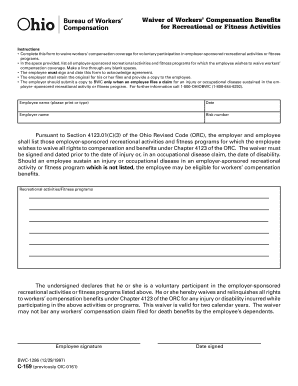

Waiver of Workers Compensation Form

What is the Waiver of Workers Compensation?

The Waiver of Workers Compensation is a legal document that allows certain business owners and self-employed individuals to opt out of mandatory workers' compensation insurance coverage in California. This exemption is primarily applicable to sole proprietors, partners, and certain corporate officers who meet specific criteria. By filing this waiver, individuals can avoid the costs associated with workers' compensation premiums while still being responsible for their own safety and health in the workplace.

How to Use the Waiver of Workers Compensation

To effectively use the Waiver of Workers Compensation, individuals must first determine their eligibility based on their business structure and role within the company. Once eligibility is confirmed, the individual can complete the waiver form, ensuring that all required information is accurately provided. After filling out the form, it should be submitted to the appropriate state agency, typically the California Department of Industrial Relations, to formalize the exemption.

Steps to Complete the Waiver of Workers Compensation

Completing the Waiver of Workers Compensation involves several key steps:

- Determine eligibility based on your business type and role.

- Obtain the Waiver of Workers Compensation form from the California Department of Industrial Relations.

- Fill out the form with accurate and complete information.

- Sign and date the form to validate your request.

- Submit the completed form to the appropriate state agency.

Key Elements of the Waiver of Workers Compensation

Several important elements must be included in the Waiver of Workers Compensation form:

- Name and contact information of the applicant.

- Business name and structure (e.g., sole proprietorship, partnership).

- Details regarding the applicant's role within the business.

- Signature of the applicant to confirm understanding and acceptance of the waiver.

Eligibility Criteria

Eligibility for the Waiver of Workers Compensation is determined by specific criteria set by California law. Generally, individuals who can apply include:

- Sole proprietors who do not have employees.

- Partners in a partnership.

- Corporate officers who hold a specific percentage of ownership in the corporation.

Form Submission Methods

The Waiver of Workers Compensation can be submitted through various methods, including:

- Online submission via the California Department of Industrial Relations website.

- Mailing the completed form to the appropriate state office.

- In-person delivery at designated state agency locations.

Quick guide on how to complete waiver of workers compensation

Effortlessly Prepare Waiver Of Workers Compensation on Any Device

Managing documents online has become increasingly popular among enterprises and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delay. Manage Waiver Of Workers Compensation on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Waiver Of Workers Compensation with Ease

- Locate Waiver Of Workers Compensation and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Waiver Of Workers Compensation and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the waiver of workers compensation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Is workers compensation required in Utah?

With few exceptions, Utah employers are required to maintain workers' compensation insurance coverage. Coverage is available from a large number of insurance companies.

-

Who is exempt from workers compensation in Utah?

Sole Proprietorships with no employee other than the owner. Partnerships with no employees other than the partners. Limited Liability Companies are treated as Partnerships and, as such, the members of an LLC may be eligible for a waiver. Director and/or officers of a corporation.

-

Who is exempt from workers' comp in Utah?

Sole Proprietorships with no employee other than the owner. Partnerships with no employees other than the partners. Limited Liability Companies are treated as Partnerships and, as such, the members of an LLC may be eligible for a waiver. Director and/or officers of a corporation.

-

What are compensation exceptions?

These exceptions include Dual Capacity, Fraudulent Concealment, Employer Assault or Ratification, Power Press, and Uninsured Employer. The civil suit can be concurrently maintained with a workers' compensation action in all of these circumstances.

-

Does a single member LLC need workers' comp in Utah?

In Utah, all businesses with employees must have workers compensation insurance to cover work-related injuries or illnesses. Sole proprietors, partners, and certain LLC members can opt out for themselves but must cover their employees.

-

Who is exempt from workers compensation in CA?

While workers' compensation is rather comprehensive, some individuals are exempt from workers' comp in California. Under California Labor Code, Division 4, Part 1, Chapter 2, Section 3352, these workers include the following: Sole Proprietors and business owners (excluding roofers) Business owners.

-

What is the penalty for not having workers' comp in Utah?

If an employer fails to maintain workers compensation coverage, the consequences can be severe. They include: Penalties of at least $1,000; Injunctions prohibiting continued business operations; and.

-

Who is exempt from Texas workers compensation?

In conclusion, not all individuals are required to have workers' compensation coverage in Texas. Business owners without employees, including independent contractors, sole proprietors, business partners, and LLC members in a firm with no employees, are typically exempt from workers' compensation requirements.

Get more for Waiver Of Workers Compensation

- Statement of home care services form for comprehensive home care providers health state mn

- Hoya safety glasses order form

- Baseline data collection sheet form

- Arion care solutions llc individual client billing document form

- Form 147 250642

- Va form 21 526

- Hqt secondary teacher form montana office of public instruction opi mt

- Mail to wdfw licensing division po box 43154 olympia wa 98504 form

Find out other Waiver Of Workers Compensation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors