Form 945

What is the Form 945

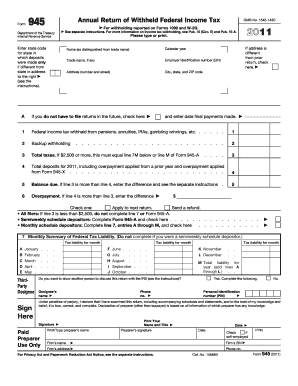

The 2015 Form 945 is an annual information return used by businesses to report nonpayroll tax payments made to individuals, such as backup withholding and certain other payments. It is essential for organizations that withhold federal income tax from payments made to non-employees, including independent contractors and freelancers. This form helps the Internal Revenue Service (IRS) track the taxes withheld and ensures compliance with federal tax regulations.

How to use the Form 945

To effectively use the 2015 Form 945, businesses should first determine if they are required to file it based on their payment activities. Once confirmed, they need to gather necessary information, including the total amount of nonpayroll payments made and the federal income tax withheld. The form must be completed accurately and submitted to the IRS by the specified deadline to avoid penalties. Businesses can also utilize electronic filing options for convenience and efficiency.

Steps to complete the Form 945

Completing the 2015 Form 945 involves several key steps:

- Gather all relevant financial records, including payment amounts and withholding details.

- Fill out the identification section with the business name, address, and Employer Identification Number (EIN).

- Report the total nonpayroll payments made and the total federal income tax withheld in the appropriate sections.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to the IRS by the deadline, either electronically or via mail.

Legal use of the Form 945

The 2015 Form 945 is legally binding when completed and submitted in accordance with IRS guidelines. It is crucial for businesses to ensure that the information reported is accurate and reflects true payment activities. Failure to comply with the filing requirements can result in penalties and interest charges. Maintaining proper records and ensuring timely submission are essential for legal compliance.

Filing Deadlines / Important Dates

The filing deadline for the 2015 Form 945 is typically January 31 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses should also be aware of any changes in deadlines that may occur due to IRS announcements. Timely filing is important to avoid penalties and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The 2015 Form 945 can be submitted to the IRS through various methods. Businesses have the option to file electronically, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address, depending on the business location. In-person submission is generally not available for this form, making electronic and mail submissions the primary methods for filing.

Quick guide on how to complete form 945 14961937

Complete Form 945 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Form 945 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 945 with ease

- Locate Form 945 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Form 945 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 945 14961937

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 form 945 and why do I need it?

The 2015 form 945 is used to report withheld federal income tax from non-payroll payments, such as those from pensions and annuities. Understanding how to correctly fill out and file the 2015 form 945 is crucial for compliance with tax regulations. Using airSlate SignNow can streamline this process by allowing you to easily eSign and send your completed documents.

-

How can airSlate SignNow assist in managing the 2015 form 945?

airSlate SignNow provides an intuitive platform where you can create, edit, and eSign essential tax documents, including the 2015 form 945. The service ensures that your documents are securely stored and easily accessible for review and signing. By utilizing our features, you can efficiently manage your tax reporting needs.

-

Is airSlate SignNow cost-effective for businesses filing the 2015 form 945?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for filing the 2015 form 945. Our pricing structure is transparent with no hidden fees, allowing you to manage your document needs without breaking the bank. You can enjoy the benefits of electronic signatures while saving on printing and mailing costs.

-

What features does airSlate SignNow offer for completing the 2015 form 945?

airSlate SignNow includes features like reusable templates, drag-and-drop document builders, and secure eSign capabilities, making it easier to complete the 2015 form 945. Additionally, you can track document status and receive notifications when your forms are signed, ensuring you stay on top of your filing obligations. These features enhance efficiency and accuracy in your tax reporting.

-

Can I integrate airSlate SignNow with my accounting software for the 2015 form 945?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to streamline your workflow when processing the 2015 form 945. This integration facilitates automatic data entry and minimizes manual errors, ensuring that your tax forms are accurate and submitted on time. You can connect your systems easily and enhance productivity.

-

What benefits does airSlate SignNow provide for eSigning the 2015 form 945?

Using airSlate SignNow for eSigning the 2015 form 945 provides numerous benefits, such as enhanced security, speed, and convenience. Your documents are securely transmitted, reducing the risk of tampering while allowing for quick execution of agreements. This ensures that you can focus on your business, knowing that your tax documents are handled efficiently.

-

How does eSigning the 2015 form 945 with airSlate SignNow improve compliance?

eSigning the 2015 form 945 with airSlate SignNow helps improve compliance by creating a regulated digital trail that keeps a record of who signed, when, and how. This transparency ensures that you maintain an audit-ready status for your business. Furthermore, the secure storage of your signed documents guarantees that they remain intact and compliant with legal standards.

Get more for Form 945

- Form 47 24870394

- Beleidsregels cfv cfv form

- Bertch online application form

- Woodforest loan form

- That follows the bhlh zip region which consists of the www4 utsouthwestern form

- 4a 104 response state of new mexico county of nmsupremecourt nmcourts form

- Encroachment agreement template form

- Guitar lesson contract template form

Find out other Form 945

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online