Form AU 866

What is the Form AU 866

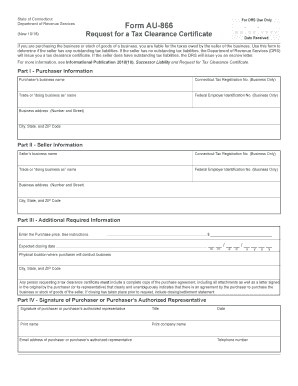

The Form AU 866 is a state-specific document used in Connecticut for tax clearance purposes. This form is essential for individuals and businesses seeking to verify their tax compliance status with the Connecticut Department of Revenue Services. It serves as a formal request for a tax clearance certificate, which confirms that all tax obligations have been met. The form is particularly relevant for those who are applying for licenses, permits, or other official approvals that require proof of tax compliance.

How to use the Form AU 866

Using the Form AU 866 involves a straightforward process. First, individuals or entities must complete the form with accurate information regarding their tax status. This includes details such as the taxpayer's name, address, and identification numbers. After filling out the form, it should be submitted to the appropriate state agency. Depending on the specific requirements, this may involve online submission, mailing a physical copy, or delivering it in person. Ensuring that all information is correct is crucial, as any discrepancies may delay the processing of the tax clearance certificate.

Steps to complete the Form AU 866

Completing the Form AU 866 requires attention to detail. Here are the steps to follow:

- Obtain the latest version of the Form AU 866 from the Connecticut Department of Revenue Services.

- Fill in your personal or business information accurately, including your name, address, and tax identification number.

- Provide any necessary supporting documentation that may be required to accompany your request.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form AU 866

The legal use of the Form AU 866 is governed by state regulations. It is important for users to understand that the form must be filled out completely and accurately to be considered valid. The submission of this form serves as a formal declaration of tax compliance, and any false information could lead to legal repercussions. Moreover, the form must be submitted to the appropriate state authorities to ensure that it is processed correctly and in a timely manner.

Required Documents

When submitting the Form AU 866, certain documents may be required to support your request. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Tax returns for the relevant years to demonstrate compliance.

- Any additional documentation requested by the Connecticut Department of Revenue Services.

Ensuring that all required documents are included can help expedite the processing of your tax clearance certificate.

Form Submission Methods

The Form AU 866 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the Connecticut Department of Revenue Services. The available submission methods include:

- Online submission through the state’s official portal.

- Mailing a hard copy to the designated address.

- Delivering the form in person to a local office.

Choosing the appropriate method can help ensure that your request is processed efficiently.

Quick guide on how to complete form au 866

Effortlessly Complete Form AU 866 on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your files quickly without delays. Manage Form AU 866 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to Modify and eSign Form AU 866 with Ease

- Locate Form AU 866 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, and errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form AU 866 while ensuring effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form au 866

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT tax clearance certificate?

A CT tax clearance certificate is an official document issued by the Connecticut Department of Revenue Services, confirming that a business has paid all its state taxes. This certificate is often required before businesses can proceed with various financial transactions, licensing, or contracting. Obtaining a CT tax clearance certificate ensures compliance and helps maintain a good standing with state authorities.

-

How can airSlate SignNow help me obtain a CT tax clearance certificate?

Using airSlate SignNow, you can easily eSign and send documents related to your CT tax clearance certificate application. Our platform streamlines the document management process, allowing you to focus on complying with tax requirements. With the ease of eSigning, you can expedite the submission of necessary forms to the DRS.

-

What are the costs associated with obtaining a CT tax clearance certificate?

The fee for obtaining a CT tax clearance certificate can vary based on your specific situation and filings. While airSlate SignNow offers cost-effective solutions for managing and eSigning documents, ensure to check the Connecticut DRS website for detailed fee information. Utilizing our services can help reduce administrative costs and improve efficiency in managing your documentation.

-

Are there any benefits to using airSlate SignNow for eSigning legal documents for my CT tax clearance certificate?

Absolutely! Using airSlate SignNow for eSigning legal documents related to your CT tax clearance certificate provides benefits like enhanced security, audit trails, and real-time tracking. Our platform makes it easier to manage and store documents securely, helping you stay organized throughout the compliance process. These features contribute to a quicker turnaround time for your application.

-

Can I integrate airSlate SignNow with other applications for tax management?

Yes, airSlate SignNow offers integrations with various tax management software and platforms. This capability allows you to seamlessly synchronize your workflow, reducing manual entry and minimizing errors when dealing with CT tax clearance certificate applications. Integrating our platform can optimize your entire document management process.

-

How secure is the document signing process with airSlate SignNow for tax clearance certificates?

The document signing process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication methods to protect your sensitive information. When working on your CT tax clearance certificate documents, you can trust that your data is protected against unauthorized access. Our compliance with industry standards ensures that your documents are safe every step of the way.

-

What types of documents can I sign related to my CT tax clearance certificate?

You can sign various documents related to your CT tax clearance certificate, including tax forms, applications, acknowledgments, and compliance statements. airSlate SignNow’s platform is designed to accommodate a range of document types, making it easier for you to manage all necessary paperwork electronically. This versatility helps ensure you meet all requirements promptly.

Get more for Form AU 866

Find out other Form AU 866

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy