Short Year or Fiscal Year Return Due Before Tax Forms 2023-2026

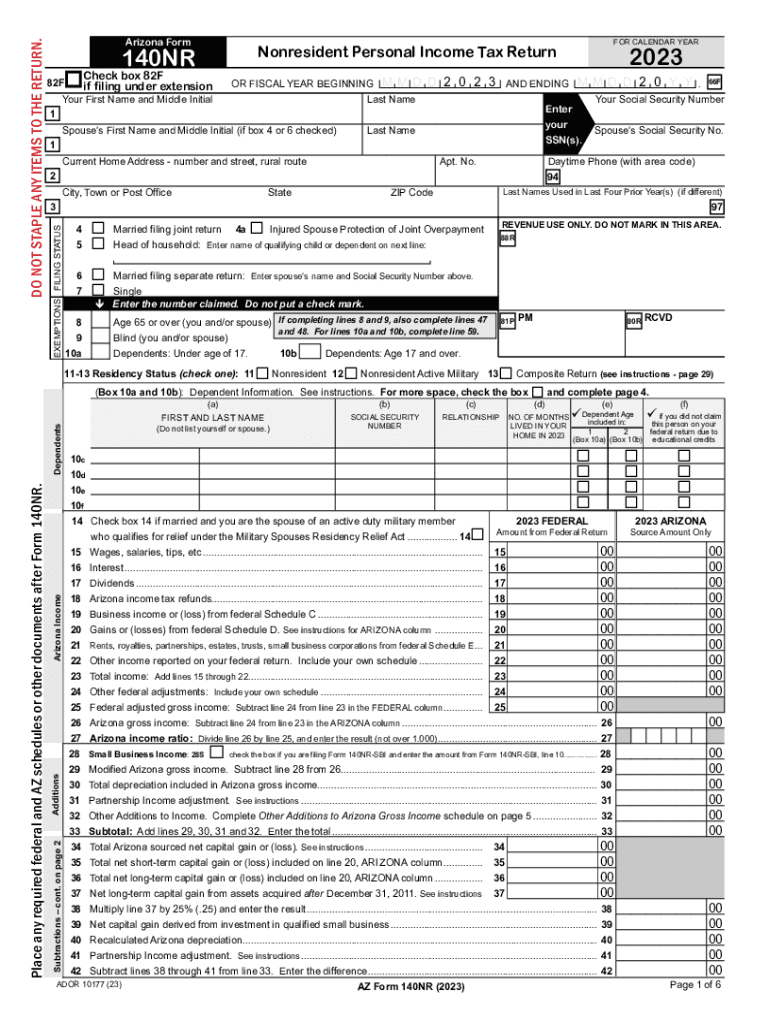

What is the Arizona Form 140NR 2022?

The Arizona Form 140NR 2022 is a tax return specifically designed for non-residents of Arizona who have earned income from sources within the state. This form allows individuals to report their income, claim deductions, and calculate their tax liability for the 2022 tax year. It is essential for non-residents to accurately complete this form to comply with Arizona tax laws and ensure proper tax reporting.

Key Elements of the Arizona Form 140NR 2022

The Arizona Form 140NR 2022 includes several key components that taxpayers must complete:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Non-residents must report income earned from Arizona sources, including wages, rental income, and business income.

- Deductions and Credits: Taxpayers can claim specific deductions and credits applicable to their situation, which may reduce their overall tax liability.

- Tax Calculation: The form includes a section for calculating the total tax owed based on reported income and applicable deductions.

Steps to Complete the Arizona Form 140NR 2022

Completing the Arizona Form 140NR 2022 involves several important steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information accurately at the top of the form.

- Report all income earned from Arizona sources in the designated sections.

- Claim any deductions or credits you qualify for to reduce your taxable income.

- Calculate your tax liability based on the provided instructions.

- Review the form for accuracy and completeness before submitting.

Filing Deadlines for the Arizona Form 140NR 2022

It is crucial to be aware of the filing deadlines for the Arizona Form 140NR 2022 to avoid penalties:

- The standard deadline for filing is typically April 15, 2023, for the 2022 tax year.

- If you need additional time, you may file for an extension, which usually grants an additional six months.

Form Submission Methods for the Arizona Form 140NR 2022

Taxpayers have several options for submitting their Arizona Form 140NR 2022:

- Online Filing: Many taxpayers choose to file electronically through approved software programs that support Arizona tax forms.

- Mail: You can also print the completed form and mail it to the Arizona Department of Revenue at the specified address.

- In-Person: Some individuals may opt to deliver their forms in person at local tax offices, although this is less common.

Penalties for Non-Compliance with the Arizona Form 140NR 2022

Failure to file the Arizona Form 140NR 2022 or inaccuracies in reporting can lead to penalties:

- Late filing penalties may apply if the form is submitted after the deadline without an approved extension.

- Underreporting income can result in additional taxes owed and potential fines from the Arizona Department of Revenue.

Quick guide on how to complete short year or fiscal year return due before tax forms

Complete Short Year Or Fiscal Year Return Due Before Tax Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without complications. Manage Short Year Or Fiscal Year Return Due Before Tax Forms from any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Short Year Or Fiscal Year Return Due Before Tax Forms seamlessly

- Find Short Year Or Fiscal Year Return Due Before Tax Forms and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Craft your signature using the Sign tool, which takes just seconds and carries the same legal validity as a standard handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your preferred device. Edit and eSign Short Year Or Fiscal Year Return Due Before Tax Forms and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct short year or fiscal year return due before tax forms

Create this form in 5 minutes!

How to create an eSignature for the short year or fiscal year return due before tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 140NR 2022?

The Arizona Form 140NR 2022 is a tax return form specifically designed for non-resident individuals who need to file their Arizona taxes. This form allows non-residents to report income earned in Arizona while providing necessary deductions and credits.

-

How can airSlate SignNow help with my Arizona Form 140NR 2022?

airSlate SignNow streamlines the process of preparing and submitting your Arizona Form 140NR 2022 by digitizing document workflows. With our eSignature capabilities, you can easily sign and send your tax forms securely and efficiently, ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for my Arizona Form 140NR 2022?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individual users and businesses. The cost is competitive and provides value by saving time and enhancing efficiency when handling documents like the Arizona Form 140NR 2022.

-

What features does airSlate SignNow offer to support Arizona Form 140NR 2022 submissions?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage that support the submission of Arizona Form 140NR 2022. The platform also allows for real-time tracking of document status, making it easy to manage your tax filings.

-

Can I integrate airSlate SignNow with other applications for my Arizona Form 140NR 2022?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including major CRM and accounting software. This means you can effortlessly incorporate Arizona Form 140NR 2022 into your broader document management process, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for Arizona Form 140NR 2022 filings?

Using airSlate SignNow for Arizona Form 140NR 2022 filings provides numerous benefits, including increased speed, efficiency, and security. With our user-friendly interface, you can easily manage and automate your document workflows, reducing the chance of errors during tax season.

-

How secure is the submission of my Arizona Form 140NR 2022 with airSlate SignNow?

Security is a top priority for airSlate SignNow. When you submit your Arizona Form 140NR 2022, your data is encrypted and stored in a secure environment, ensuring that your sensitive tax information remains confidential and protected from unauthorized access.

Get more for Short Year Or Fiscal Year Return Due Before Tax Forms

- Tow service agreement 2015 2018 form

- Calrecycle application 2014 form

- Calrecycle application 2018 2019 form

- Apostille colorado secretary of state us apostille form

- Electrical permit application city of aspen form

- Weld county flood hazard development permit 2018 2019 form

- Flood hazard development permit fhdp submittal weld county co weld co form

- How to ucc1 2011 form

Find out other Short Year Or Fiscal Year Return Due Before Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors