Verification of Mortgage Payment Form 1998-2026

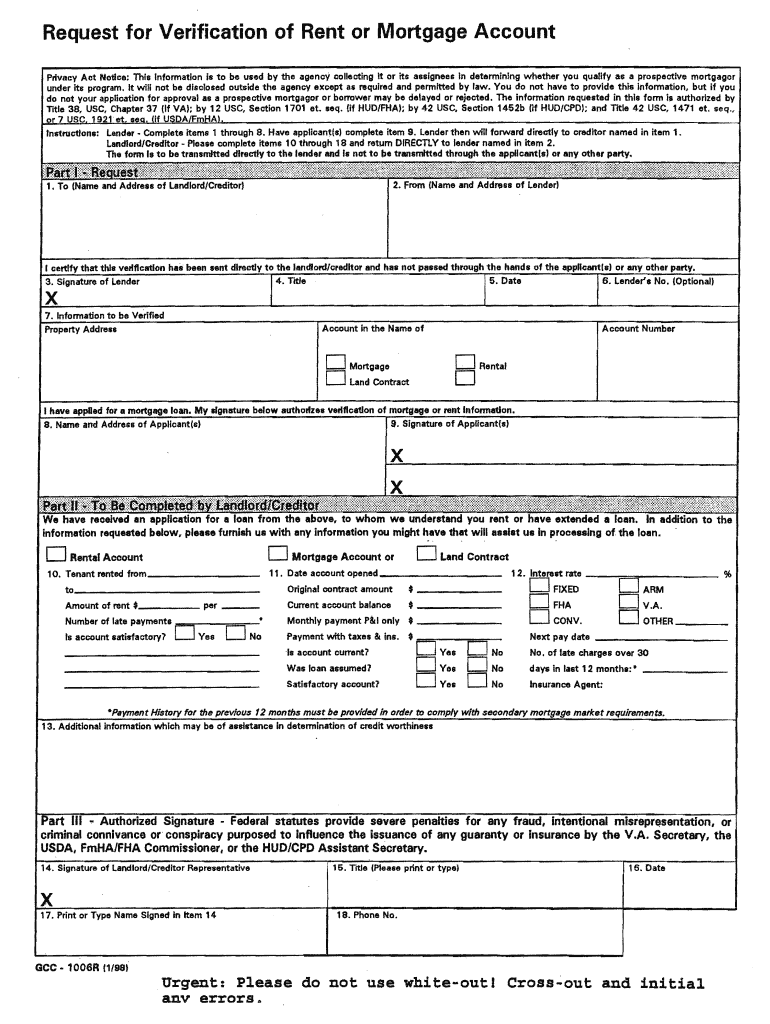

What is the verification of mortgage payment form?

The verification of mortgage payment form is a document used to confirm the accuracy of mortgage payment information. This form is typically requested by lenders to verify a borrower's mortgage payment history and current status. It serves as an essential tool in the mortgage application process, allowing lenders to assess the financial reliability of applicants. The form includes details such as the mortgage account number, payment history, and the current balance owed. It is crucial for ensuring that all parties involved have a clear understanding of the borrower's mortgage obligations.

How to use the verification of mortgage payment form

Using the verification of mortgage payment form involves several straightforward steps. First, the borrower must request the form from their lender or mortgage servicer. Once received, the borrower fills out the necessary information, including personal details and mortgage account specifics. After completing the form, it should be submitted back to the lender for processing. The lender will then verify the information and return the completed form to the borrower or directly to the requesting party, such as a new lender or financial institution.

Steps to complete the verification of mortgage payment form

Completing the verification of mortgage payment form requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the form from your lender or mortgage servicer.

- Fill in your personal information, including your name, address, and contact details.

- Provide your mortgage account number and any other required identifiers.

- Detail your payment history, including dates and amounts of payments made.

- Sign and date the form to authorize the verification process.

- Submit the completed form to your lender for verification.

Legal use of the verification of mortgage payment form

The verification of mortgage payment form is legally recognized as a valid document in the mortgage process. It must be completed accurately and honestly to ensure compliance with legal standards. Lenders rely on this form to make informed decisions regarding loan applications, and any discrepancies or inaccuracies can lead to legal implications for the borrower. It is essential to understand that providing false information on this form can result in serious consequences, including potential fraud charges.

Key elements of the verification of mortgage payment form

Several key elements must be included in the verification of mortgage payment form to ensure its effectiveness. These elements typically include:

- Borrower's full name and contact information.

- Mortgage account number and property address.

- Payment history, including dates and amounts of payments made.

- Current balance and status of the mortgage.

- Signature of the borrower authorizing the verification.

Examples of using the verification of mortgage payment form

There are various scenarios in which the verification of mortgage payment form is utilized. For instance, when applying for a new mortgage, lenders often require this form to assess the applicant's financial history. Additionally, when refinancing an existing mortgage, the new lender may request this verification to confirm the borrower's payment reliability. It can also be used when a borrower is seeking to consolidate debts or apply for a home equity line of credit, as it provides essential insights into the borrower's current mortgage obligations.

Quick guide on how to complete request for verification of rent or mortgage form 100116822

The optimal method for locating and signing Verification Of Mortgage Payment Form

On a corporate scale, inefficient workflows involving paper approvals can consume signNow amounts of labor hours. Executing paperwork like Verification Of Mortgage Payment Form is a routine aspect of operations across various sectors, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the company’s overall success. With airSlate SignNow, signing your Verification Of Mortgage Payment Form is incredibly straightforward and quick. This platform provides you with the most up-to-date version of virtually any document. Even better, you can sign it instantly without needing to install additional software on your device or print any hard copies.

Steps to acquire and sign your Verification Of Mortgage Payment Form

- Browse our collection by category or utilize the search bar to find the document you require.

- Click Learn more to view the form preview and confirm it is the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and input any necessary information using the toolbar.

- Once complete, click the Sign feature to sign your Verification Of Mortgage Payment Form.

- Choose the most convenient signing method: Draw, Generate initials, or upload a picture of your handwritten signature.

- Select Done to complete editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your documentation efficiently. You can search for, fill out, modify, and even send your Verification Of Mortgage Payment Form in one tab without any difficulty. Enhance your processes by utilizing a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Is it ultimately better to rent or own a home?

It’s Financial Suicide To Own A HouseI am sick of me writing about this. Do you ever get sick of yourself? I am sick of me.But every day I see more propaganda about the American Dream of owning the home.I see codewords a $15 trillion dollar industry uses to hypnotize its religious adherents to BELIEVE.Lay down your money, your hard work, your lives and loves and debt, and BELIEVE!But I will qualify: if s1omeone wants to own a home, own one. There should never be a judgment. I’m the last to judge. I’ve owned two homes. And lost two homes.If were to write an autobiography called: “My life – 10 Miserable moments” owning a home would be two of them.I will never write that book, though, because I have too many moments of pleasure. I focus on those.But I will tell you the reasons I will never own a home again.Maybe some of you have read this before from me. I will try to add. Or, even better, be more concise.IT’S NOT AN INVESTMENTEveryone has a story. And we love our stories. We see life around us through the prism of story.So here’s a story. Mom and Dad bought a house, say in 1965, for $30,000. They sold it in 2005 for $1.5 million and retired.That’s a nice story. I like it. It didn’t happen to my mom and dad. The exact opposite happened. But…for some moms I hope it went like that.Maybe Mom and Dad had their troubles, their health issues, their marriage issues. Maybe they both loved someone else but they loved their home.Here’s a fact: The average house has gone up 0.2% per year for the past century.Only in small periods have housing prices really jumped and usually right after, they would fall again.The best investor in the world, Warren Buffett, is not good enough to invest in real estate. He even laughs and says he’s lost money on every real estate decision he’s made. He’s a liar also. So I don’t know. But that’s what he says.There’s about $15 trillion in mortgage debt in the United States. This is the ENTIRE way banks make money.They want you to take on debt. Else they go out of business and many people lose their jobs.So they say, and the real estate agents say, and the furniture warehouses say, and your neighbors say, “it’s the American Dream”.But does a country dream? Do all 320 million of us have the same dream?What could we do as a society if we had our $15 trillion back? If maybe banks loaned money to help people build businesses and make new discoveries and hire people.HOUSING IS NOT AN INVESTMENT, PART IILet me tell you the qualities of a good investment good investment:It’s not the bulk of your net worth. Good investments are usually part of a diversified set of investments you make in your life, including the investment you make in yourself (acquiring more skills, having more experiences, etc).It doesn’t require heavy debt. (see above, i.e. $15,000,000,000,000)You can get your money back when you need it.From hard experience I know when I needed money most, it’s exactly at those moments I can’t get it. The house can’t get sold.And the bank that was so friendly lending the money, starts calling within 12 hours of not getting their check. And then starts suing me.Usually when I make an investment, I’m not the one getting sued. Except when I buy a house.ISN’T RENTING LIKE THROWING MONEY DOWN THE TOILET?No, renting is like “making money”. And I will tell you how.Let’s say you want to buy a $500,000 house at a 6% mortgage.You put $200,000 down.The entire house would rent for about $2500, give or take. So that’s 80 months or almost eight years worth of rent you just gave to the bank in a single check.Do you ever get that bank money back?No, because after mortgage debt (most of which cannot be written off in taxes), property maintenance, and taxes (which go up with inflation and are almost never considered in the price of the house), closing costs, buying costs, title insurance, property upgrades, etc. the homeowner might spend close to $1,000,000 in the lifespan of the house. Or twice that.So instead of writing that $200,000 check in one day (as opposed to spreading rent out over eight years and the landlord is in charge of all maintenance, taxes, etc so you don’t have to deal with it), you could invest in yourself.Can you get more than 0.2% a year investing in yourself?I hope so. Simple example: If you take two or three courses in a month on WordPress development, you can take freelance jobs making $5000 a month.I know 14 year olds doing that. Illustration, ghostwriting, 3D rendering, are other skills you can learn. And many more. There are 1000 ways to make more.How much do those courses cost? Often nothing. But definitely less than a mortgage.Every investment in the world is judged by its SAFETY VERSUS ALTERNATIVES. A house investment is not safe versus the alternatives.HOUSE OWNER: IT’S GOOD TO HAVE ROOTSThe average house owner, owns their house for 4.5 years. Some own for much longer, some own for less. That’s just an average.4.5 years is not “roots”.Why do people move? Because jobs are no longer as stable as they once were.And they are no longer in one or two cities but all over the country or world.So the original reasons for owning a house (a guaranteed easy commute into an urban area where the jobs are) are no longer valid, as demonstrated by the increasingly short lifespan of house ownership.This is a trend that is continuing forever.OPPORTUNITY COSTThe other day my sink broke. How come? Because hair falls out in the shower, stuff gets put in the toilet that shouldn’t go there, food gets caught in the pipes, and a million other things.My house is 150 years old. It used to be a hotel. Things break. Pipes crumble in the hands of the plumber.I email the landlord, who calls a plumber, who gets new pipes that are paid for by the landlord. The landlord wasn’t expecting it but that’s what they signed up for.Meanwhile, I read a book on the couch in the other room.The same thing when Hurricane Sandy came over the river. People were canoeing in the street outside my house. The water filled two feet in my house.“This is the first time in 100 years the water got this high,” the landlord told me. So he ripped up floors, cleaned out mold, fixed furniture, and took care of it.This time I was upstairs reading a book.FLEXIBILITYSome people like to know where they will be in 30 years. They feel comfort in that.When you rent, you never know if you will be kicked out eventually or if the house will get sold and you have to move.So there is no judging here. But I like flexibility in my life. I like to know I can move. And in my area, so many houses are for sale, I always know I can find a good place to rent.And with so many houses for sale, I know those people are stuck while I am not.Will it always be that way? No. Things cycle. But America has a tendency to overbuild. And then people overbuy. And then rentals are available.I always look at rentals. Right now there are better houses for less rent available within a mile of my house. But I like my landlord and house and I don’t blow a good thing if I have it.I live right on the river and can watch the leaves turn green and in the summer there are giant parties in the park next to my house.And on Sunday nights they show movies outside next door and the whole town shows up. I watched “Bladerunner”.But I still want the ability to pick up and move at a moment’s notice if I want to. Freedom makes me happy.PROPERTY RIGHTS ARE THE BASIS OF AMERICAMany people like to own real estate because of the word “real”. It feels more real than money.Or stocks. Or bonds.I get that. It is real. And in America, nobody can take your land from you if you own it.But not many people own their land. The bank owns it. Hence the $15 trillion in debt.And people will never own it (the 4.5 year average thing).But this is a judgment call again.I like to know I can live out of a single bag. I’ve been doing that all my life.When I moved to NYC I lived out of a garbage bag. Before I got married I lived in a dive hotel. After I got divorced I lived in the same hotel.I like feeling like I could lose everything and survive. Maybe this is why I have lost everything sometimes. But it’s also how I keep surviving and learning more each time.This will sound corny so please skip to the next part: but property rights are not real.Loving who you are and where you are and what you are doing is the only thing that is real.Live in your heart and not your home and you will never feel lonely or the need to establish roots.Share that love with the people around you. And then, they also, will feel less need for roots.That is the best investment. That is the best return on investment. That is the best home to live in.The America Dream has us chained us to the land so they can feed us like pigs in a trough with debt, with factory/cubicle jobs that we can’t escape because it’s so hard to move (until they kick us out with 2 weeks severance), with forced friends in our neighbors, with supposed roots for our kids even though the statistics show those roots are a lie.Freedom is more important than a dream.—Everyone has the story. They have bought and sold three houses and made money on each of them.I believe them. Perhaps many people are phenomenal investors.Others live in a good, secure neighborhoods that they want their kids to grow up in.I believe those people also. But I’ve also seen the pain they’ve gone through when jobs were not as stable as they thought or marriages are not as stable as they thought and that mortgage would’ve been nice in their hands instead of in the bank’s hands.We need a little bit of breathing room in order to survive when the noose is put around our neck.WHAT DO I DO THEN?You can rent. Just like some houses are bad and some are good, some landlords are better than others. Like anything that is an important life decision, it takes research.You can find roots with a good landlord. You can even paint the house and knock down walls and do whatever you want.If you believe in housing as an investment, there are companies that just own houses that you can invest in on the stock market.So you get all the benefits of a long-term investment in housing and get your cash out in five seconds if you need it.But what should you do with all of that extra cash you have if you don’t own a house?Maybe nothing. Having cash is a nice thing. It reduces stress.But also you can invest in yourself. Or companies that are growing.If companies aren’t growing, I can tell you that housing prices will go lower. Because housing prices depend on the stability of employment.By definition then, companies will always grow faster than housing, in aggregate.Average income for people age 18-35 has done from $36,000 to $33,000 in the past twenty years. While debt has increased 100x. Not good.WHY DO PEOPLE ALWAYS ARGUE FOR HOUSINGThere’s something called “investment bias”. Your brain thinks, “I’ve just made the biggest investment of my life so it must be right”.Your brain loves you. It doesn’t want you to think it made a bad decision for you. It’s scared you won’t use it anymore.So it tells you, “that $200,000 down was the best decision you ever made. Everything else involves flushing money down the toilet, or no roots, or no stability!” So it’s hard to consider the alternatives.It’s a lot of work to own a house also. Have you ever spent time in the Death Star? I mean Home Depot. That place is huge. And I only need that one special color of paint.But where is it? The stormtroopers at Home Depot are never around when you need them.And what about that “snake” that can clean my toilet. Where is it? And how do I use it? And is it gross? Why do they call it a snake?It’s no wonder that plumbing is one of the highest paid professions in America.And how long does it take to paint a house. Or who do I go to? And will they overcharge me if they pave the driveway?Did I calculate that into my total cost of owning a house?I like to sit in the garden area of Home Dept. There’s thousands of flowers and plants and it smells like dirt.To be honest, that’s the closest I will ever get to hiking – sitting in the garden area of Home Depot.I’m pathetic. And I flush my rent down the toilet. And I don’t have roots. And I refuse to fix my toilets or shovel my driveway or deal with my flooded basement. All I like to do is read.And one day I’ll move. Maybe next to an ocean. And take a walk on the beach. Last week, a friend told me the sun sets in the West.Maybe one day I’ll move to California. Five years until my youngest graduates.I’ll sit on the porch and watch the sun set and have cash in the bank (I hope) while someone is fixing my toilet.When the sun has 15 minutes yet to live that day, maybe I will feel like I’m falling in love.Read More: Why I Am Never Going to Own a Home Again - Altucher Confidential

-

Does a girlfriend have to fill out a leave request form for a US Army Soldier in Special Operations in Africa?

Let me guess, you've been contacted via email by somebody you’ve never met. they've told you a story about being a deployed soldier. At some stage in the dialogue they’ve told you about some kind of emotional drama, sick relative/kid etc. They tell you that because they are in a dangerous part of the world with no facilities they need you to fill in a leave application for them. Some part of this process will inevitably involve you having to pay some money on their behalf. The money will need to be paid via ‘Western Union’. Since you havent had much involvement with the military in the past you dont understand and are tempted to help out this poor soldier. they promise to pay you back once they get back from war.if this sounds familiar you are being scammed. There is no soldier just an online criminal trying to steal your money. If you send any money via Western Union it is gone, straight into the pockets of the scammer. you cant get it back, it is not traceable, this is why scammers love Western Union. They aernt going to pay you back, once they have your money you will only hear from them again if they think they can double down and squeeze more money out of you.Leave applications need to be completed by soldiers themselves. They are normally approved by their unit chain of command. If there is a problem the soldier’s commander will summon them internally to resolve the issue. This is all part of the fun of being a unit commander!! If the leave is not urgent they will wait for a convenient time during a rotation etc to work out the problems, if the leave is urgent (dying parent/spouse/kid etc) they will literally get that soldier out of an operational area ASAP. Operational requirements come first but it would need to be something unthinkable to prevent the Army giving immediate emergency leave to somebody to visit their dying kid in hospital etc.The process used by the scammers is known as ‘Advance fee fraud’ and if you want to read about the funny things people do to scam the scammers have a read over on The largest scambaiting community on the planet!

-

How do I fill my address in the SSC form if I live on rent and don’t have a permanent address? I feared for police verification.

Hari om, you are asking a question as to: “How do I fill my address in the SSC form of I live on rent and don't have a permanent address? I feared for Police verification.”Hari om.You will not get a Government job without Police verification. Police verification is a must before giving you the Government job.Rented house is no problem.But, give factual details of your residences where ever you have Stayed in the last 5 years .This is very essential for Government jobs. This is the reason elders advise you not to enter into Police records during students life.Hari om.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the request for verification of rent or mortgage form 100116822

How to make an electronic signature for the Request For Verification Of Rent Or Mortgage Form 100116822 online

How to make an electronic signature for your Request For Verification Of Rent Or Mortgage Form 100116822 in Chrome

How to generate an electronic signature for putting it on the Request For Verification Of Rent Or Mortgage Form 100116822 in Gmail

How to make an eSignature for the Request For Verification Of Rent Or Mortgage Form 100116822 right from your mobile device

How to create an eSignature for the Request For Verification Of Rent Or Mortgage Form 100116822 on iOS

How to create an eSignature for the Request For Verification Of Rent Or Mortgage Form 100116822 on Android devices

People also ask

-

What is a verification of mortgage form?

A verification of mortgage form is a document used to confirm details regarding a borrower's mortgage. It typically includes information about the loan amount, payment history, and outstanding balance. This form is essential for lenders and buyers during the mortgage approval process.

-

How can I complete a verification of mortgage form using airSlate SignNow?

With airSlate SignNow, you can easily complete a verification of mortgage form by uploading your document and utilizing our eSigning features. The intuitive interface allows you to fill out required fields and add your digital signature quickly. This streamlines the process, making it efficient and straightforward.

-

Are there any costs associated with using airSlate SignNow for verification of mortgage forms?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is affordable and provides access to features like document templates and secure eSigning. You can check our pricing page for more details on costs and features associated with verification of mortgage forms.

-

What features does airSlate SignNow offer for verification of mortgage forms?

airSlate SignNow provides several features for managing verification of mortgage forms, including customizable templates and secure eSigning options. Additionally, you can track document status, send reminders, and integrate with other platforms for a seamless experience. These features enhance efficiency and reliability in handling mortgage-related documents.

-

What are the benefits of using airSlate SignNow for mortgage documents?

Using airSlate SignNow for your verification of mortgage forms offers signNow benefits, such as speed, security, and improved collaboration. The platform ensures that all your documents are securely stored and accessible, facilitating quick modifications and approvals. This not only saves time but also enhances the overall user experience.

-

Can I integrate airSlate SignNow with my existing systems for verification of mortgage forms?

Absolutely! airSlate SignNow supports various integrations with popular applications and systems. This allows you to manage verification of mortgage forms seamlessly within your current workflow, ensuring that all your tools work together efficiently for optimal productivity.

-

Is airSlate SignNow user-friendly for new users preparing a verification of mortgage form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for new users. The platform offers step-by-step guidance and straightforward navigation for preparing a verification of mortgage form. You can quickly learn how to use all the features available to streamline your document processes.

Get more for Verification Of Mortgage Payment Form

- St 8 form ga

- Estate claim form 100431962

- Confirmation of cessation of employment form

- Peer review questionaire peer review questionaire form

- Cg 1650 form

- Import permit application form

- Fillable online 568e declaration of source funds fax form

- Patuharakeke whale stranding guidelines 160310docx patuharakeke maori form

Find out other Verification Of Mortgage Payment Form

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form