Arizona 140nr Fillable Form 2017

What is the Arizona 140nr Fillable Form

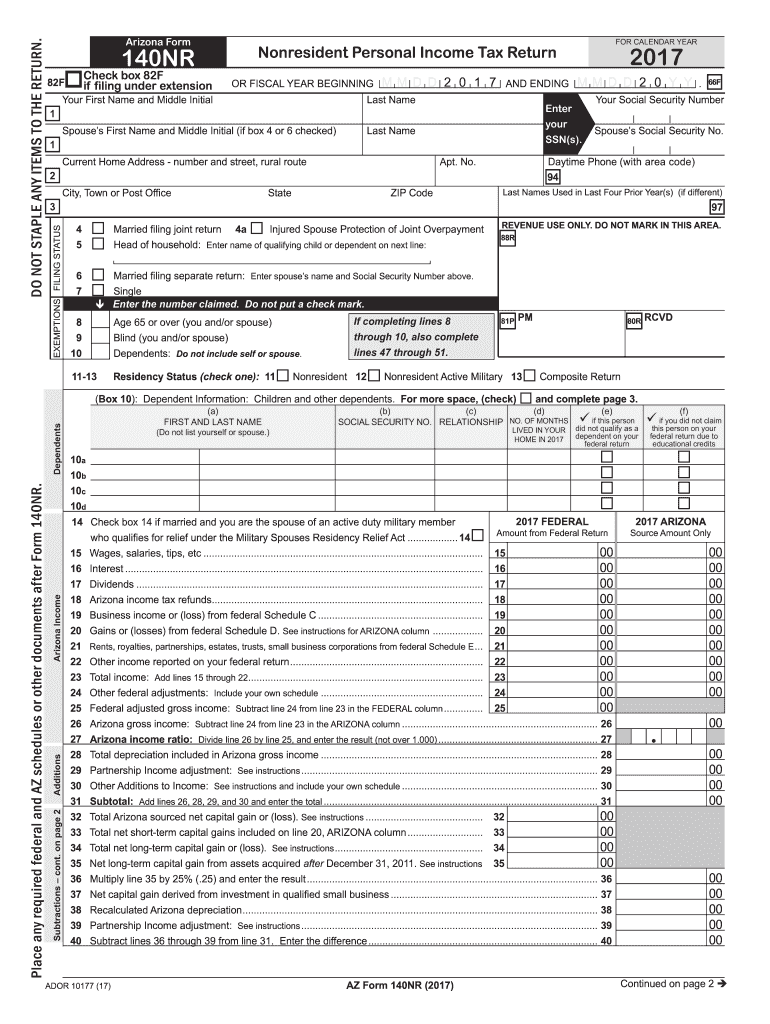

The Arizona 140nr fillable form is a tax document specifically designed for non-residents who earn income in Arizona. This form allows individuals to report their income, calculate their tax liability, and claim any applicable credits or deductions. It is essential for non-residents to accurately complete this form to ensure compliance with Arizona tax laws and to avoid potential penalties.

How to use the Arizona 140nr Fillable Form

Using the Arizona 140nr fillable form is straightforward. Taxpayers can access the form online, fill it out digitally, and submit it electronically. The fillable format allows users to enter their information directly into the form fields, making it easier to complete and ensuring that all necessary data is included. Once completed, the form can be signed electronically, streamlining the submission process.

Steps to complete the Arizona 140nr Fillable Form

Completing the Arizona 140nr fillable form involves several key steps:

- Gather all necessary documents, including W-2s and 1099s, that report your Arizona income.

- Access the Arizona 140nr fillable form online and begin entering your personal information.

- Input your income details, ensuring accuracy in reporting all sources of income earned in Arizona.

- Calculate your tax liability using the provided instructions and available tax tables.

- Review the form for any errors or omissions before finalizing your submission.

- Sign the form electronically and submit it according to the provided guidelines.

Legal use of the Arizona 140nr Fillable Form

The Arizona 140nr fillable form is legally recognized for filing state income taxes for non-residents. It complies with Arizona tax regulations, allowing taxpayers to fulfill their legal obligations. When completed and submitted correctly, this form serves as an official record of income earned in the state and the taxes owed, protecting taxpayers from potential legal issues related to non-compliance.

Form Submission Methods

Taxpayers have several options for submitting the Arizona 140nr fillable form:

- Online Submission: After filling out the form electronically, it can be submitted directly through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided in the form instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Arizona Department of Revenue offices.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Arizona 140nr fillable form. Generally, the deadline for submitting the form aligns with the federal tax filing deadline, which is typically April fifteenth. However, taxpayers should check for any updates or changes to this date each tax year to ensure timely submission and avoid penalties.

Quick guide on how to complete married filing separate return enter spouses name and social security number above

Your assistance manual on how to prepare your Arizona 140nr Fillable Form

If you’re interested in understanding how to finish and submit your Arizona 140nr Fillable Form, here are a few concise guidelines to simplify your tax declaration.

To start, you need to create your airSlate SignNow account to transform your online document management. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, draft, and finalize your tax forms easily. Utilizing its editor, you can toggle between text, checkboxes, and e-signatures, and go back to modify answers as necessary. Enhance your tax administration with sophisticated PDF editing, e-signing, and straightforward sharing.

Complete the following steps to achieve your Arizona 140nr Fillable Form in a matter of minutes:

- Set up your account and start working on PDFs in no time.

- Browse our library to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Arizona 140nr Fillable Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding e-signature (if needed).

- Review your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Be aware that filing on paper can lead to return errors and delay refunds. Additionally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct married filing separate return enter spouses name and social security number above

FAQs

-

I had filed form 843 for refund of wrongly withheld Social Security taxes and Medicare taxes about 6 months back. I just realised that I mistakenly filled the wrong address in the column "Name and address shown on return if different from above". What should I do? Is that causing a delay in my refund?

You might want to contact them with a follow up letter, but, that isn't delay...843's can take quite a long time to get processed...I have some take 18 months.

Create this form in 5 minutes!

How to create an eSignature for the married filing separate return enter spouses name and social security number above

How to make an eSignature for your Married Filing Separate Return Enter Spouses Name And Social Security Number Above in the online mode

How to generate an eSignature for your Married Filing Separate Return Enter Spouses Name And Social Security Number Above in Google Chrome

How to generate an eSignature for putting it on the Married Filing Separate Return Enter Spouses Name And Social Security Number Above in Gmail

How to generate an electronic signature for the Married Filing Separate Return Enter Spouses Name And Social Security Number Above right from your mobile device

How to generate an eSignature for the Married Filing Separate Return Enter Spouses Name And Social Security Number Above on iOS devices

How to create an electronic signature for the Married Filing Separate Return Enter Spouses Name And Social Security Number Above on Android OS

People also ask

-

What is the Arizona 140nr Fillable Form?

The Arizona 140nr Fillable Form is a state-specific tax form designed for non-residents filing their income tax in Arizona. This form allows users to report their income earned in Arizona and claim applicable deductions or credits. Utilizing the Arizona 140nr Fillable Form ensures accurate filing and compliance with Arizona tax regulations.

-

How can I access the Arizona 140nr Fillable Form?

You can easily access the Arizona 140nr Fillable Form through the airSlate SignNow platform. Our user-friendly interface allows you to fill out, edit, and e-sign the form electronically. Simply create an account, and you can download or fill out the Arizona 140nr Fillable Form directly online.

-

Is the Arizona 140nr Fillable Form free to use?

While the Arizona 140nr Fillable Form can be accessed for free, airSlate SignNow offers premium features that may incur charges. These features include advanced document management and electronic signature capabilities. However, signing up for a trial can allow you to explore these features at no cost initially.

-

What are the benefits of using the Arizona 140nr Fillable Form through airSlate SignNow?

Using the Arizona 140nr Fillable Form through airSlate SignNow provides several advantages, such as a streamlined filing process, enhanced accuracy, and secure storage of sensitive information. Additionally, our platform enables users to track their documents in real-time, ensuring that you never miss an important deadline.

-

Can I integrate the Arizona 140nr Fillable Form with other software?

Yes, airSlate SignNow allows you to integrate the Arizona 140nr Fillable Form with various applications and software. This includes popular tools like Google Drive, Dropbox, and CRM systems, which help in managing your documents efficiently. Integration simplifies data sharing and enhances workflow.

-

Is it safe to use the Arizona 140nr Fillable Form on airSlate SignNow?

Absolutely! The Arizona 140nr Fillable Form on airSlate SignNow is protected with state-of-the-art encryption and security protocols. We prioritize your data's safety, ensuring that all personal and financial information remains confidential and secure during the entire process.

-

How long does it take to complete the Arizona 140nr Fillable Form?

The time required to complete the Arizona 140nr Fillable Form varies based on your specific tax situation. However, with airSlate SignNow's intuitive design and step-by-step guidance, most users can fill out the form in a matter of minutes. This efficiency allows for a quicker submission of your tax return.

Get more for Arizona 140nr Fillable Form

- Emergency equipment rental agreement state of alaska forestry alaska form

- Contact information a list of campverde az

- Wsfm western states form

- Mining claim form

- Nwcg interagency training nomination and agreement to collect funds azsf az form

- Prescriberdispenser database access request form

- Arizona civil standby form

- Kingman cerbat pay fines form

Find out other Arizona 140nr Fillable Form

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document