Et 706 Form 2016

What is the Et 706 Form

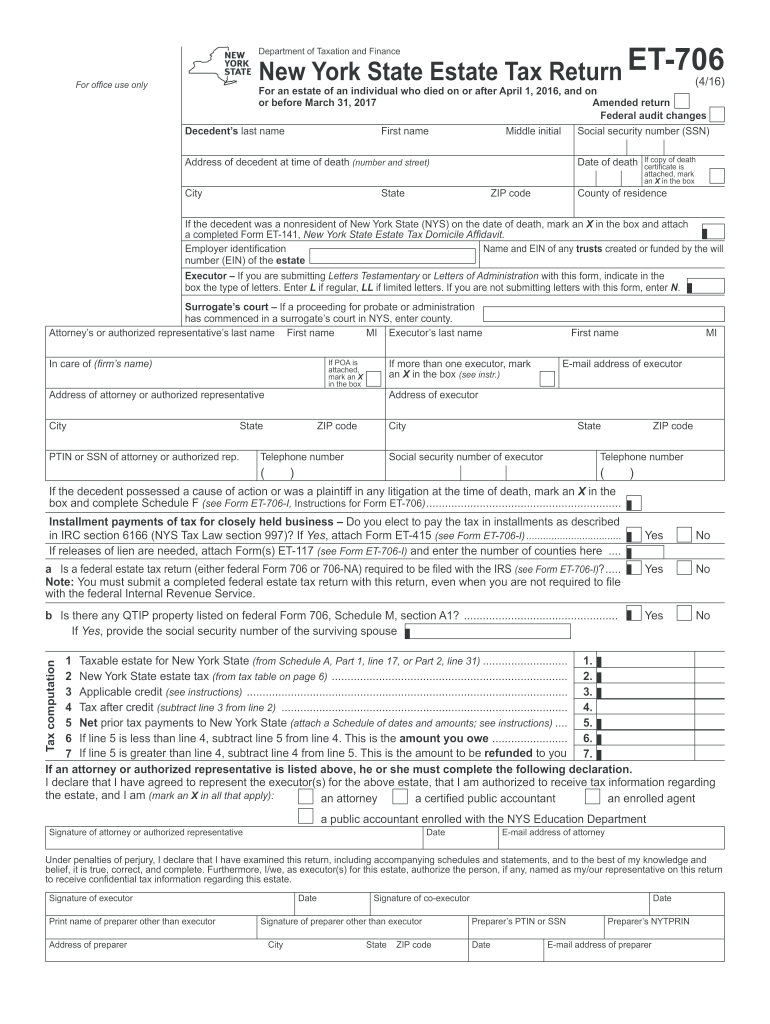

The Et 706 Form is a legal document used in the United States for estate tax purposes. It is specifically designed to report the value of an estate when the total value exceeds the federal exemption limit. This form helps the Internal Revenue Service (IRS) assess the estate tax owed by the deceased's estate. Understanding the purpose and requirements of the Et 706 Form is essential for executors and administrators managing an estate.

How to use the Et 706 Form

Using the Et 706 Form involves several key steps. First, gather all necessary information about the deceased's assets, liabilities, and any deductions that may apply. Next, accurately complete each section of the form, ensuring that all values are correctly reported. It's important to follow the IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form must be submitted to the IRS along with any required payment for estate taxes.

Steps to complete the Et 706 Form

Completing the Et 706 Form requires careful attention to detail. Here are the essential steps:

- Collect all relevant financial documents, including appraisals of assets and information about debts.

- Fill in the decedent's information, including their name, Social Security number, and date of death.

- List all assets and their fair market values, including real estate, bank accounts, and investments.

- Include any allowable deductions, such as funeral expenses and debts owed by the estate.

- Calculate the total taxable estate and the estate tax owed based on IRS guidelines.

- Review the form for accuracy and completeness before submitting it.

Legal use of the Et 706 Form

The Et 706 Form is legally binding and must be used in accordance with federal and state laws governing estate taxes. Properly completing and filing this form ensures compliance with IRS regulations, which can help avoid legal complications. Additionally, the form serves as a record of the estate's value and tax obligations, which may be necessary for future legal proceedings or audits.

Filing Deadlines / Important Dates

Filing the Et 706 Form is subject to specific deadlines. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be requested if more time is needed to gather necessary documentation. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid estate taxes.

Required Documents

To complete the Et 706 Form, several documents are required. These include:

- Death certificate of the decedent.

- Financial statements detailing the decedent's assets and liabilities.

- Appraisals for real estate and other significant assets.

- Documentation for any debts or expenses that can be deducted from the estate.

- Tax returns for the decedent, if applicable.

Quick guide on how to complete et 706 2016 form

Complete Et 706 Form seamlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your paperwork quickly without delays. Manage Et 706 Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Et 706 Form with ease

- Obtain Et 706 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Et 706 Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 2016 form

Create this form in 5 minutes!

How to create an eSignature for the et 706 2016 form

How to create an electronic signature for your Et 706 2016 Form online

How to generate an eSignature for your Et 706 2016 Form in Chrome

How to make an eSignature for putting it on the Et 706 2016 Form in Gmail

How to generate an eSignature for the Et 706 2016 Form right from your smartphone

How to create an electronic signature for the Et 706 2016 Form on iOS devices

How to create an electronic signature for the Et 706 2016 Form on Android OS

People also ask

-

What is the ET 706 Form and how does it work?

The ET 706 Form is a tax document used for reporting the estate tax for estates that exceed the federal exclusion amount. With airSlate SignNow, you can easily complete and eSign the ET 706 Form online, streamlining the filing process. Our platform ensures that your documents are secure and compliant with all regulations.

-

How can airSlate SignNow help with the ET 706 Form?

airSlate SignNow provides a user-friendly platform to prepare, sign, and send the ET 706 Form efficiently. You can utilize our templates to fill out the form accurately and send it directly to recipients for eSignature, reducing errors and saving time.

-

Is there a cost associated with using airSlate SignNow for the ET 706 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for individuals and teams. These plans provide access to features that simplify the process of completing and managing the ET 706 Form, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing the ET 706 Form?

airSlate SignNow includes features such as document templates, advanced editing tools, and secure eSignature capabilities specifically for the ET 706 Form. Additionally, you can track the status of your documents in real-time and receive notifications once they are signed.

-

Can I integrate airSlate SignNow with other applications when working on the ET 706 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Microsoft Office, allowing you to manage your ET 706 Form alongside your other documents. This integration enhances your workflow and keeps all your files organized.

-

What are the benefits of using airSlate SignNow for the ET 706 Form?

Using airSlate SignNow for the ET 706 Form offers several benefits, including improved efficiency, reduced turnaround time, and enhanced security for your sensitive information. Our platform simplifies the eSignature process, ensuring that your form is completed quickly and accurately.

-

Is airSlate SignNow secure for sending the ET 706 Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your ET 706 Form and other documents are protected. We use encryption and stringent security protocols to safeguard your data during transmission and storage.

Get more for Et 706 Form

- Jiffy lube fleet application online application form

- Multistate riders and addenda form 3183 single family fannie mae uniform instrument

- Demand and notice of default on installment promissory note carrolllibrary form

- Towing contract with allstatepdffillercom form

- Utah retirement systems roth ira withdrawal urs form

- Tsp address change form

- Uben142 form

- Rollover form ctd01314

Find out other Et 706 Form

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement