Cp521 Form

What is the Cp521

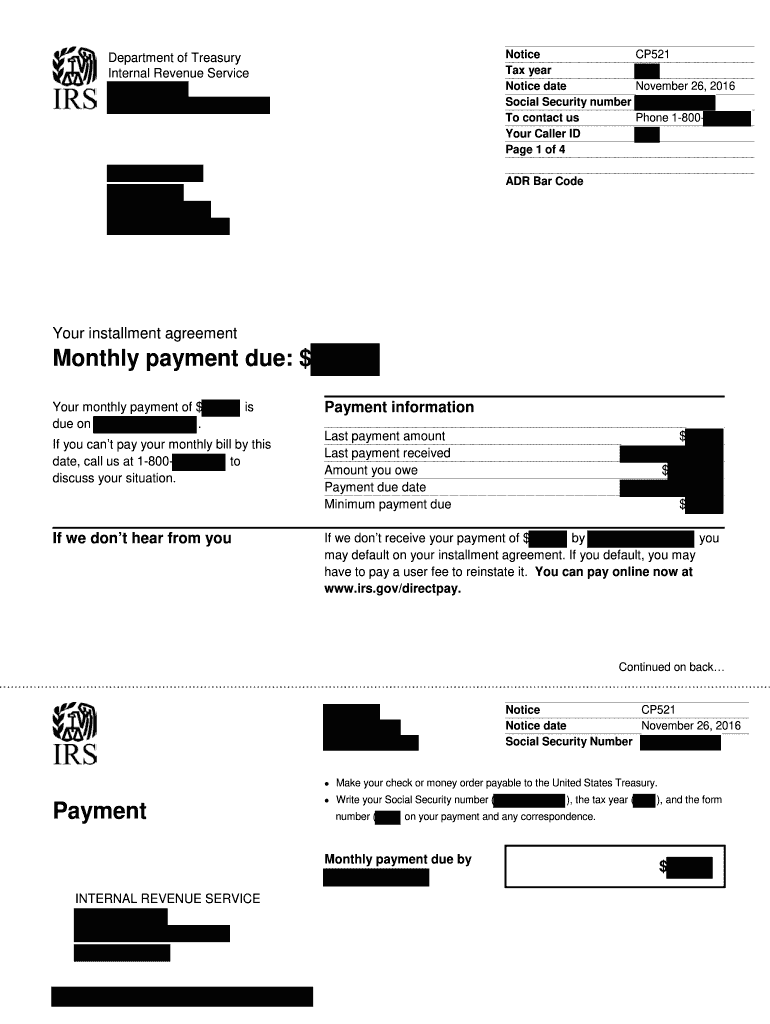

The Cp521 is a notice issued by the IRS, commonly referred to as the "Notice of Balance Due." It informs taxpayers about outstanding tax balances and provides essential details regarding payment options. Understanding this form is crucial for taxpayers who may be facing financial obligations to the IRS, as it outlines the amount owed, due dates, and potential consequences of non-payment.

How to use the Cp521

Using the Cp521 involves reviewing the information provided in the notice carefully. Taxpayers should check the balance due and the payment deadline. If the taxpayer agrees with the amount, they can proceed to make a payment through the IRS's designated channels. If there are discrepancies or if the taxpayer cannot pay the full amount, they should contact the IRS to discuss payment plans or disputes.

Steps to complete the Cp521

Completing the process related to the Cp521 involves several key steps:

- Review the notice for accuracy, ensuring that the balance and personal information are correct.

- Determine the payment method—options include online payments, checks, or money orders.

- If unable to pay the full amount, consider applying for a payment plan through the IRS.

- Keep a copy of the notice and any correspondence for your records.

Legal use of the Cp521

The Cp521 is legally valid and serves as an official communication from the IRS. It is important for taxpayers to respond appropriately to this notice to avoid penalties or further collection actions. The IRS adheres to specific regulations regarding the issuance of such notices, ensuring that taxpayers are informed of their obligations and rights.

Filing Deadlines / Important Dates

Taxpayers receiving the Cp521 should pay close attention to the deadlines indicated in the notice. Typically, payments are due within a specified period to avoid additional penalties and interest. It is advisable to mark these dates on a calendar and ensure timely compliance to maintain good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

When addressing the balance indicated in the Cp521, taxpayers have several submission methods available:

- Online: Payments can be made through the IRS website using direct debit or credit card options.

- Mail: Taxpayers can send checks or money orders to the address specified in the notice.

- In-Person: Payments can also be made at designated IRS offices, though this method may require an appointment.

Quick guide on how to complete cp521 payment address form

Effortlessly Manage Cp521 on Any Device

Digital document handling has become increasingly favored by companies and individuals alike. It offers a suitable eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without delays. Handle Cp521 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Cp521 effortlessly

- Find Cp521 and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Cp521 and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I change my address in the Aadhar card?

You can change the following details in Aadhar Card:NameGenderDate of BirthAddressE-mail IDTHINGS TO REMEMBER BEFORE APPLYING FOR AADHAR CARD DETAILS CHANGE:Your Registered Mobile Number is mandatory in the online process.You need to submit Documents for change of – Name, Date of Birth and Address. However, Change in Gender and E-mail ID do not require any document.You have to fill details in both – English and Regional/Local language (Eg. Hindi, Oriya, Bengali etc)Aadhar Card Details are not changed instantly. It is changed after Verification and Validation by the authoritySTEPS TO AADHAR CARD DETAILS CHANGE ONLINE:Click Here for going to the link.Enter your Aadhar Number.Fill Text VerificationClick on Send OTP. OTP is sent on your Registered mobile number.Also Read: Simple Steps to Conduct Aadhar Card Status Enquiry by NameYou will be asked to choose the Aadhar Card Details that you want to change.You can select multiple fields. Select the field and Submit.In next window fill the Correct Detail in both – English and Local language (if asked) and Submit.For Example – Here one has to fill the Email IdNOTE – If you are changing – Name, Date of Birth or Address, you have to upload the scanned documents. Click Here to know the Documents or Check them here.Verify the details that you have filled. If all the details look good then proceed or you can go back and edit once again.You may be asked for BPO Service Provider Selection. Select the provider belonging to your region.At last – You will be given an Update Request Number. Download or Print the document and keep it safe. It is required in checking the status of the complaint in future.So this step completes the process of Aadhar Card details change online.CHECK THE STATUS OF YOUR AADHAR CARD DETAILS CHANGE REQUESTStep 1 – Go the website by Clicking HereStep 2 – Fill the Aadhaar No. and URN – Update Request NumberStep 3 – Click on “Get Status”You are done. The new window on the screen will show the status of your request for change in Aadhar Card Details.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do I fill out a address line 1?

The recipients name/company:Name (John, Smith)Adresss (1000 County Way, Unit 200)ZIP, City, State, Country (90254, Neverland, CA, USAIn Europe the addressing scheme is slightly different:AustriaHerr Franz HuberBeethovenstrasse 121010 WIENAUSTRIABelgiumMr Willy JanssensLange Stationsstraat 3523000 LEUVENBELGIUMM. Emile DuboisRue du Diamant 2154800 VERVIERSBELGIUMDenmarkMr Thor NielsenTietgensgade 1378800 VIBORGDENMARKMr Torben RaldorfPO Box 100COPENHAGEN1004 VIBORGDENMARKFinlandMr Asko TeirilaPO Box 51139140 AKDENMAAFINLANDFranceM. Robert MARINRue de l’EgliseDunes82340 AUVILLARFRANCEMme Marie PAGE23 Rue de Grenell75700 PARIS CEDEXFRANCEWhen addressing mail to France, write the addressee’s surname in CAPITAL letters.GermanyMrs F MeierWeberstr. 253113 BONN 1GERMANYMr P KundeLange Str. 1204103 LEIPZIGGERMANYGermany has strict rules about receiving mail, which, if ignored, may result in your mail being returned to you with no attempt at delivery. When addressing mail to Germany, always:• Use the new five-digit postcode (using an old four-digit postcode will cause delay)• Put the postcode before the town name• Put the house number after the street nameGreeceMr George LatsisAlkamenou 37117 80 ATHENSGREECEIcelandMr Jon JonssonEinimel 80107 REYKJAVIKICELANDIrelandFrom 15 July 2015, a new seven digit postcode system has been developed for Ireland and should be used in all addresses, other than those for PO Boxes.All mail for Ireland should now be addressed as illustrated below:Eason80 Abbey Street MiddleDUBLIN 1DO1 P8N3IRELANDThe introduction of the new codes will not in any way affect the existing address structure. The postcode will occupy a new line at the bottom of addresses for domestic mail and the penultimate line for international mail.ItalySig. Giovanni Mascivia Garibaldi 2747037 RIMINI RNITALYLuxembourgM. Jaques Muller71 route de Longway4750 PETANGELUXEMBOURGMonacoAs FranceThe NetherlandsMr J van DietenMorsstr 1112312 BK LEIDENTHE NETHERLANDS(There should be a double space between the postcode and the post town)NorwayHerr Hans HansenSvingen 229230 BEKKEHAUGNORWAYPortugalSenhor Carlos Manuel PereiraAv das A’Augsa LivresMonte Trigo7220 PORTELPORTUGALRosalina SilvaR Conde Redondo 801192 LISBOA CODEXPORTUGALSpainSra Ana JimenezMimbreras 403201 ELCHE (Alicante)SPAIN(The province should be included in brackets after the town)SwedenFru Inger LiljaVasavagen 3 4tr582 20 LINKOPINGSWEDENSwitzerlandM. Andre PerretSchanzenstrasse 73030 BERNESWITZERLAND

Create this form in 5 minutes!

How to create an eSignature for the cp521 payment address form

How to make an electronic signature for the Cp521 Payment Address Form in the online mode

How to generate an electronic signature for the Cp521 Payment Address Form in Chrome

How to make an electronic signature for signing the Cp521 Payment Address Form in Gmail

How to make an electronic signature for the Cp521 Payment Address Form straight from your mobile device

How to make an electronic signature for the Cp521 Payment Address Form on iOS devices

How to generate an electronic signature for the Cp521 Payment Address Form on Android

People also ask

-

What is Cp521 and how does it work with airSlate SignNow?

Cp521 refers to a specific document type that can be efficiently managed using airSlate SignNow's electronic signature platform. With airSlate SignNow, users can easily upload, send, and eSign Cp521 documents, streamlining the process and ensuring compliance with legal standards.

-

How much does it cost to use airSlate SignNow for Cp521 document signing?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those requiring Cp521 document signing. You can choose from monthly or annual subscriptions, allowing you to select the best option based on your usage, ensuring that you get great value for handling Cp521 documents.

-

What features does airSlate SignNow offer for managing Cp521 documents?

airSlate SignNow includes a variety of features for managing Cp521 documents, such as customizable templates, bulk sending, and real-time tracking of document status. These features simplify the signing process and enhance overall efficiency when dealing with Cp521 documents.

-

Is airSlate SignNow compliant with regulations for Cp521 document signing?

Yes, airSlate SignNow complies with all relevant regulations, including e-signature laws, ensuring that your Cp521 documents are signed legally and securely. This compliance gives you peace of mind when sending and signing important documents.

-

Can I integrate airSlate SignNow with other software for Cp521 document management?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage Cp521 documents alongside your existing software tools. This integration capability enhances your workflow and improves your overall document management process.

-

What are the benefits of using airSlate SignNow for Cp521 documents?

Using airSlate SignNow for Cp521 documents provides numerous benefits, including reduced turnaround time, cost savings on paper and postage, and enhanced security. This solution empowers businesses to operate more efficiently and focus on core activities, leaving document signing to airSlate SignNow.

-

Can I access airSlate SignNow from multiple devices for Cp521 document signing?

Yes, airSlate SignNow is accessible from multiple devices, including desktop and mobile, allowing you to handle Cp521 document signing on the go. This flexibility ensures that you can manage your documents anytime, anywhere, making your workflow more efficient.

Get more for Cp521

- Naui medical form

- Restorative justice template form

- Hoja padronal madrid form

- Firearm training certificate in form s 1

- Cuna mutual life insurance death claim form 28865341

- Cursive practice upper and lower case letters lower case and upper case cursive letter practice form

- Mittarointipyynto vantaa form

- Semesterlista visma form

Find out other Cp521

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy