Individual Income Tax Estimated Tax Voucher 740 Es Form

What is the Individual Income Tax Estimated Tax Voucher 740 Es Form

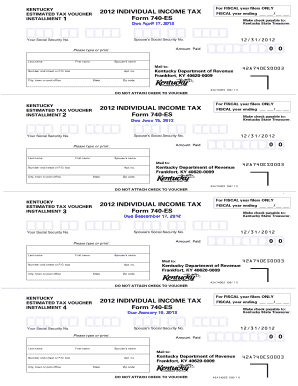

The Individual Income Tax Estimated Tax Voucher 740 Es Form is a crucial document used by taxpayers in the United States to report and pay estimated income taxes. This form is particularly relevant for individuals who expect to owe tax of one thousand dollars or more when filing their annual tax return. It allows taxpayers to make quarterly payments to avoid underpayment penalties. The 740 Es Form is specifically designed for residents of certain states, and it ensures that individuals stay compliant with state tax regulations throughout the year.

How to use the Individual Income Tax Estimated Tax Voucher 740 Es Form

Using the Individual Income Tax Estimated Tax Voucher 740 Es Form involves several straightforward steps. First, taxpayers need to calculate their estimated tax liability for the year based on their expected income, deductions, and credits. Once the estimated amount is determined, the taxpayer can fill out the form, indicating the payment amount for each quarter. It is essential to submit the form along with the payment by the specified due dates to avoid penalties. Taxpayers can also utilize digital tools to complete and sign the form efficiently.

Steps to complete the Individual Income Tax Estimated Tax Voucher 740 Es Form

Completing the Individual Income Tax Estimated Tax Voucher 740 Es Form requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated annual income and any deductions or credits you anticipate.

- Determine your estimated tax liability using the appropriate tax rate.

- Fill out the 740 Es Form with your personal information and estimated payment amounts for each quarter.

- Review the form for accuracy and completeness before submission.

- Submit the form along with your payment by the due dates.

Legal use of the Individual Income Tax Estimated Tax Voucher 740 Es Form

The Individual Income Tax Estimated Tax Voucher 740 Es Form is legally binding when properly completed and submitted. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the IRS and relevant state tax authorities. This includes providing accurate information, signing the form, and submitting it within the designated time frames. Utilizing a reliable electronic signature solution can further enhance the legal standing of the document, as it complies with eSignature laws and provides a digital certificate for verification.

Filing Deadlines / Important Dates

Timely submission of the Individual Income Tax Estimated Tax Voucher 740 Es Form is critical to avoid penalties. The typical deadlines for estimated tax payments are:

- First quarter payment: April 15

- Second quarter payment: June 15

- Third quarter payment: September 15

- Fourth quarter payment: January 15 of the following year

Taxpayers should be aware of these dates and plan accordingly to ensure compliance.

Who Issues the Form

The Individual Income Tax Estimated Tax Voucher 740 Es Form is issued by state tax authorities. Each state may have its own version of the form, tailored to its specific tax laws and regulations. Taxpayers should ensure they are using the correct form for their state to avoid issues with their estimated tax payments.

Quick guide on how to complete individual income tax estimated tax voucher 740 es form

Effortlessly Complete Individual Income Tax Estimated Tax Voucher 740 Es Form on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your files quickly and without interruptions. Manage Individual Income Tax Estimated Tax Voucher 740 Es Form across any platform with the airSlate SignNow apps available for Android or iOS, and streamline any document-related task today.

The Easiest Method to Edit and eSign Individual Income Tax Estimated Tax Voucher 740 Es Form with Ease

- Find Individual Income Tax Estimated Tax Voucher 740 Es Form and click Get Form to initiate the process.

- Employ the tools we provide to complete your document.

- Mark essential sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form via email, text (SMS), invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Individual Income Tax Estimated Tax Voucher 740 Es Form to ensure outstanding communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual income tax estimated tax voucher 740 es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Income Tax Estimated Tax Voucher 740 Es Form?

The Individual Income Tax Estimated Tax Voucher 740 Es Form is a document used by taxpayers in certain regions to calculate and pay their estimated income tax. This form helps individuals manage their tax obligations throughout the year, ensuring they remain compliant with tax laws and avoid penalties.

-

How can airSlate SignNow help with the Individual Income Tax Estimated Tax Voucher 740 Es Form?

airSlate SignNow provides tools that simplify the process of filling out and electronically signing the Individual Income Tax Estimated Tax Voucher 740 Es Form. Our user-friendly interface allows you to complete your form quickly and securely, streamlining your tax management tasks.

-

Is airSlate SignNow cost-effective for managing tax documents like the Individual Income Tax Estimated Tax Voucher 740 Es Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your tax documents, including the Individual Income Tax Estimated Tax Voucher 740 Es Form. With flexible pricing plans, you can choose the one that best suits your business needs without compromising on features and security.

-

Can I integrate airSlate SignNow with other accounting software for the Individual Income Tax Estimated Tax Voucher 740 Es Form?

Absolutely! airSlate SignNow supports integrations with various accounting software, allowing you to seamlessly manage the Individual Income Tax Estimated Tax Voucher 740 Es Form alongside your financial data. This integration enhances efficiency and reduces the risk of errors in your tax filings.

-

What features does airSlate SignNow offer for the Individual Income Tax Estimated Tax Voucher 740 Es Form?

airSlate SignNow includes features such as electronic signatures, document templates, and cloud storage that are ideal for handling the Individual Income Tax Estimated Tax Voucher 740 Es Form. These features help users save time, ensure accuracy, and increase organization in their tax documentation process.

-

How secure is the transmission of the Individual Income Tax Estimated Tax Voucher 740 Es Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your sensitive information, including the Individual Income Tax Estimated Tax Voucher 740 Es Form, ensuring that your data remains confidential and safe from unauthorized access.

-

Can I track the status of my Individual Income Tax Estimated Tax Voucher 740 Es Form with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Individual Income Tax Estimated Tax Voucher 740 Es Form in real-time. This feature helps you stay informed about when your document has been viewed, signed, and finalized, providing peace of mind during tax season.

Get more for Individual Income Tax Estimated Tax Voucher 740 Es Form

- Ems narrative generator form

- Texas a m document id sheet download form

- Reset your childs brain pdf form

- Form 4790 united states importers cigarette sales to

- Employer withholding tax refund request form

- Instructions for form cg 213 cigarette stamping agent certification of compliance with tax law article 20 revised 724

- Iowa withholding quarterly tax return form

- Form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year

Find out other Individual Income Tax Estimated Tax Voucher 740 Es Form

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document