Schedule X Form

What is the Schedule X Form

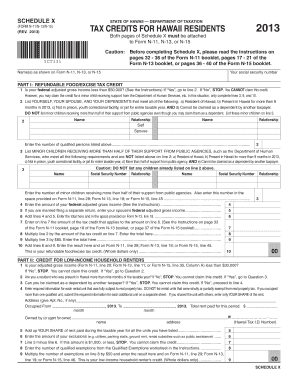

The Schedule X tax form is a supplementary form used by taxpayers in the United States to report specific types of income, deductions, or credits that are not captured on the standard tax return forms. It is commonly utilized by individuals who need to provide additional details regarding their financial situation, particularly when claiming certain tax benefits or adjustments. Understanding the purpose of the Schedule X form is crucial for ensuring accurate and compliant tax reporting.

How to use the Schedule X Form

Using the Schedule X tax form involves several steps to ensure that all necessary information is accurately reported. Taxpayers should begin by gathering relevant financial documents, including income statements and receipts for deductions. Once these documents are ready, individuals can download the Schedule X form from the IRS website or obtain a physical copy from a tax professional. After filling out the form with the appropriate details, it should be attached to the main tax return when submitting to the IRS.

Steps to complete the Schedule X Form

Completing the Schedule X form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Download the Schedule X form from the IRS website or obtain it from a tax professional.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Report any additional income, deductions, or credits in the appropriate sections of the form.

- Double-check all entries for accuracy and completeness.

- Attach the completed Schedule X form to your main tax return.

- Submit your tax return by the designated deadline, either electronically or by mail.

Legal use of the Schedule X Form

The Schedule X tax form is legally binding when completed accurately and submitted according to IRS guidelines. It is essential for taxpayers to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be signed and dated before submission to confirm that the taxpayer agrees with the information reported. Compliance with IRS regulations is crucial for the legal validity of the Schedule X form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule X form align with the overall tax return deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these dates to avoid late filing penalties. Additionally, extensions may be available, but the Schedule X form must still be filed by the original deadline unless an extension is granted.

Examples of using the Schedule X Form

There are various scenarios in which taxpayers might need to use the Schedule X form. For instance, self-employed individuals may report additional income from freelance work, while those claiming specific tax credits, such as education credits, would need to provide detailed information on the Schedule X form. Other examples include reporting capital gains or losses from investments not included on the main tax return. Each situation requires careful consideration of the information to be reported on the Schedule X form.

Quick guide on how to complete schedule x form

Prepare Schedule X Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule X Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Schedule X Form with ease

- Find Schedule X Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with features that airSlate SignNow has designed specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify your details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate reprinting new documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Schedule X Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost to schedule x with airSlate SignNow?

To schedule x using airSlate SignNow, you can choose from different pricing plans tailored to your needs. Each plan offers various features and capabilities, allowing you to select the one that fits your budget. Visit our pricing page for more details on costs and discounts.

-

How can I schedule x for my team?

Scheduling x with airSlate SignNow is straightforward. Simply log in to your account, choose the document to eSign, and then set the date and time for the signing process. Your team members will receive notifications to ensure they are updated.

-

What features support scheduling x in airSlate SignNow?

airSlate SignNow boasts an array of features that enhance the scheduling x process, such as automated reminders, customizable workflows, and real-time tracking. These features help ensure that all signers are fully informed and able to participate in the signing at the scheduled time.

-

What are the benefits of using airSlate SignNow to schedule x?

Using airSlate SignNow to schedule x allows for a more efficient document management process, reducing the time spent on manual tasks. With eSigning capabilities and automated scheduling, you can streamline your workflow and enhance team collaboration, leading to faster completion of documents.

-

Can I integrate other tools with airSlate SignNow for scheduling x?

Yes, airSlate SignNow offers integrations with various productivity tools such as CRMs, project management software, and cloud storage services. This allows you to seamlessly schedule x alongside your existing workflows, enhancing overall efficiency and ease of use.

-

Is it easy to schedule x on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to easily schedule x from anywhere at any time. The mobile app provides full access to all features, ensuring you can manage your documents even while on the go.

-

What types of documents can I schedule x for?

You can schedule x for a variety of document types using airSlate SignNow, including contracts, agreements, and consent forms. The platform supports different formats, so you can be confident in managing both simple and complex documents effectively.

Get more for Schedule X Form

Find out other Schedule X Form

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement