for CALENDAR YEAR 2022

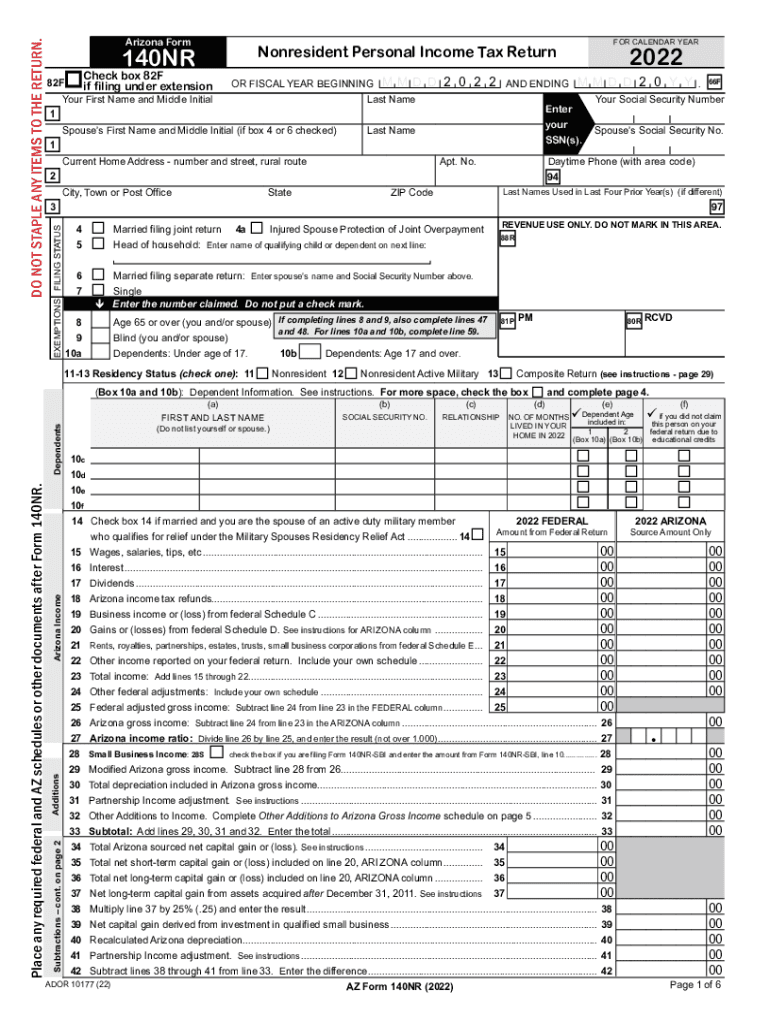

What is the Arizona 140NR Form?

The Arizona 140NR form is a state income tax return specifically designed for non-residents of Arizona who earn income within the state. This form is essential for individuals who do not reside in Arizona but have income sourced from Arizona, such as wages, rental income, or business earnings. By filing the Arizona 140NR, taxpayers can report their income and calculate their state tax liability accurately. It is crucial for ensuring compliance with Arizona tax laws and avoiding potential penalties.

Steps to Complete the Arizona 140NR Form

Completing the Arizona 140NR form involves several key steps:

- Gather Required Information: Collect all necessary documents, including W-2s, 1099s, and any other income statements related to your Arizona earnings.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Report Income: Enter all income earned from Arizona sources in the appropriate sections of the form.

- Calculate Deductions: Identify any deductions you may qualify for, such as standard deductions or specific Arizona deductions.

- Determine Tax Liability: Use the tax tables provided in the form instructions to calculate your tax owed based on your reported income.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it before submission.

Legal Use of the Arizona 140NR Form

The Arizona 140NR form is legally binding when filled out correctly and submitted on time. To ensure its legal validity, it is important to follow Arizona Department of Revenue guidelines, including using the most current version of the form. Additionally, e-signatures are accepted if you are using a compliant platform, ensuring that your submission meets electronic signature regulations. This form is crucial for fulfilling your tax obligations and avoiding legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona 140NR form typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of these dates to avoid late filing penalties. Additionally, if you are requesting an extension, ensure that you file the appropriate forms before the original deadline.

Required Documents for the Arizona 140NR Form

To complete the Arizona 140NR form accurately, you will need several documents:

- Income Statements: W-2 forms from employers and 1099 forms for any freelance or contract work.

- Proof of Deductions: Documentation supporting any deductions claimed, such as receipts or tax forms.

- Identification: Your Social Security number and other personal identification details.

- Previous Tax Returns: If applicable, having your prior year’s tax return can help in completing the current form.

Form Submission Methods

The Arizona 140NR form can be submitted through various methods, ensuring convenience for taxpayers. You can file the form electronically using approved e-filing software, which often streamlines the process and provides immediate confirmation of receipt. Alternatively, you may print the completed form and mail it to the Arizona Department of Revenue. Ensure that you check the latest mailing address and guidelines to avoid delays. In-person submission is also an option at designated tax offices, providing assistance if needed.

Quick guide on how to complete for calendar year

Complete FOR CALENDAR YEAR effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and efficiently. Manage FOR CALENDAR YEAR on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The most efficient way to alter and electronically sign FOR CALENDAR YEAR without stress

- Find FOR CALENDAR YEAR and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as an original wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form retrievals, or mistakes that necessitate the printing of additional document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign FOR CALENDAR YEAR and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year

Create this form in 5 minutes!

How to create an eSignature for the for calendar year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona 140NR form?

The Arizona 140NR form is a vital document for non-residents filing their state taxes in Arizona. This form helps ensure compliance with Arizona tax laws and accurately calculates any taxes owed. Utilizing tools like airSlate SignNow can simplify the process of completing and filing your Arizona 140NR form.

-

How can airSlate SignNow help with the Arizona 140NR form?

airSlate SignNow offers an intuitive platform that allows users to easily complete and eSign the Arizona 140NR form electronically. This streamlines the filing process, reduces the risk of errors, and saves time. Plus, it ensures that your documents are securely stored and accessible anytime.

-

What are the pricing options for using airSlate SignNow for the Arizona 140NR form?

airSlate SignNow provides various pricing plans designed to fit different needs and budgets when handling the Arizona 140NR form. Plans are often tiered based on features and the volume of documents processed, making it accessible for individuals and businesses alike. You can visit our pricing page for more details on each plan.

-

Is eSigning the Arizona 140NR form legally binding?

Yes, eSigning the Arizona 140NR form through airSlate SignNow is legally binding and compliant with federal and state regulations. Our platform meets stringent security standards to ensure that your signature is valid and will hold up in any legal matters. This provides you with peace of mind when filing your taxes.

-

What features does airSlate SignNow offer for handling tax forms like the Arizona 140NR form?

airSlate SignNow includes features such as document templates, seamless eSigning, and secure cloud storage that cater specifically to the needs of filing the Arizona 140NR form. These features make it easy to customize your documents and ensure all necessary information is included before submission. Additionally, notifications keep you updated on the signing status.

-

Can I integrate airSlate SignNow with other software for the Arizona 140NR form?

Absolutely! airSlate SignNow offers integrations with various platforms such as Google Drive, Dropbox, and CRM systems, allowing you to streamline the workflow for the Arizona 140NR form. This connectivity aids in managing documents more efficiently across different applications, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the Arizona 140NR form compared to traditional methods?

Using airSlate SignNow for the Arizona 140NR form provides signNow advantages over traditional filing methods, including faster processing times and enhanced accuracy. Digital signatures reduce the risk of misplaced documents and ensure a clear audit trail. Additionally, the platform is user-friendly, making it accessible to everyone.

Get more for FOR CALENDAR YEAR

- Tn deed trust 497327100 form

- Tn deed trust 497327101 form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy tennessee form

- Warranty deed for parents to child with reservation of life estate tennessee form

- Warranty deed for separate or joint property to joint tenancy tennessee form

- Warranty deed for separate property of one spouse to both spouses as joint tenants tennessee form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries tennessee form

- Tennessee partnership llc form

Find out other FOR CALENDAR YEAR

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online