Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed

Understanding the Private Education Loan Applicant Self Certification Form

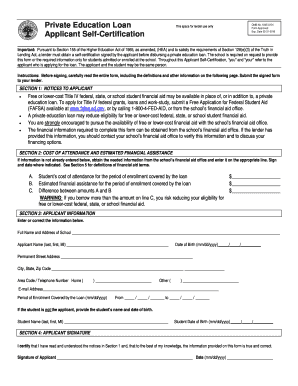

The Private Education Loan Applicant Self Certification Form is a vital document required for obtaining private student loans. This form helps lenders assess the borrower’s financial situation and determine eligibility for loans. It includes essential information regarding the applicant's income, expenses, and the cost of education. Understanding this form is crucial for both borrowers and potential cosigners, as it lays the groundwork for responsible borrowing and financial planning.

Key Elements of the Private Education Loan Applicant Self Certification Form

This form consists of several key components that borrowers must complete accurately. These elements include:

- Personal Information: Full name, address, and contact details of the applicant.

- Income Details: Monthly or annual income, including any additional sources of income.

- Cost of Attendance: Estimated expenses related to tuition, fees, and living costs.

- Loan Amount Requested: The total amount the applicant is seeking to borrow.

Providing accurate information is essential, as discrepancies can lead to delays or denials in loan approval.

Steps to Complete the Private Education Loan Applicant Self Certification Form

Completing the Private Education Loan Applicant Self Certification Form involves several straightforward steps:

- Gather Documentation: Collect all necessary financial documents, including pay stubs, tax returns, and any other relevant information.

- Fill Out the Form: Carefully enter all required information, ensuring accuracy and completeness.

- Review Your Information: Double-check all entries for errors or omissions.

- Submit the Form: Follow the lender's guidelines for submission, whether online or via mail.

Following these steps can help streamline the loan application process and improve the chances of approval.

Who Can Be a Cosigner on Student Loans?

A cosigner is typically someone who agrees to take on the responsibility of the loan alongside the primary borrower. Common cosigners include:

- Parents: Many students have their parents cosign loans to help secure better terms.

- Guardians: Legal guardians can also act as cosigners if they have a strong financial background.

- Relatives: Siblings or other family members may be willing to cosign to assist with educational financing.

- Close Friends: In some cases, trusted friends with good credit may cosign.

Cosigners should have a stable income and a good credit history to increase the likelihood of loan approval.

Legal Use of the Private Education Loan Applicant Self Certification Form

The Private Education Loan Applicant Self Certification Form is legally binding once completed and signed. It is essential for both the borrower and the cosigner to understand their obligations under the loan agreement. This form must comply with federal regulations, ensuring that all parties are aware of the terms and conditions associated with the loan. Proper execution of this form can prevent legal issues and ensure a smooth borrowing experience.

Quick guide on how to complete private education loan applicant self certification form pdf ifap ifap ed

Effortlessly prepare Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hold-ups. Handle Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed with minimal effort

- Locate Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private education loan applicant self certification form pdf ifap ifap ed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who would most likely be a cosigner on some student loans Everfi?

Typically, a cosigner on student loans Everfi would be a parent, guardian, or relative who has a strong credit history. This person agrees to take on the responsibility of the loan if the primary borrower cannot make payments. Having a cosigner can help the primary borrower secure better loan terms and lower interest rates.

-

What features does airSlate SignNow offer for signing student loan documents?

AirSlate SignNow provides a seamless platform for electronic signatures, making it easier to sign student loan documents securely. Features include document templates, real-time notifications, and tracking, which ensures both the borrower and cosigner can complete the signing process efficiently. This is crucial for those asking who would most likely be a cosigner on some student loans Everfi.

-

How can airSlate SignNow enhance the signing experience for student loans?

With airSlate SignNow, the signing experience for student loans is enhanced through intuitive navigation and mobile capability. Users can sign documents from anywhere, making it convenient for both borrowers and cosigners. This flexibility supports those who might be uncertain about who would most likely be a cosigner on some student loans Everfi.

-

What is the pricing structure of airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to different business needs, ensuring affordability for all users. Plans are designed to cater to small businesses, educational institutions, and larger organizations alike. This inclusivity helps those interested in understanding who would most likely be a cosigner on some student loans Everfi without breaking the bank.

-

Does airSlate SignNow integrate with other software for student loan management?

Yes, airSlate SignNow integrates with various applications such as CRM systems and document management solutions, streamlining the student loan management process. These integrations ensure that you can manage documents and signatures effectively, which is essential for determining who would most likely be a cosigner on some student loans Everfi.

-

What benefits does airSlate SignNow provide for educational institutions?

AirSlate SignNow simplifies the signing and documentation process for educational institutions by reducing paperwork and improving efficiency. This digital solution allows schools to handle numerous student loan agreements while ensuring compliance and security. It directly addresses individuals exploring who would most likely be a cosigner on some student loans Everfi.

-

Is airSlate SignNow secure for managing sensitive loan documents?

Absolutely, airSlate SignNow is committed to maintaining security with bank-level encryption and secure access features. This ensures that all sensitive loan documents, including those with cosigner agreements, remain protected. Users can have peace of mind when answering who would most likely be a cosigner on some student loans Everfi.

Get more for Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed

Find out other Private Education Loan Applicant Self Certification Form PDF IFAP Ifap Ed

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free