Department of Treasury W 9 Form Revised 10 Fillable

What is the Department Of Treasury W-9 Form Revised 10 Fillable

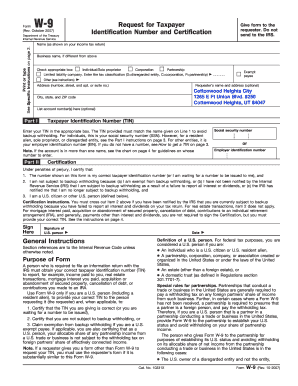

The Department Of Treasury W-9 Form Revised 10 Fillable is a tax form used in the United States by individuals and entities to provide their taxpayer identification information to others, typically for income reporting purposes. This form is essential for freelancers, contractors, and businesses that need to report payments made to individuals or other businesses. The revised version ensures compliance with current IRS regulations and provides a fillable format for ease of use.

How to use the Department Of Treasury W-9 Form Revised 10 Fillable

Using the Department Of Treasury W-9 Form Revised 10 Fillable involves a straightforward process. First, download the form and open it in a compatible PDF reader. Complete the required fields, including your name, business name (if applicable), address, and taxpayer identification number. Once filled out, the form can be saved and sent electronically or printed for physical submission. Ensure that all information is accurate to avoid issues with tax reporting.

Steps to complete the Department Of Treasury W-9 Form Revised 10 Fillable

Completing the W-9 Form Revised 10 Fillable involves several key steps:

- Download the form from a reliable source.

- Open the form in a PDF reader that supports fillable forms.

- Enter your name and, if applicable, your business name.

- Provide your address, including city, state, and ZIP code.

- Input your taxpayer identification number, which can be your Social Security number or Employer Identification Number.

- Sign and date the form to validate it.

- Save the completed form for your records or send it to the requesting party.

Legal use of the Department Of Treasury W-9 Form Revised 10 Fillable

The legal use of the W-9 Form Revised 10 Fillable is crucial for ensuring compliance with IRS regulations. This form is used to certify that the taxpayer identification number provided is correct and to confirm that the individual or entity is not subject to backup withholding. Proper completion and submission of the form help facilitate accurate income reporting and prevent potential legal issues related to tax obligations.

Key elements of the Department Of Treasury W-9 Form Revised 10 Fillable

The key elements of the W-9 Form Revised 10 Fillable include:

- Name: The individual or business name of the taxpayer.

- Business Name: If applicable, the name under which the business operates.

- Address: The complete mailing address.

- Taxpayer Identification Number: Either the Social Security number or Employer Identification Number.

- Signature: A signature is required to validate the information provided.

- Date: The date when the form is completed and signed.

Form Submission Methods

The completed Department Of Treasury W-9 Form Revised 10 Fillable can be submitted through various methods, depending on the preferences of the requesting party. Common submission methods include:

- Email: Sending the completed form as an attachment.

- Fax: If required, faxing the completed form to the requesting party.

- Mail: Physically mailing the form to the address specified by the requester.

- In-Person: Delivering the form directly to the requesting entity, if applicable.

Quick guide on how to complete department of treasury w 9 form revised 10 fillable

Accomplish Department Of Treasury W 9 Form Revised 10 Fillable seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Department Of Treasury W 9 Form Revised 10 Fillable on any platform with airSlate SignNow's Android or iOS applications and enhance any documentation process today.

The easiest way to modify and electronically sign Department Of Treasury W 9 Form Revised 10 Fillable effortlessly

- Find Department Of Treasury W 9 Form Revised 10 Fillable and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign Department Of Treasury W 9 Form Revised 10 Fillable and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of treasury w 9 form revised 10 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Department Of Treasury W 9 Form Revised 10 Fillable?

The Department Of Treasury W 9 Form Revised 10 Fillable is an official IRS form used by individuals and businesses to provide their taxpayer identification information. This fillable format allows for easy completion and submission, streamlining the process of gathering necessary tax information.

-

How can airSlate SignNow help with the Department Of Treasury W 9 Form Revised 10 Fillable?

airSlate SignNow enables users to easily upload, fill out, and eSign the Department Of Treasury W 9 Form Revised 10 Fillable online. This eliminates the need for printing and scanning documents, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Department Of Treasury W 9 Form Revised 10 Fillable?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. Each plan allows unlimited access to features, including the use of the Department Of Treasury W 9 Form Revised 10 Fillable, making it a cost-effective solution.

-

What features does airSlate SignNow offer for the Department Of Treasury W 9 Form Revised 10 Fillable?

airSlate SignNow offers a user-friendly interface, advanced document management features, and seamless eSignature capabilities for the Department Of Treasury W 9 Form Revised 10 Fillable. Users can also store, track, and organize their forms efficiently.

-

Are there any integrations available for the Department Of Treasury W 9 Form Revised 10 Fillable with airSlate SignNow?

Yes, airSlate SignNow integrates with various third-party applications, enhancing functionality when dealing with the Department Of Treasury W 9 Form Revised 10 Fillable. This includes popular tools like Google Drive, Dropbox, and more, facilitating smoother workflows.

-

What are the benefits of using airSlate SignNow for the Department Of Treasury W 9 Form Revised 10 Fillable?

Using airSlate SignNow for the Department Of Treasury W 9 Form Revised 10 Fillable provides numerous benefits, such as reducing paperwork, saving time, and improving accuracy. The platform ensures security while also making it easy to manage and submit important tax documents.

-

Can I access the Department Of Treasury W 9 Form Revised 10 Fillable on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing users to access and complete the Department Of Treasury W 9 Form Revised 10 Fillable from their smartphones or tablets. This flexibility ensures that you can handle your documents anytime, anywhere.

Get more for Department Of Treasury W 9 Form Revised 10 Fillable

Find out other Department Of Treasury W 9 Form Revised 10 Fillable

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself