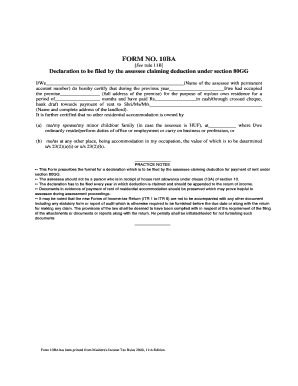

Form 10 Ba

What is the Form 10 Ba

The Form 10 Ba is a specific document used in the context of income tax in the United States. It serves as a means for taxpayers to report certain financial information to the Internal Revenue Service (IRS). This form is particularly relevant for individuals and businesses that need to disclose specific income or deductions that may not be covered in standard tax forms. Understanding the purpose and requirements of the Form 10 Ba is crucial for accurate tax reporting and compliance.

How to use the Form 10 Ba

Using the Form 10 Ba involves several steps to ensure that all required information is accurately reported. Taxpayers should first gather all necessary financial documents, such as income statements and deduction records. Once the information is compiled, the form can be completed by entering the relevant data in the designated fields. It is important to review the form for accuracy before submission, as errors can lead to delays in processing or potential penalties.

Steps to complete the Form 10 Ba

Completing the Form 10 Ba involves a systematic approach:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Download or access the Form 10 Ba in the appropriate format, such as PDF or Word.

- Fill in the required fields with accurate information, ensuring all entries are legible and complete.

- Review the completed form for any errors or omissions.

- Sign and date the form, if required.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form 10 Ba

The legal use of the Form 10 Ba is governed by IRS regulations. It is essential for taxpayers to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions. The form must be used in accordance with applicable tax laws, and any misrepresentation of information can lead to penalties or audits. Understanding the legal framework surrounding the Form 10 Ba helps ensure compliance and protects taxpayers' rights.

Key elements of the Form 10 Ba

Several key elements are essential when filling out the Form 10 Ba:

- Identification Information: This includes the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Income Reporting: Detailed entries for various types of income must be provided, including wages, dividends, and other sources.

- Deductions: Taxpayers must list any deductions they are claiming, which can reduce their taxable income.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate its authenticity.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10 Ba are critical for compliance. Typically, the IRS sets specific dates for when the form must be submitted, which may vary based on the taxpayer's circumstances. It is advisable to check the IRS website or consult a tax professional for the most current deadlines. Missing these deadlines can result in penalties or interest on unpaid taxes, underscoring the importance of timely submission.

Quick guide on how to complete form 10 ba

Prepare Form 10 Ba effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without interruptions. Manage Form 10 Ba on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 10 Ba without effort

- Find Form 10 Ba and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from your chosen device. Modify and eSign Form 10 Ba to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10 ba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 10ba of income tax?

Form 10BA of income tax is a tax form used in India for claiming a tax deduction on donations made to charitable organizations. This form is crucial for individuals and businesses wanting to manage their taxable income efficiently and maximize their deductions.

-

How can airSlate SignNow help with form 10ba of income tax?

airSlate SignNow provides a seamless way to electronically sign and manage the documents required for filing form 10BA of income tax. With intuitive features and templates, users can expedite their document processes, ensuring they meet compliance requirements without hassle.

-

What features does airSlate SignNow offer for handling income tax forms?

airSlate SignNow offers features like eSigning, document templates, and audit trails that are particularly beneficial for managing income tax forms such as form 10BA. These functionalities streamline the entire filing process and improve efficiency for businesses and individuals alike.

-

Is airSlate SignNow cost-effective for small businesses filing form 10ba of income tax?

Yes, airSlate SignNow is a cost-effective solution that allows small businesses to easily manage their document signing needs, including filing form 10BA of income tax. Our affordable pricing plans ensure that every business, regardless of size, can benefit from our services without overspending.

-

Can I integrate airSlate SignNow with other accounting software for form 10ba of income tax?

Absolutely! airSlate SignNow offers integrations with leading accounting and tax preparation software, making it easy to manage form 10BA of income tax alongside your other financial documents. This integration ensures a cohesive workflow and improved accuracy in your tax filing processes.

-

What are the security measures for documents related to form 10ba of income tax?

airSlate SignNow takes document security seriously, employing bank-level encryption and secure cloud storage for all documents, including those related to form 10BA of income tax. Users can feel confident that their sensitive information will remain safe and confidential throughout the entire signing process.

-

How long does it take to complete form 10ba of income tax with airSlate SignNow?

With airSlate SignNow, completing form 10BA of income tax can be done quickly, often within minutes. The streamlined eSigning process and available templates signNowly reduce the time required to gather signatures and finalize documents.

Get more for Form 10 Ba

- Estado libre asociado de puerto rico solicitud de permiso de construccion administracin de reglamentos y permisos nmerofecha de form

- Form vs 9 application for burial expenses

- Referral form special education and related services shastacoe

- Form 11vehicle inspection checklist courtesy safe work sa

- Omes form 3 notarized claim form ok

- Homophone poems form

- Special transitory food unit ampamp mobile food establishment form

- Taxicab limousine operating permit application mbs form

Find out other Form 10 Ba

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself