Et 706 2019

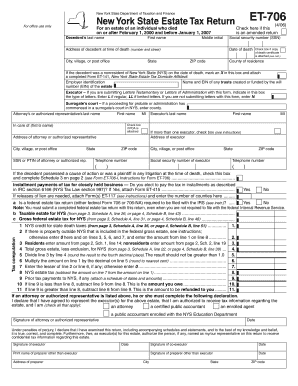

What is the ET 706?

The ET 706 is a form used in New York State for estate tax purposes. It is specifically designed to report the value of the estate of a deceased individual and calculate any estate taxes owed to the state. This form is essential for ensuring compliance with state tax laws and is part of the estate settlement process. The ET 706 provides a comprehensive overview of the estate's assets, liabilities, and the overall value that will be subject to taxation.

How to Use the ET 706

Using the ET 706 involves several steps to ensure accurate reporting of the estate's value. First, gather all necessary documentation related to the deceased's assets, including property deeds, bank statements, and investment records. Next, fill out the form with detailed information about the estate's assets and liabilities. It is crucial to ensure that all valuations are accurate and supported by appropriate documentation. After completing the form, review it for accuracy and completeness before submission.

Steps to Complete the ET 706

Completing the ET 706 requires careful attention to detail. Follow these steps to ensure proper completion:

- Collect all relevant financial documents, including appraisals and tax returns.

- Fill out the personal information section, including the decedent's name and date of death.

- List all assets, categorizing them appropriately (real estate, bank accounts, investments).

- Detail any liabilities or debts that the estate owes.

- Calculate the total value of the estate, subtracting liabilities from assets.

- Review the form for any errors or omissions before finalizing.

Legal Use of the ET 706

The ET 706 must be used in compliance with New York State laws regarding estate taxation. It serves as a legal document that reports the estate's value and determines the tax liability. Proper use of the form ensures that the estate complies with state requirements, avoiding potential penalties or legal issues. It is important to understand the legal implications of the information provided on the form, as inaccuracies can lead to audits or disputes with tax authorities.

Filing Deadlines / Important Dates

Filing the ET 706 is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. It is advisable to check for any updates or changes to deadlines, as these can vary based on specific circumstances or legislative changes. Timely submission of the ET 706 is essential for the smooth processing of the estate.

Required Documents

When preparing to file the ET 706, certain documents are required to support the information provided on the form. These may include:

- Death certificate of the decedent.

- Property appraisals for real estate and other significant assets.

- Bank statements and financial records.

- Documentation of any debts or liabilities.

- Previous tax returns if applicable.

Quick guide on how to complete et 706

Effortlessly Prepare Et 706 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Et 706 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Et 706 with Ease

- Locate Et 706 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Et 706 and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706

Create this form in 5 minutes!

How to create an eSignature for the et 706

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYS ET 706 and how does SignNow support it?

NYS ET 706 refers to the New York State Estate Tax Return form. airSlate SignNow supports this by allowing users to easily eSign and send the forms securely, ensuring compliance and simplifying the filing process.

-

How much does airSlate SignNow cost for handling NYS ET 706?

airSlate SignNow offers various pricing plans that can accommodate your needs for managing NYS ET 706 documents. Pricing starts with affordable options for small businesses, while providing advanced features for larger organizations to handle estate tax returns efficiently.

-

What features does SignNow offer for managing NYS ET 706 documents?

SignNow provides a range of features for NYS ET 706 document management, including customizable templates, automated workflows, and secure eSigning. These tools enable users to streamline the completion and submission of estate tax returns.

-

Can I integrate SignNow with other software for NYS ET 706 processing?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing for efficient processing of NYS ET 706 forms. By integrating with tools like CRM systems and accounting software, you can enhance your workflow and data management.

-

Is SignNow compliant with legal regulations for NYS ET 706?

Absolutely! airSlate SignNow is in full compliance with the legal regulations for eSigning, including those related to NYS ET 706. Our platform ensures that all signatures and submissions are legally binding and secure.

-

What are the benefits of using SignNow for NYS ET 706?

Using airSlate SignNow for NYS ET 706 offers numerous benefits, including reduced processing time, enhanced security, and improved collaboration among stakeholders. This makes the often complex estate tax return process straightforward and hassle-free.

-

How does SignNow ensure the security of NYS ET 706 documents?

airSlate SignNow employs top-notch security measures to protect your NYS ET 706 documents. This includes encryption, secure cloud storage, and regular security audits to ensure your sensitive information remains confidential.

Get more for Et 706

- Eu ewr bescheinigung form

- Gravel moses lake form

- Fnb smart bond application form fnb co

- The platinum rule pdf form

- Application spotlight employer sponsored coverage esc form

- Tucson fire department 300 s fire central place t form

- Bullhead city fire department form

- Authorization for release of ferpa records former student

Find out other Et 706

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement