Form 8278

What is the Form 8278

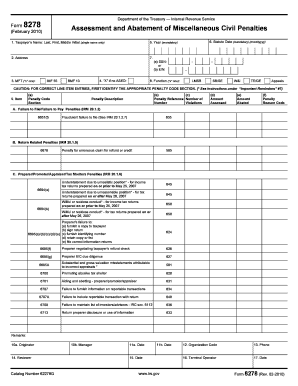

The Form 8278, also known as the IRS Form 8278, is a tax-related document used by taxpayers to report certain tax liabilities. This form is primarily utilized for the purpose of reporting and calculating tax amounts owed to the Internal Revenue Service (IRS). It is essential for individuals and businesses to understand the specific requirements associated with this form to ensure compliance and avoid potential penalties.

How to use the Form 8278

Using the Form 8278 involves several key steps. First, ensure that you have the correct version of the form, which can be downloaded from the IRS website. Next, gather all necessary financial information, including income, deductions, and any relevant tax credits. Fill out the form accurately, providing all required details. Once completed, review the form for any errors before submitting it to the IRS.

Steps to complete the Form 8278

Completing the Form 8278 requires careful attention to detail. Here are the steps to follow:

- Download the Form 8278 from the IRS website.

- Gather all necessary financial documentation, such as income statements and tax records.

- Fill out the personal information section, including your name, address, and taxpayer identification number.

- Complete the sections related to your income and deductions.

- Calculate the total tax liability as indicated on the form.

- Sign and date the form to certify its accuracy.

- Submit the form to the IRS via the appropriate method.

Legal use of the Form 8278

The legal use of the Form 8278 is governed by IRS regulations. It is crucial that the form is filled out correctly and submitted on time to avoid legal repercussions. The form serves as a formal declaration of tax liabilities, and any inaccuracies can lead to audits or penalties. Understanding the legal implications of this form helps ensure that taxpayers remain compliant with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8278 are critical for taxpayers to observe. Typically, the form must be submitted by the tax return due date, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is essential to stay informed about any updates to filing dates to ensure timely submission.

Penalties for Non-Compliance

Failing to comply with the requirements of the Form 8278 can result in significant penalties. The IRS may impose fines for late submissions or inaccuracies in reporting tax liabilities. Additionally, taxpayers may face interest charges on any unpaid taxes. Understanding these penalties emphasizes the importance of accurately completing and submitting the form on time.

Quick guide on how to complete form 8278

Manage Form 8278 seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily find and securely store the appropriate forms online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Handle Form 8278 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

Steps to modify and electronically sign Form 8278 effortlessly

- Find Form 8278 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact confidential information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and then click the Done button to save your changes.

- Choose your preferred method of delivering your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8278 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8278

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8278 and how can airSlate SignNow help?

Form 8278 is used for reporting certain tax implications and transactions. With airSlate SignNow, you can easily create, send, and eSign form 8278 digitally, ensuring that your documents are handled in a secure and efficient manner.

-

Is there a cost associated with using airSlate SignNow for form 8278?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide cost-effective solutions for managing form 8278 along with other documents, so you can choose one that fits your budget.

-

What features does airSlate SignNow offer for managing form 8278?

airSlate SignNow provides a user-friendly interface, customizable templates, and robust eSigning capabilities for form 8278. These features help streamline your document workflow and improve productivity while ensuring compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for form 8278 processing?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more. This allows you to easily manage your form 8278 alongside other business processes, enhancing overall efficiency.

-

How does airSlate SignNow ensure the security of form 8278?

Security is a priority for airSlate SignNow. We utilize advanced encryption and multiple layers of authentication to protect your form 8278 and sensitive information, ensuring that your documents remain secure throughout the signing process.

-

Can multiple users collaborate on form 8278 with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 8278 easily. You can invite team members to review, edit, and eSign the document, all in real-time, making it ideal for collaborative workflows.

-

How quickly can I get started with airSlate SignNow for form 8278?

Getting started with airSlate SignNow for form 8278 is quick and straightforward. Simply sign up for an account, create your form using our templates or tools, and you’ll be ready to send and eSign documents within minutes.

Get more for Form 8278

- Nyc exemption application for owners fillable form

- Graphs of f f and f worksheet pdf form

- California judges benchguide unlawful detainer form

- Hi 144 form

- Nabor sales contract residential improved property dated form

- Www promonkey inuatudnyc property registrationnyc property registration form pdf

- Nyc department of finance scriedrie walk in center form

- Rental application screening print out form

Find out other Form 8278

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer