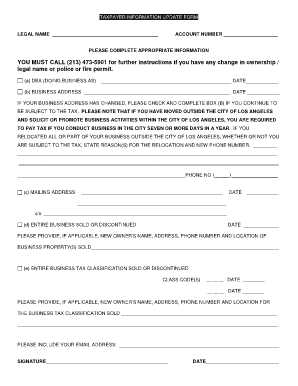

Taxpayer Information Update Form

What is the Taxpayer Information Update Form

The taxpayer information update form is an essential document used by individuals and businesses to update their personal or business information with the relevant tax authorities. This form is particularly important for maintaining accurate records, ensuring that tax notifications and communications are sent to the correct address. It may include information such as name changes, address updates, and changes in business structure. In the United States, this form is often required by local tax offices, such as the city of Los Angeles office of finance, to keep taxpayer records current and compliant with local regulations.

How to use the Taxpayer Information Update Form

Using the taxpayer information update form involves several straightforward steps. First, individuals or business representatives should obtain the form from the appropriate tax authority's website or office. Once in possession of the form, users should carefully fill out all required fields, ensuring that the information provided is accurate and up to date. After completing the form, it can be submitted according to the guidelines provided by the tax authority, which may include options for online submission, mailing, or in-person delivery. Utilizing electronic signature solutions can streamline this process, making it easier to sign and submit the form securely.

Steps to complete the Taxpayer Information Update Form

Completing the taxpayer information update form involves a series of clear steps:

- Obtain the form from the relevant tax authority.

- Read the instructions carefully to understand the requirements.

- Fill in your current and updated information accurately.

- Review the form for any errors or omissions.

- Sign the form electronically or manually, as required.

- Submit the completed form through the designated method.

Following these steps ensures that the update process is smooth and compliant with tax regulations.

Legal use of the Taxpayer Information Update Form

The taxpayer information update form is legally binding when completed and submitted according to the established guidelines. In the United States, electronic signatures are recognized under the ESIGN and UETA acts, provided that the signing process meets specific criteria. This includes the use of a secure platform for signing, which can provide an electronic certificate to verify the identity of the signer. It is crucial to ensure compliance with all legal requirements to avoid any issues with the validity of the submitted form.

Required Documents

When filling out the taxpayer information update form, certain documents may be required to support the information provided. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Documentation of any name changes, such as a marriage certificate or court order.

- Business registration documents, if applicable.

Having these documents ready can facilitate a smoother update process and help ensure that all information is verified correctly.

Form Submission Methods

The taxpayer information update form can typically be submitted through various methods, depending on the regulations of the local tax authority. Common submission methods include:

- Online submission via the tax authority's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices.

Choosing the appropriate method can depend on personal preference and the urgency of the update.

Quick guide on how to complete taxpayer information update form 100121685

Complete Taxpayer Information Update Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Taxpayer Information Update Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Taxpayer Information Update Form without any hassle

- Locate Taxpayer Information Update Form and click Get Form to begin.

- Use the tools we provide to submit your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose how you want to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Taxpayer Information Update Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer information update form 100121685

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxpayer information update form and how does it work?

A taxpayer information update form is a document that allows individuals or entities to update their taxpayer information with relevant authorities. airSlate SignNow simplifies this process by enabling users to create, send, and eSign the form easily, ensuring that your updated information is submitted accurately and securely.

-

How can airSlate SignNow help me manage my taxpayer information update forms?

airSlate SignNow provides a user-friendly platform to handle taxpayer information update forms efficiently. You can easily create customized forms, share them with your clients or employees, and collect signatures electronically, streamlining your workflow while reducing paperwork.

-

Is there a cost associated with using the taxpayer information update form feature?

Yes, airSlate SignNow operates on a subscription model with various pricing plans to suit different business needs. Each plan includes access to features for managing taxpayer information update forms, ensuring that you can choose the right option based on your usage and budget.

-

Are there any integrations available with the taxpayer information update form in airSlate SignNow?

Absolutely! airSlate SignNow offers a range of integrations with popular applications such as Google Drive, Salesforce, and more. This allows you to seamlessly incorporate taxpayer information update forms into your existing workflows and manage your documentation effortlessly.

-

What are the benefits of using airSlate SignNow for taxpayer information update forms?

Using airSlate SignNow for taxpayer information update forms offers multiple benefits, including enhanced security, faster processing times, and reduced paper usage. The easy eSigning feature also means you can get approvals quickly, helping you stay compliant and organized in managing your taxpayer information.

-

Can I customize my taxpayer information update form with airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your taxpayer information update form to meet your specific needs. You can add fields, change the layout, and incorporate your branding to create a professional document that aligns with your company’s standards and enhances user experience.

-

Is it easy to track the status of taxpayer information update forms sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of taxpayer information update forms in real-time. You can see when a form has been viewed, signed, or is still pending, making it easier to follow up with recipients and keep your documentation up to date.

Get more for Taxpayer Information Update Form

- Credit card payment slip us hang gliding and paragliding ushpa form

- Pos perkins statewide articulation agreement documentation coversheet student name secondary school name secondary school form

- Request for authorization for rescheduled training form

- Ewr form pdf

- Sanction renewal american contract bridge league web2 acbl form

- Massage medical history form

- What is an s parte notice form

- Vendor service agreement template form

Find out other Taxpayer Information Update Form

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template