Authorization to Release Payoff Information

What is the Authorization to Release Payoff Information

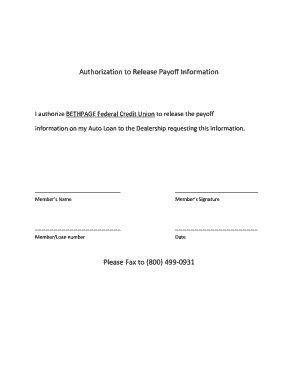

The authorization to release payoff information is a formal document that allows a lender or financial institution to share details regarding a loan payoff with a designated third party. This document is crucial when a borrower is looking to sell or refinance a vehicle, as it provides the necessary information about the outstanding balance on the loan. By granting this authorization, the borrower ensures that the third party, such as a potential buyer or another lender, can obtain accurate and timely information about the loan status.

How to Use the Authorization to Release Payoff Information

Using the authorization to release payoff information involves several straightforward steps. First, the borrower must complete the authorization form, providing essential details such as their name, contact information, and loan account number. Next, the borrower should specify the third party authorized to receive the payoff information. Once the form is completed, it should be signed and dated to validate the authorization. The borrower can then submit the form to their lender, either electronically or via traditional mail, depending on the lender's requirements.

Steps to Complete the Authorization to Release Payoff Information

Completing the authorization to release payoff information requires careful attention to detail. Here are the steps to follow:

- Obtain the authorization form from your lender or financial institution.

- Fill in your personal information, including your name, address, and contact details.

- Provide the loan account number and any other relevant details required by the lender.

- Identify the third party who will receive the payoff information, including their name and contact details.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your lender through the preferred method (online, mail, or in-person).

Key Elements of the Authorization to Release Payoff Information

Several key elements must be included in the authorization to release payoff information to ensure its effectiveness:

- Borrower Information: Full name, address, and contact number.

- Loan Details: Loan account number and type of loan.

- Third Party Information: Name and contact details of the individual or organization authorized to receive the information.

- Signature: The borrower's signature and the date of signing.

Legal Use of the Authorization to Release Payoff Information

The authorization to release payoff information is a legally binding document that complies with various regulations governing privacy and data sharing. By signing this authorization, the borrower grants permission for their lender to disclose sensitive financial information to a third party. It is essential to ensure that the document is completed accurately and submitted according to the lender's guidelines to maintain its legal standing.

Examples of Using the Authorization to Release Payoff Information

There are several scenarios in which the authorization to release payoff information is commonly used:

- Vehicle Sale: When a borrower sells their vehicle, the buyer may request payoff information to confirm the outstanding loan balance.

- Refinancing: A borrower seeking to refinance their auto loan may need to provide authorization for the new lender to obtain payoff details from the original lender.

- Loan Transfer: If a borrower transfers their loan to another financial institution, the new lender may require this authorization to facilitate the transfer process.

Quick guide on how to complete authorization to release payoff information

Complete Authorization To Release Payoff Information effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Authorization To Release Payoff Information on any platform using airSlate SignNow Android or iOS applications and ease any document-related process today.

The easiest way to edit and electronically sign Authorization To Release Payoff Information with ease

- Find Authorization To Release Payoff Information and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Authorization To Release Payoff Information and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization to release payoff information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payoff letter for car?

A payoff letter for a car is an official document from a lender that details the total amount needed to pay off your auto loan. This letter is crucial when selling or refinancing your vehicle, as it ensures you and any buyers are aware of the remaining balance. With airSlate SignNow, you can easily request and receive your payoff letter for car electronically, streamlining the process.

-

How do I obtain a payoff letter for my car?

You can obtain a payoff letter for your car by contacting your lender directly or accessing their online portal. Many lenders allow you to request a payoff letter electronically, which can be signed and returned through airSlate SignNow. This not only saves time but also ensures that your payoff letter for car is easily accessible and secure.

-

Can I sign my payoff letter for car electronically?

Yes, you can sign your payoff letter for car electronically using airSlate SignNow. Our platform offers a simple and secure way to eSign documents, making it convenient for you to finalize your paperwork without the hassle of printing and scanning. This feature speeds up transactions, making processes smoother for all involved.

-

How much does it cost to use airSlate SignNow for a payoff letter for car?

airSlate SignNow offers flexible pricing plans, making it a cost-effective solution for obtaining and signing your payoff letter for car. Our subscription models cater to different business needs, ensuring you only pay for the features you require. Additionally, our free trial allows you to explore all functionalities before committing.

-

What features does airSlate SignNow offer for managing a payoff letter for car?

airSlate SignNow provides several features to manage your payoff letter for car effectively, including secure eSignature capabilities, document storage, and easy sharing options. You can track the status of your documents in real-time, ensuring you're always updated on the transaction. Our user-friendly interface makes document management straightforward and efficient.

-

Is airSlate SignNow compliant with legal standards for a payoff letter for car?

Yes, airSlate SignNow adheres to all legal standards and regulations for electronic signatures, making it compliant for your payoff letter for car. Our platform employs bank-level security measures to protect your information, ensuring that your transactions are safe and legally binding. Trust in our solution for all your document signing needs.

-

Can I integrate airSlate SignNow with other applications for my payoff letter for car?

Absolutely! airSlate SignNow offers various integrations with popular applications, making it easy to manage your payoff letter for car alongside your existing workflows. Whether using CRM systems or cloud storage solutions, our platform enhances productivity by seamlessly connecting with your daily tools. This flexibility aids in efficient document handling.

Get more for Authorization To Release Payoff Information

- Wilson 5x5 drill form

- Gbhc080x form

- Parade entry form town of duncan arizona townofduncan

- Personal property tax waiver application bob boyer form

- Private payment agreement template form

- Private personal loan agreement template form

- Private placement agreement template form

- Private purchase agreement template form

Find out other Authorization To Release Payoff Information

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online