T1 General Non Residents Form

What is the T1 General Non Residents Form

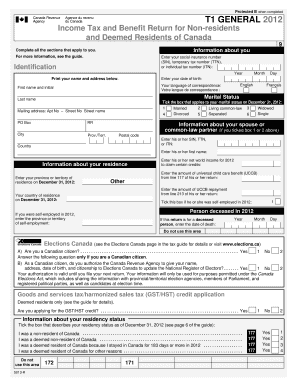

The T1 General Non Residents Form is a tax document used by individuals who are not residents of Canada but have income sourced from Canada. This form is essential for reporting income, claiming deductions, and ensuring compliance with Canadian tax regulations. It allows non-residents to accurately report their earnings and fulfill their tax obligations, even while residing outside the country.

How to use the T1 General Non Residents Form

Using the T1 General Non Residents Form involves several steps. First, gather all necessary documentation, including income statements and relevant identification. Next, fill out the form by providing accurate information regarding your income, deductions, and any applicable tax credits. Ensure that all sections are completed thoroughly to avoid delays or issues with processing. Finally, submit the form according to the guidelines provided by the Canada Revenue Agency (CRA).

Steps to complete the T1 General Non Residents Form

Completing the T1 General Non Residents Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the CRA website or authorized sources.

- Fill in personal information, including your name, address, and identification number.

- Report your income from Canadian sources, such as employment or investments.

- Claim any eligible deductions and tax credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the T1 General Non Residents Form

The T1 General Non Residents Form is legally binding when completed and submitted according to Canadian tax laws. It is crucial to provide truthful and accurate information, as any discrepancies can lead to penalties or legal issues. Compliance with the guidelines set forth by the CRA ensures that the form is accepted and processed correctly, safeguarding the taxpayer's interests.

Required Documents

To complete the T1 General Non Residents Form, specific documents are required. These may include:

- Income statements, such as T4 slips or other proof of earnings.

- Identification documents, including a passport or residency card.

- Records of any tax withheld at source from Canadian income.

- Documentation supporting claims for deductions or credits.

Filing Deadlines / Important Dates

Filing deadlines for the T1 General Non Residents Form are critical to avoid penalties. Typically, the deadline for non-residents to file their tax returns is April 30 of the following year after the tax year ends. However, if you have income from self-employment, the deadline may differ. It is essential to stay informed about any changes in deadlines announced by the CRA to ensure timely submission.

Quick guide on how to complete t1 general non residents form

Finalize T1 General Non Residents Form effortlessly on any gadget

Digital document management has become prevalent among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the instruments you require to create, modify, and eSign your files quickly without delays. Manage T1 General Non Residents Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to alter and eSign T1 General Non Residents Form with ease

- Locate T1 General Non Residents Form and click Get Form to commence.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and eSign T1 General Non Residents Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1 general non residents form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the T1 General Non Residents Form?

The T1 General Non Residents Form is a tax return form specifically designed for individuals who do not reside in Canada but have income sourced from Canada. This form allows non-resident taxpayers to report their income and calculate any applicable taxes. Using airSlate SignNow, you can easily eSign and submit the T1 General Non Residents Form securely.

-

How can I access the T1 General Non Residents Form?

You can access the T1 General Non Residents Form through the Canada Revenue Agency (CRA) website or by using tax preparation software that supports this form. With airSlate SignNow, you can upload the form and electronically sign it, streamlining the submission process. This makes managing your non-resident tax obligations more efficient.

-

What are the features of airSlate SignNow for handling the T1 General Non Residents Form?

airSlate SignNow offers features such as secure eSigning, document tracking, and collaboration tools, making it ideal for managing the T1 General Non Residents Form. You can easily send your signed forms to clients or accountants and track their status in real-time. Additionally, its intuitive interface simplifies the entire signing process.

-

What are the benefits of using airSlate SignNow for the T1 General Non Residents Form?

Using airSlate SignNow for the T1 General Non Residents Form provides benefits such as enhanced security, cost-effectiveness, and ease of use. You can finalize your tax submission without the hassle of printing and mailing physical documents. This not only saves time but also reduces your overall processing costs.

-

Can I integrate airSlate SignNow with other tools for filing the T1 General Non Residents Form?

Yes, airSlate SignNow can integrate with various accounting and productivity tools, which can enhance your workflow when filing the T1 General Non Residents Form. This seamless integration allows for automatic data transfer between platforms, reducing manual entry errors. You can easily manage all your tax documents in one place.

-

What is the pricing for using airSlate SignNow for the T1 General Non Residents Form?

airSlate SignNow offers flexible pricing plans to cater to different business needs, making it affordable to manage the T1 General Non Residents Form. Plans generally range from basic to advanced options, allowing users to choose features that suit their requirements. Exploring the pricing page will provide detailed information on the available packages.

-

Is airSlate SignNow legally compliant for filing the T1 General Non Residents Form?

Absolutely, airSlate SignNow meets all legal requirements for electronic signatures and is compliant with national and international eSignature laws. This ensures that your T1 General Non Residents Form holds the same legal standing as a handwritten signature, giving you peace of mind while managing your tax documents. Compliance is a key aspect of airSlate SignNow's service.

Get more for T1 General Non Residents Form

- Patient profile form 27466511

- Virginia sp 248 fillable form

- Indus river valley civilization cloze reading form

- Jntuk certificate download form

- M1 form archdiocese of cincinnati catholiccincinnati

- Chartercom byyout form fill online

- Transaction certificate 398991560 form

- Idaho department of fish and game application for temporary employment idaho department of fish and game application for form

Find out other T1 General Non Residents Form

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien