Et 706 Form 2019-2026

What is the ET 706 Form

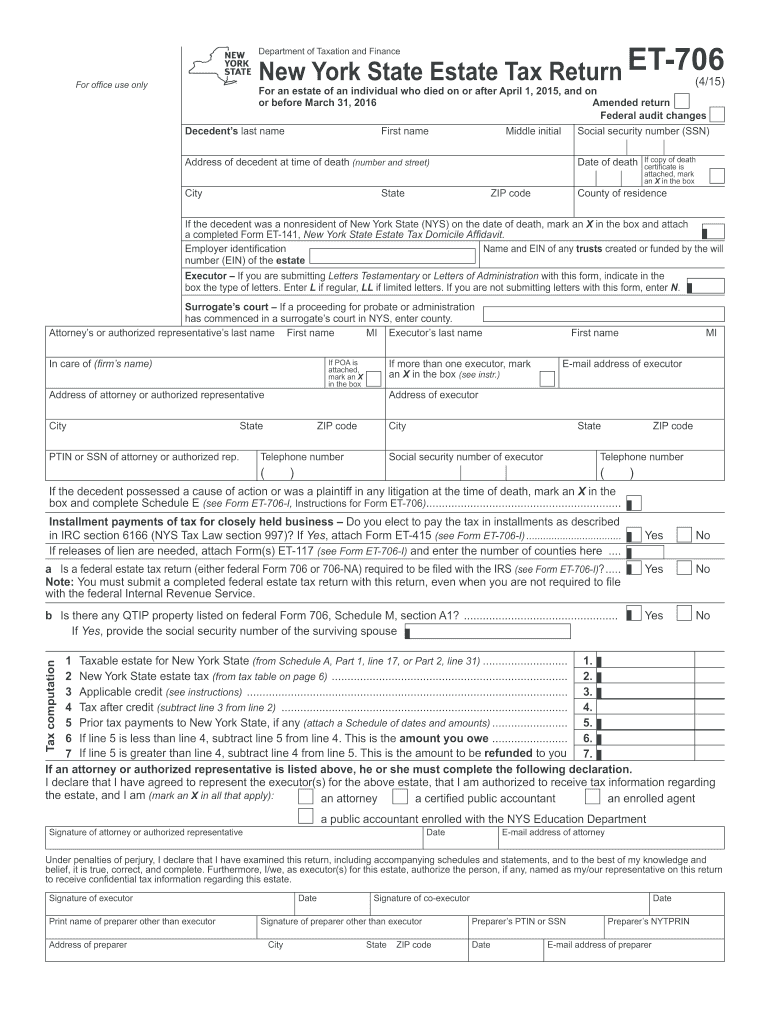

The ET 706 form, also known as the New York Estate Tax Return, is a crucial document for estates that exceed a certain value threshold in New York State. This form is used to calculate the estate tax owed by the decedent's estate. It is essential for ensuring compliance with state tax laws and is required for estates with a gross value exceeding the exemption limit set by New York State. Proper completion of the ET 706 form is vital for the smooth settlement of the estate and for avoiding potential penalties.

How to Use the ET 706 Form

Using the ET 706 form involves several steps that ensure accurate reporting of the estate's value and tax obligations. First, gather all necessary financial documentation, including property valuations, debts, and other relevant financial information. Next, complete the form by providing detailed information about the decedent, the estate's assets, and any deductions that may apply. Once the form is filled out, it should be reviewed for accuracy before submission to the New York State Department of Taxation and Finance. This careful approach helps prevent delays and ensures compliance with state regulations.

Steps to Complete the ET 706 Form

Completing the ET 706 form requires attention to detail and adherence to specific guidelines. Begin by filling in the decedent's personal information, including name, date of death, and social security number. Next, list all assets owned by the decedent at the time of death, including real estate, bank accounts, and investments. Calculate the total value of the estate and apply any deductions, such as debts and funeral expenses. Finally, calculate the estate tax owed based on the total taxable estate. Ensure that all calculations are accurate, as errors can lead to complications or penalties.

Legal Use of the ET 706 Form

The legal use of the ET 706 form is governed by New York State tax laws. This form must be filed within nine months of the decedent's death to avoid penalties and interest on unpaid taxes. It is essential to ensure that the information provided is complete and accurate, as the form serves as a legal declaration of the estate's value and tax liability. Filing the ET 706 form correctly helps protect the estate from legal challenges and ensures that beneficiaries receive their inheritance without unnecessary delays.

Filing Deadlines / Important Dates

Filing deadlines for the ET 706 form are critical to avoid penalties. The form must be submitted within nine months of the date of death of the decedent. If additional time is needed, an extension can be requested, but it is important to note that this does not extend the time to pay any taxes owed. Keeping track of these deadlines is essential for estate executors and administrators to ensure compliance with New York State tax regulations.

Required Documents

To complete the ET 706 form, several documents are necessary. These include the decedent’s death certificate, a list of all assets and their valuations, any outstanding debts or liabilities, and documentation of any deductions that may apply. Having these documents organized and readily available will facilitate the completion of the form and help ensure that all required information is accurately reported.

Quick guide on how to complete et 706 2015 form

Effortlessly Prepare Et 706 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and store it securely online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any delays. Manage Et 706 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

How to Modify and Electronically Sign Et 706 Form with Ease

- Find Et 706 Form and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select the method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Et 706 Form and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 2015 form

Create this form in 5 minutes!

How to create an eSignature for the et 706 2015 form

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 706 2013 form and how can airSlate SignNow assist with it?

The 706 2013 form is used for estate tax purposes, and airSlate SignNow streamlines the process by allowing businesses to easily create, send, and eSign these documents. Our platform ensures that the 706 2013 form is completed accurately and efficiently, reducing the chance of errors.

-

What pricing plans does airSlate SignNow offer for handling 706 2013 forms?

airSlate SignNow offers various pricing plans tailored to businesses of all sizes, starting from a cost-effective monthly subscription. Each plan provides access to features specifically designed to simplify the management of important documents like the 706 2013 form.

-

What features does airSlate SignNow provide to help with the 706 2013 form?

Features such as customizable templates, in-app collaboration, and secure cloud storage make it easy for businesses to manage the 706 2013 form. Additionally, the platform includes options for audit trails and reminders, enhancing compliance and efficiency.

-

How does airSlate SignNow ensure the security of my 706 2013 documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the 706 2013 form. Our platform employs advanced encryption standards and secure user authentication to protect your information throughout the entire signing process.

-

Can I integrate airSlate SignNow with other software for 706 2013 management?

Yes, airSlate SignNow offers integration capabilities with popular software tools, allowing you to manage your 706 2013 form seamlessly. This includes integrations with CRM systems, cloud storage providers, and more, facilitating a streamlined workflow.

-

What are the benefits of using airSlate SignNow for the 706 2013 form?

Using airSlate SignNow for the 706 2013 form provides numerous benefits such as increased efficiency, reduced paperwork, and improved accuracy. Our solution helps businesses save time and resources, enabling them to focus on more important tasks.

-

Is airSlate SignNow user-friendly for preparing the 706 2013 form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it simple for anyone to prepare the 706 2013 form. Features like drag-and-drop functionality and an intuitive interface ensure that users can navigate the platform easily.

Get more for Et 706 Form

Find out other Et 706 Form

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online