Form 763 S

What is the Form 763 S

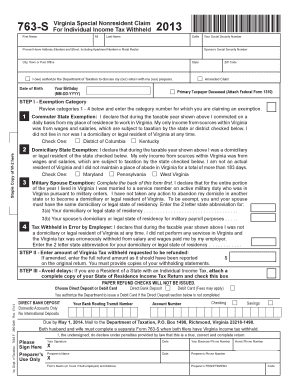

The Form 763 S is a specific document used primarily in tax-related processes within the United States. This form is designed to facilitate the reporting of certain financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to understand the purpose of this form, as it plays a crucial role in compliance with federal tax regulations. The information provided on the Form 763 S helps the IRS assess tax liabilities accurately and ensures that taxpayers fulfill their obligations appropriately.

How to use the Form 763 S

Using the Form 763 S involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents and records that pertain to the information required on the form. This may include income statements, expense reports, and any relevant tax documents. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors or omissions before submitting it to the IRS. Proper use of the Form 763 S can help prevent delays in processing and potential penalties.

Steps to complete the Form 763 S

Completing the Form 763 S involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documentation.

- Read the instructions provided with the form carefully.

- Fill in personal identification information, including your name and Social Security number.

- Report all income and deductions as required by the form.

- Double-check all entries for accuracy.

- Sign and date the form to certify the information provided.

- Submit the form to the IRS via the appropriate method (online, mail, or in person).

Legal use of the Form 763 S

The legal use of the Form 763 S is governed by IRS regulations and guidelines. To be considered valid, the form must be completed accurately and submitted in accordance with the established deadlines. Failure to comply with these requirements can lead to penalties or legal repercussions. It is important to maintain thorough records of the information submitted on the form, as this may be required for future reference or audits. Understanding the legal implications of using the Form 763 S is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Form 763 S are crucial for compliance with tax regulations. Generally, the form must be submitted by the tax filing deadline for the year in which the income was earned. For most taxpayers, this date falls on April fifteenth. However, specific circumstances, such as extensions or special filing statuses, may alter these deadlines. It is advisable to stay informed about any changes to filing dates and to plan accordingly to avoid late submissions and potential penalties.

Required Documents

To complete the Form 763 S accurately, certain documents are required. These may include:

- Previous tax returns for reference.

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Any other relevant financial statements.

Having these documents on hand will streamline the completion process and help ensure that all necessary information is included.

Quick guide on how to complete form 763 s

Complete Form 763 S effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage Form 763 S on any platform using the airSlate SignNow Android or iOS applications and streamline any document-oriented task today.

The easiest way to modify and electronically sign Form 763 S without stress

- Obtain Form 763 S and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and electronically sign Form 763 S and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 763 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 763s and how do they work with airSlate SignNow?

763s are a unique identifier system used within airSlate SignNow to streamline document management. They help track and organize documents efficiently, ensuring that users can access their eSigned documents quickly and easily.

-

How much does it cost to use airSlate SignNow for 763s?

Pricing for using airSlate SignNow starts at a competitive rate tailored for businesses of all sizes. For those looking to utilize 763s, airSlate SignNow offers flexible subscription plans that include various features designed to enhance document workflows.

-

What features are included in the airSlate SignNow 763s integration?

The 763s integration with airSlate SignNow includes features such as document templates, automated workflows, and secure storage. These tools enhance productivity while ensuring that all signed documents are organized and easily retrievable.

-

Can I integrate 763s with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing the functionality of 763s. This means you can connect your favorite tools for better efficiency and collaboration across your document workflow.

-

What are the benefits of using airSlate SignNow for managing 763s?

Using airSlate SignNow for managing 763s simplifies the process of eSigning and tracking documents. The platform is user-friendly and helps ensure compliance, thus reducing the risks associated with document management.

-

Is airSlate SignNow secure for handling sensitive documents identified by 763s?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect all documents, including those identified by 763s. This ensures that sensitive information remains confidential and secure at all times.

-

How can airSlate SignNow help improve my team's workflow with 763s?

airSlate SignNow streamlines team workflows by utilizing 763s for easier document sharing and tracking. This reduces response times and enhances collaboration, allowing teams to focus on what matters most instead of administrative tasks.

Get more for Form 763 S

- 1 866 4 uswage www wagehour dol gov united states dol form

- Organic chemistry 7e bruice chapter 4 isomers the konkuk ac form

- Georgetown teacher recommendations form

- Instructions for additional branch pest control field form

- Booster club membership form 255058746

- Indoor volleyball team roster and waiver form

- Joyce hudman texas state directory online form

- Travis county water control ampamp improvement district 173812 eck lane form

Find out other Form 763 S

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself