations, and any discrepancies or omissions may lead to legal repercussions. It is advisable to consult with a tax professional if there are uncertainties regarding the form's completion or legal implications.

Filing Deadlines / Important Dates

The filing deadline for the 1996 Form 709 is typically April 15 of the year following the tax year in which the gifts were made. If the individual is unable to file by this date, they may request an extension, which generally extends the deadline by six months. However, it is important to note that any gift tax owed must still be paid by the original due date to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The 1996 Form 709 can be submitted to the IRS using various methods. Taxpayers may choose to file electronically through approved e-filing software, which can streamline the process and reduce errors. Alternatively, individuals can print the completed form and mail it to the appropriate IRS address based on their location. In-person submission is generally not available for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete form 709 1670349

Complete Form 709 easily on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 709 on any device with airSlate SignNow's Android or iOS apps and simplify any document-driven process today.

How to modify and eSign Form 709 effortlessly

- Find Form 709 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 709 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 1670349

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1996 form 709 and why is it important?

The 1996 form 709 is a federal gift tax return in the United States, used to report gifts made during the year. It is crucial for tax purposes as it helps determine any tax liability associated with gifted amounts exceeding the annual exclusion.

-

How can airSlate SignNow help with the completion of the 1996 form 709?

airSlate SignNow provides an intuitive platform to easily complete and eSign the 1996 form 709, ensuring accuracy and compliance with IRS regulations. Its user-friendly interface simplifies the process, allowing users to focus on their gifting strategies without the stress of paperwork.

-

What features does airSlate SignNow offer for signing the 1996 form 709?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to streamline the signing process for the 1996 form 709. These features enhance the experience, making it faster and more secure to manage important tax documents.

-

Is airSlate SignNow a cost-effective solution for filing the 1996 form 709?

Yes, airSlate SignNow is a cost-effective solution for filing the 1996 form 709, offering various pricing plans to suit different budgets. By reducing the need for paper and postage, users save money while efficiently managing their tax documentation.

-

What integrations does airSlate SignNow provide for managing the 1996 form 709?

airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage services, facilitating an efficient workflow for managing the 1996 form 709. This interoperability allows users to access their forms and data from multiple platforms, enhancing overall productivity.

-

Can I store and access the 1996 form 709 securely with airSlate SignNow?

Absolutely! airSlate SignNow ensures that your 1996 form 709 and other documents are stored securely in the cloud with robust encryption. This provides peace of mind by safeguarding sensitive information while allowing easy access whenever needed.

-

Does airSlate SignNow provide customer support for issues related to the 1996 form 709?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions or issues relating to the 1996 form 709. Our dedicated support team is available to help ensure that your experience with the platform is smooth and efficient.

Get more for Form 709

Find out other Form 709

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free