Amc Form 140 1999-2026

What is the AMC Form 140

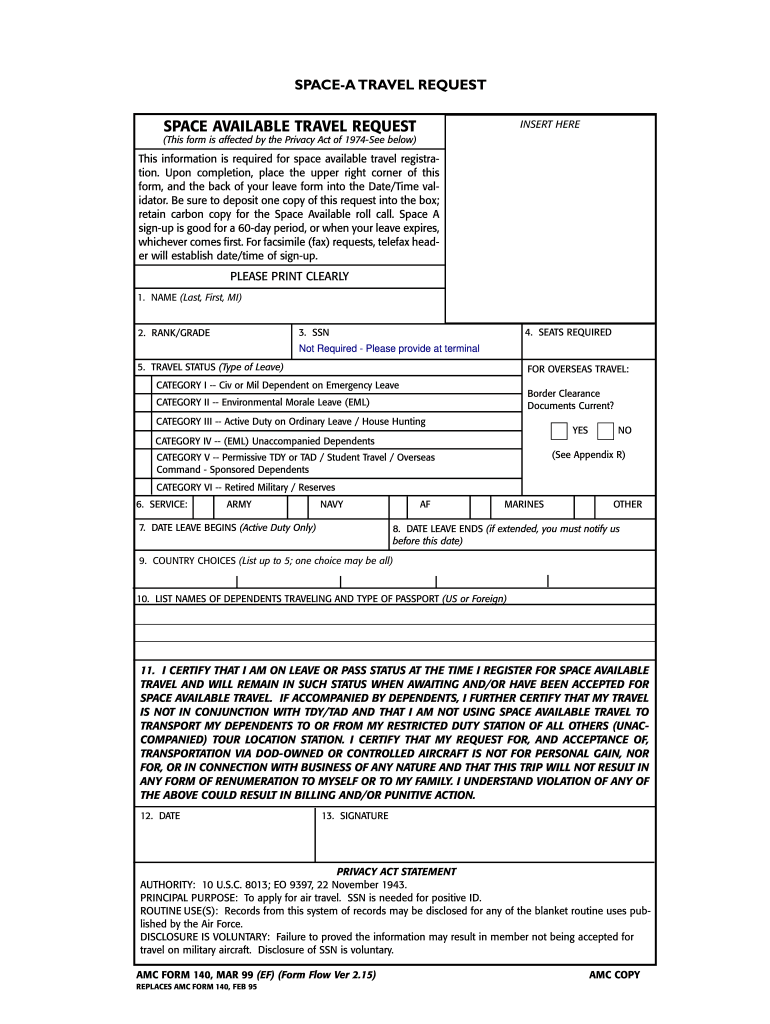

The AMC Form 140 is a document used primarily in the United States for specific administrative purposes. It is often associated with requests for information or actions related to property assessments and valuations. This form is crucial for ensuring that the necessary information is collected and processed correctly by relevant authorities. Understanding its purpose and implications is essential for individuals and businesses involved in property transactions or assessments.

How to use the AMC Form 140

Using the AMC Form 140 involves several straightforward steps. First, ensure you have the most current version of the form, as outdated versions may not be accepted. Next, fill in all required fields accurately, providing detailed information as requested. It is important to review the form for completeness before submission. Once filled, you can submit the form according to the guidelines provided by the issuing authority, which may allow for online submission, mailing, or in-person delivery.

Steps to complete the AMC Form 140

Completing the AMC Form 140 requires careful attention to detail. Begin by gathering all necessary information, including property details and any supporting documents. Follow these steps:

- Download the latest version of the AMC Form 140.

- Fill in your name, contact information, and any relevant identification numbers.

- Provide detailed information about the property in question, including its location and valuation.

- Attach any required documentation, such as previous assessment reports or supporting evidence.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the AMC Form 140

The legal use of the AMC Form 140 is critical for ensuring compliance with local and state regulations. This form must be filled out accurately and submitted to the appropriate authority to avoid any legal repercussions. It is essential to understand the legal implications of the information provided, as inaccuracies can lead to penalties or delays in processing. Always consult relevant guidelines or legal counsel if unsure about any aspect of the form.

Key elements of the AMC Form 140

Key elements of the AMC Form 140 include various sections that require specific information. These typically encompass:

- Identification information of the applicant.

- Details about the property, including its address and current valuation.

- Attachments required to support the request.

- Signature and date fields to confirm the authenticity of the submission.

Each of these elements plays a vital role in the processing of the form and should be completed with care.

Form Submission Methods

The AMC Form 140 can be submitted through several methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission via a secure portal, if available.

- Mailing the completed form to the designated office.

- In-person delivery at the appropriate administrative office.

Choosing the right submission method can help ensure timely processing and reduce the risk of delays.

Quick guide on how to complete amc form

Uncover the simplest method to complete and sign your Amc Form 140

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior approach to fill out and sign your Amc Form 140 and associated forms for public services. Our innovative electronic signature solution equips you with everything necessary to handle documents swiftly and in compliance with official standards - robust PDF editing, managing, protecting, signing, and sharing tools are all available within an intuitive interface.

You only need to perform a few steps to complete the filling out and signing of your Amc Form 140:

- Insert the editable template into the editor using the Get Form button.

- Verify what details you need to include in your Amc Form 140.

- Move between the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is crucial or Obscure irrelevant areas.

- Press Sign to create a legally enforceable electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Amc Form 140 in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our solution also provides adaptable form sharing. There's no obligation to print your templates when you need to submit them to the appropriate public office - handle it via email, fax, or by requesting a USPS delivery from your account. Give it a go today!

Create this form in 5 minutes or less

FAQs

-

How do I invest Rs.1000 a month in the Birla Sun Life Top 100 Fund SIP?

It is great that you have decided to invest through SIPs for the period of 20 years. It is an investment period that will yield you substantial long term capital gains. To start investments in Mutual Funds two things are mandatory:1. Bank account in any nationalised bank. Both public and private2. Filling out a Know Your Customer or KYC form which is a one time procedure before starting investments.How to get Mutual Funds done?1. Nationalized banks, both public and private, sell Mutual Funds as they act as distribution house for the Asset Management Companies. 2. You can invest through online investment platforms such as Myuniverse, Zipsip, ICICI Direct.3. You can get in touch with a distribution house who will help you with the investments.4. You can get in touch with a financial advisor. Both the options are easily available in Kolkata. 5. You can invest directly. Open a bank account first. Fill out a KYC form online here Mutual Funds portfolio, Forms and fact Sheets. In the investment form fill "DIRECT" as the broker code and submit it in the respective AMC office.Hope this helps!Priyanka Chakrabartywww.advisorkhoj.com

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How can I learn mutual funds investment?

Its not that complex… Here, i have written everything you need to know about Mutual funds. Read this, you can start investing without anyone’s help.Mutual fund is like fixed deposit where we deposit our money and it will give us return.There are three types of mutual funds, they are debt fund, equity fund & balanced fund.Debt fund is similar to Bank. When we invest our money in debt fund, fund house will use our money to give loans to private companies or Indian government or State government.Debt fund - Risk is low. Return is around 8%. If you withdraw money within 3 years, you need to pay tax based on your income tax slab (like 10% or 20% or 30%). If you withdraw after 3 years, you need to pay 20% tax with indexation.Indexation: 20% tax with indexation means you will be discounting inflation while paying tax. So you will be paying less tax after discounting inflation (less than 15%)Inflation: Inflation is most important factor when comes to finance. It means decrease in purchasing power of money. To give you an example, before 10 years Rs.10 is a big amount. But now??? In 10 years from now Rs.10 will be nothing. Thats the inflation, every year value of money will get reduced. Government regularly release inflation details.There are many types of debt funds like gilt, income, short term, liquid, ultra short term.Gilt fund - your money will be loaned to government. Risk is very low since borrower is Government.Income fund - you will receive monthly income. Suitable for retired people.Liquid fund - you can withdraw your money anytime without any charges. It is like savings account.Short term or Ultra short term - if you like to invest only for some months.Let me warn you, debt funds are not risk free. They too carry some risk. Sometimes company default loans (Vijay Mallya, Nirav Modi). Then there is a risk of interest rate.If like to invest with minimal risk, then open the debt fund in valueresearchonline website. There you will find the below diagram (or chart?). Good low risk debt fund should have black box in red area. The meaning is, the fund is less sensitive to interest rate change and has good credit quality.Equity fund. As the name says, your money will get invested in Share market.Equity fund is riskier than debt fund. But it gives good return like 12% to 25%. If you withdraw withing an year you need to pay short term capital gain tax of 15%. If you withdraw after 1 year and if your return is more than 1 lakh, you need to pay capital gain tax of 10%.It is recommended to hold equity mutual funds at least 5 years to see decent return.Equity mutual funds comes in many types like large cap, mid cap, small cap, sector.Large cap or Bluechip fund - your money will get invested in big companies. Risk is low and return is around 10% - 13%.Mid cap fund - your money will get invested in medium size companies. Return is more than 13%. Medium risk.Small cap fund - your money will get invested in small companies. Very risky but good return, more than 20%.Sector fund - your money will get invested in companies in specific sector. For example, Equity Infra fund means, your money will get invested in Infrastructure companies. Return varies based on sector, but it will be more than 15%.Index fund - Return is around 10%. Medium risk.What is index fund? There are many indices in India like Nifty, Sensex, Bank nifty, etc., Each index comprise of many companies with different weightage. For example, Nifty comprise of top 50 companies in NSE. If you invest your money in Nifty index fund, it is like investing in top 50 companies in NSE.ELSS - It is tax saving mutual fund. You can save tax under Section 80C. It is getting popular now. Lock in period is 3 years. Return is around 12%.Arbitrage fund - It is very very low risk equity fund. Arbitrage fund won’t get affected by markets up and down. Return is 8%. Taxing is same as equity mutual funds.Balanced or Hybrid fund. It is mix of Equity and Debt fund. (65% equity and 35% debt). Low risk. Return around 12%. Taxation is similar to equity fund.First, choose fund type based on your risk potential (like debt or equity or balanced).If you are retired person or if you don’t want to take any risks then choose Debt funds.If you like to take only small amount of risk, choose balanced fund.If you earn average income, then choose balanced fund or large cap or both.If you fall under huge income category, then mix large cap, mid cap and small cap.To choose fund, visit Funds - Value Research Online. Here are the list of things to note while choosing fund…See the fund’s performance from inception. See yearly, 3 year, 5 year and overall return.See the expense ratio. Expense ratio is the amount you are going to pay as commission. Less than 1% is better.See exit load. This is amount you need to pay when you withdraw.Value research online gives star rating for all funds. Choose funds with atleast 4 Stars.IMPORTANT NOTE: All funds comes in two plans Regular & Direct plan. Regular means you invest via Broker or Agent. Direct means you invest directly. Broker or Agents charge commission. Their commission will be around 1% per year. IT IS LOT OF MONEY. So never go with Broker or Agents.If you are new to mutual fund, you need to register KYC first. It is one time process and it is centralized. Once you get registered, you can invest in any mutual funds just by giving your PAN number. To register KYC, first select fund house (example, SBI Mutual fund or HDFC mutual fund). Find their office in your city and go and register KYC. You can also register e-KYC online, but it has some limitations. So i suggest you to visit office and do it in person.Once KYC is done, you can invest in any mutual funds. If you do KYC in SBI mutual fund, you can also invest in HDFC or ICICI mutual funds. KYC is centralized.Once KYC is done, visit mutual fund company website (like SBI mutual fund site or LT mutual fund site). Register there. Start investing. You can either invest as Lump sum. Or as SIP. SIP means you can invest small amount monthly. Money will be automatically deducted from your account.FAQ:When should i invest?If you are planning to invest via SIP you can start anytime. But if you are planning to invest as Lumpsum, there is a completely different approach. If you like to invest lumpsum in debt fund. You can invest anytime, no issues.But if you like to invest lumpsum in equity mutual fund, you need to follow different approach, since investing lumpsum in equity mutual fund is very risky. First invest your lump amount in liquid fund or ultra short term debt fund [Lets call Fund A]. These funds don’t have exit load (or withdrawing fee), so there is no charges when money gets transferred. Now, set up STP (Systematic Transfer Plan) to transfer a fixed amount monthly to an equity fund [Fund B]. For example, if you have 1 lakh lump amount, set a monthly amount to Rs.5,000. Every month, Rs.5,000 from Fund A will get transferred to Fund B. Fully automatic.Note: Never invest lump amount directly in equity mutual funds.Is there any service which helps me to invest in Mutual funds easily?There are so many apps these days which help you to invest money in mutual funds via direct plan. Like, Zerodha Coins [Not a promotion, you can try any app you want]. These apps are not free, they charge small amount monthly. You can easily set up investments from the app and also you can track the fund performance. I personally find such apps useful.I heard mutual fund is risky.Every investment is risky, whether it is real estate, gold or FD.Gold. What if someone stole or you lose is somewhere? Think how many times you heard from your friends or relatives (or happened to you) that they lost Jewels?FD. FD return is very low. If you are a tax payer and if you invest in FD, then you are LOSING MONEY because of tax and inflation. You will be losing 1% or more per year if you invest in FD. And also, what happens if bank goes bankrupt? FD is insured for Rs.1 lakh. If you have 10 lakhs in FD and bank goes bankrupt, you receive Rs.1 lakh.Real estate. Many factors affect real estate like current government, policies, economy, water issue, etc., And there is liquidity problem . You can’t buy or sell real estate fast.Like these mutual funds also carry risk. If you plan properly you can reduce the risk by investing GILT fund or Arbitrage fund. Remember, mutual fund house invest your money in companies like ICICI bank, TCS, ITC, Tata motors, etc., It is very unlikely that these companies shut down their business.Is it true that debt fund carry Zero Risk?No. As i said earlier Risk is everywhere. When compared with equity, debt fund carry low risk. Still there is some risk. Companies default their loan (remember Kingfisher?). Companies goes bankrupt.What funds are you investing?I am investing in…Aditya Birla SL Balanced '95 Direct-G (Balanced fund)IDFC Focused Equity Direct-G (Large and mid cap)L&T Emerging Businesses Direct-G (Small cap)What should i choose? Growth or Dividend or Dividend reinvestment?Growth - To unleash the power of compound interest choose Growth. It will give you massive return in long term. (Recommended)Dividend - If you want regular income from your investment, then choose Dividend. This option is recommended for retired people.Dividend reinvestment - Companies release dividend regularly. If you choose this option then fund house will buy new units of the fund with dividend money.If I choose dividend fund, do I need to pay income tax for dividend income?No, there is no income tax for dividend income.What is the minimum age required to invest in mutual fund?There is no minimum age. You can start at any age. If you are below 18, you need to provide birth certificate.What is the minimum amount needed to invest in mutual fund?You can start with as low as Rs.500.I am already investing via Regular plan. How to switch to direct plan?Visit fund company website. Register yourself and login. There will be option to Switch. While switching select Direct plan. Simple.How do I know whether I am investing in Regular plan or Direct plan?Login to your account or check your statement. See the fund name. If the name ends with Direct, it is direct plan. Or if it ends with regular it is regular plan.What should i do after investing?It takes atleast 5 years to see decent return from equity mutual funds. Bookmark the website value research online. It is popular site about mutual funds. They give star rating for all mutual funds. Good fund should have atleast 4 stars. Every once in a while check number of stars for your fund. If it goes below 3 stars, i suggest you to switch fund.I am investing in equity mutual fund. I got negative returns. Now i have less money than what i invest. What should i do?Market fluctuates. It is normal. As i said earlier, you need to wait atleast 5 years to see decent return from equity mutual funds.How to withdraw money?Login to your account. Choose redeem option. Money will be withdrawn to your bank account.How to terminate mutual fund?First redeem your money. Then you need to send post (physical, no email) to mutual fund company asking them to terminate. But it is not necessary. Just withdraw money and done with that.What happens if I fail to pay monthly instalment for SIP because of no funds in my savings account?Nothing will happen. Don't worry.How to switch funds?Case 1: Switch funds from same fund house. For example, LT Fund A to LT Fund B. Login to fund house website. Choose switch option. It is simple.Case 2: Switch funds of different fund house. For example, LT Fund A to SBI Fund A. There is no direct option for this. First you need to withdraw money from fund A and invest freshly in Fund B.How to track my mutual funds investments?If you are investing via apps like Zerodha coin, you can easily track form those apps.What are open ended and close ended mutual funds?When comes to mutual funds always go with open ended funds. Open ended fund gives better return than close ended. And also you can enter and exit open ended funds anytime.———————————————————————————————————Hope, i explained everything here. Please don’t contact me with questions which i already explained here. I won’t respond. Spend some time to read. If i missed anything, do comment here.Invest with your own risk. Market fluctuates, sometimes market crashes, companies default their loans. Anything can happen. I am just sharing knowledge.Happy investing.Ashok Ramesh.

-

How do I change KYC address details in India?

You should intimate your change of Name/Address/Status/Signature etc to any convenient PoS. You need to quote your PAN and submit proof (in case of new address). You should provide for at least 10 days for the change of address to take effect with all the Mutual Funds with whom you are invested. Please note that you should not write to the Mutual Fund or its Registrar for the change of address (unless as a designated PoS). The specified form can be obtained from the AMFI/Mutual Fund/CDSL website. All details of the holders in the Mutual Fund records will be replaced by the address details available in the CVL record.HERE IS THE FORM: https://www.cvlindia.com/include...do upvote if you find it usefull.

Create this form in 5 minutes!

How to create an eSignature for the amc form

How to generate an electronic signature for the Amc Form in the online mode

How to make an eSignature for your Amc Form in Google Chrome

How to make an electronic signature for putting it on the Amc Form in Gmail

How to generate an eSignature for the Amc Form from your smartphone

How to make an eSignature for the Amc Form on iOS

How to create an electronic signature for the Amc Form on Android OS

People also ask

-

What is the Amc Form 140 and how can it be used with airSlate SignNow?

The Amc Form 140 is an important document used in various business processes, and with airSlate SignNow, you can easily eSign and send this form securely. Our platform allows you to fill out the Amc Form 140 digitally, ensuring a streamlined process for both the sender and the recipient.

-

How much does it cost to use airSlate SignNow for the Amc Form 140?

airSlate SignNow offers various pricing plans that cater to different business needs, making it affordable to eSign documents like the Amc Form 140. You can choose a plan that suits your volume of usage, and our rates are competitive, ensuring that you get value for your investment.

-

What features does airSlate SignNow offer for managing the Amc Form 140?

With airSlate SignNow, you gain access to features such as customizable templates, real-time tracking, and secure storage, all of which enhance the handling of the Amc Form 140. These features simplify the signing process and ensure that your document management is efficient and organized.

-

Can I integrate airSlate SignNow with other software when using the Amc Form 140?

Yes, airSlate SignNow supports various integrations with popular software tools, allowing you to seamlessly manage the Amc Form 140 alongside your existing systems. This flexibility means you can streamline your workflows and enhance productivity by connecting your favorite applications.

-

Is it safe to eSign the Amc Form 140 using airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security and compliance, making it safe to eSign the Amc Form 140. Our platform employs advanced encryption and follows industry standards to protect your sensitive information at all times.

-

How can I track the status of my Amc Form 140 once sent through airSlate SignNow?

You can easily track the status of your Amc Form 140 document after sending it through airSlate SignNow. Our platform provides real-time updates, so you can see when the document is viewed, signed, or completed, giving you peace of mind throughout the process.

-

What are the benefits of using airSlate SignNow for the Amc Form 140 in my business?

Using airSlate SignNow for the Amc Form 140 offers numerous benefits, including increased efficiency, reduced turnaround time, and cost savings on paper and printing. By digitizing your document processes, you can focus more on your core business activities and less on administrative tasks.

Get more for Amc Form 140

Find out other Amc Form 140

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form