Fannie Mae Form 1005 Example

Understanding the Fannie Mae Form 1005 Example

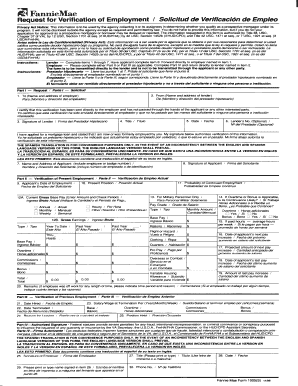

The Fannie Mae Form 1005 is a critical document used primarily for verifying employment and income for mortgage applications. This form is essential for lenders to assess the borrower's financial stability and ability to repay the loan. It typically includes detailed information about the borrower's employment history, income sources, and any additional relevant financial data. Understanding the specifics of this form can help ensure that it is completed accurately, which is vital for the loan approval process.

Steps to Complete the Fannie Mae Form 1005 Example

Completing the Fannie Mae Form 1005 involves several key steps to ensure all required information is accurately provided. Begin by gathering necessary documentation, such as pay stubs, W-2 forms, and tax returns. Next, fill out the form with accurate details regarding employment history, including employer names, addresses, and the duration of employment. It is crucial to provide precise income figures, including bonuses and overtime, if applicable. After completing the form, review it for any errors or omissions before submitting it to the lender.

Legal Use of the Fannie Mae Form 1005 Example

The Fannie Mae Form 1005 must be completed in compliance with relevant laws and regulations governing mortgage applications. This includes adhering to the standards set forth by the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA). Ensuring that the form is filled out correctly and submitted in accordance with these legal requirements is essential for protecting both the borrower and the lender. Additionally, utilizing a secure electronic signing platform can help maintain the document's integrity and legal standing.

Key Elements of the Fannie Mae Form 1005 Example

Several key elements are critical to the Fannie Mae Form 1005. These include the borrower's personal information, employment details, and income verification. The form requires the borrower to provide their full name, Social Security number, and contact information. Employment details should include the employer's name, address, and phone number, along with the borrower's job title and length of employment. Income verification must encompass all sources of income, including base salary, bonuses, and any other relevant financial information.

Form Submission Methods for the Fannie Mae Form 1005 Example

The Fannie Mae Form 1005 can be submitted through various methods, depending on lender preferences. Typically, lenders accept submissions via mail, in-person delivery, or electronically through secure eSignature platforms. When submitting the form, ensure that all required documents are included to avoid delays in processing. Electronic submission is often the fastest method, allowing for immediate confirmation of receipt and reducing the risk of lost documents.

Examples of Using the Fannie Mae Form 1005 Example

Examples of using the Fannie Mae Form 1005 include scenarios where borrowers are applying for conventional loans, refinancing existing mortgages, or seeking government-backed loans. Each of these situations requires accurate income and employment verification to support the loan application. For instance, a self-employed individual may need to provide additional documentation, such as profit and loss statements, alongside the completed form to demonstrate their income stability.

Quick guide on how to complete fannie mae form 1005 example

Complete Fannie Mae Form 1005 Example effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without hold-ups. Manage Fannie Mae Form 1005 Example on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Fannie Mae Form 1005 Example with ease

- Locate Fannie Mae Form 1005 Example and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Form your signature using the Sign tool, which takes moments and carries the same legal authority as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fannie Mae Form 1005 Example and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fannie mae form 1005 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fannie Mae form 1005 example?

A Fannie Mae form 1005 example is a document used to verify borrower employment and income as part of the mortgage application process. It plays a crucial role in assessing a borrower’s financial situation. By providing a clear example of this form, you can better understand the data needed for a smooth mortgage approval process.

-

How can airSlate SignNow help with Fannie Mae form 1005?

airSlate SignNow simplifies the process of filling out and eSigning Fannie Mae form 1005. Our platform allows for easy collaboration, enabling multiple users to complete the form seamlessly. This streamlines the mortgage application process and ensures that all necessary details are accurately captured.

-

What features does airSlate SignNow offer for Fannie Mae form 1005?

airSlate SignNow offers features like eSignature, real-time collaboration, and document tracking for Fannie Mae form 1005. This ensures that all parties can efficiently complete and sign the document without delays. Additionally, our platform provides templates that can save you time when preparing standardized forms.

-

Is there a cost associated with using airSlate SignNow for Fannie Mae forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our plans provide access to essential features like eSigning and document management to easily handle Fannie Mae form 1005. You can choose a plan that best fits your volume of documents and usage requirements.

-

Can I integrate airSlate SignNow with other software for Fannie Mae form 1005?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems. This allows you to manage your Fannie Mae form 1005 alongside other documents, ensuring a streamlined workflow and easy access to all necessary information.

-

What are the benefits of using airSlate SignNow for Fannie Mae form 1005?

Using airSlate SignNow for Fannie Mae form 1005 offers numerous benefits, including increased speed and efficiency in document signing processes. Our platform reduces paper usage and enhances compliance with digital storage options. You’ll also have access to advanced features like templates and document analytics for better management.

-

Is airSlate SignNow secure for managing Fannie Mae form 1005?

Yes, security is a top priority for airSlate SignNow. Our platform adheres to stringent security protocols and employs encryption to protect sensitive information on Fannie Mae form 1005. You can rest assured that your documents and data are safe throughout the entire signing process.

Get more for Fannie Mae Form 1005 Example

Find out other Fannie Mae Form 1005 Example

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple