Gst62 Fillable PDF Form

What is the Gst62 Fillable Pdf

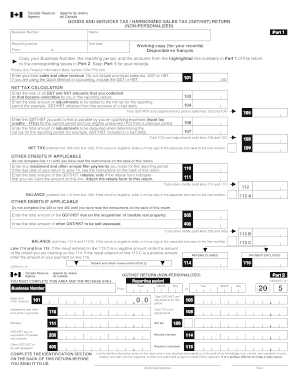

The Gst62 fillable PDF is a specific form used for filing Goods and Services Tax (GST) and Harmonized Sales Tax (HST) returns in Canada. It is designed to help businesses accurately report their tax obligations. This form allows users to enter their information directly into the PDF, making it easier to complete and submit. The fillable format is particularly useful for ensuring that all necessary fields are completed before submission, reducing the likelihood of errors that could lead to compliance issues.

How to use the Gst62 Fillable Pdf

Using the Gst62 fillable PDF is straightforward. First, download the form from a reliable source. Once downloaded, open the PDF using a compatible PDF reader that supports fillable forms. You can then click on each field to enter the required information, such as your business details, tax amounts, and any applicable deductions. After filling out the form, review all entries for accuracy. Finally, save the completed form and proceed to submit it according to the guidelines provided by the relevant tax authority.

Steps to complete the Gst62 Fillable Pdf

Completing the Gst62 fillable PDF involves several key steps:

- Download the Gst62 fillable PDF from an authorized source.

- Open the form in a compatible PDF reader.

- Fill in your business information, including name, address, and tax identification number.

- Provide details of your sales, purchases, and any input tax credits.

- Double-check all entries for accuracy to avoid mistakes.

- Save the completed form to your device.

- Submit the form electronically or print it out for mailing, following the submission guidelines.

Legal use of the Gst62 Fillable Pdf

The Gst62 fillable PDF is legally binding when completed and submitted in accordance with tax regulations. To ensure its validity, it is essential to provide accurate information and comply with the filing deadlines set by tax authorities. Using a secure platform for submission can also enhance the legal standing of the document. The form must be signed electronically or physically, depending on the submission method chosen, to affirm the authenticity of the information provided.

Key elements of the Gst62 Fillable Pdf

Several key elements make up the Gst62 fillable PDF, including:

- Business Information: Name, address, and tax identification number.

- Sales and Purchases: Detailed reporting of taxable sales and purchases made during the reporting period.

- Input Tax Credits: Claims for tax credits on purchases related to business activities.

- Net Tax Calculation: The final calculation that determines the amount owed or refunded.

- Signature Field: A section for the taxpayer's signature, confirming the accuracy of the information.

Filing Deadlines / Important Dates

Filing deadlines for the Gst62 form are critical for compliance. Typically, businesses must submit their GST/HST returns quarterly or annually, depending on their reporting frequency. The deadlines vary based on the fiscal year-end of the business. It is essential to be aware of these dates to avoid penalties. Keeping a calendar with reminders can help ensure timely submissions and maintain compliance with tax obligations.

Quick guide on how to complete gst62 fillable pdf 87540248

Complete Gst62 Fillable Pdf seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly and without interruption. Manage Gst62 Fillable Pdf on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Gst62 Fillable Pdf effortlessly

- Locate Gst62 Fillable Pdf and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature utilizing the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Gst62 Fillable Pdf to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst62 fillable pdf 87540248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HST return?

An HST return is a form that businesses file with the Canada Revenue Agency to report their Harmonized Sales Tax (HST) collected on sales. It's essential for businesses to comply with tax regulations and avoid penalties. By using airSlate SignNow, you can easily eSign and send your HST returns electronically, streamlining the process.

-

How can airSlate SignNow help manage my HST return?

airSlate SignNow simplifies the process of managing your HST return by providing a user-friendly interface to prepare, sign, and send documents securely. You can collaborate with team members and clients in real-time, ensuring that all necessary individuals are involved in the HST return process. Plus, our platform offers templates to make creating your returns even quicker.

-

Is there a cost associated with using airSlate SignNow for HST returns?

Yes, airSlate SignNow offers various pricing plans that fit different business needs. Our cost-effective solution ensures that you only pay for what you use, making it a great choice for businesses preparing HST returns. We also offer a free trial, allowing you to explore our features before committing to a plan.

-

What features does airSlate SignNow offer for HST return management?

The platform provides features such as eSigning, document templates, and secure cloud storage, all tailored to enhance your HST return process. Additionally, you can track the status of your documents in real-time and send reminders to ensure timely submissions. These tools streamline compliance and make managing HST returns hassle-free.

-

Can I integrate airSlate SignNow with my accounting software for HST returns?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing your workflow for HST returns. This integration ensures that data is consistent across platforms, reducing errors and saving you time during tax season. Our API allows for easy customization to fit your specific needs.

-

How secure is the information shared when filing HST returns through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect the information you share while filing HST returns. Additionally, our compliance with industry standards ensures that your documents are kept safe and secure throughout the entire signing process.

-

Can multiple users collaborate on an HST return using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on an HST return document. You can invite team members to review, edit, and sign the return, making the process more efficient. This collaborative feature helps ensure accuracy and completeness in your HST return filings.

Get more for Gst62 Fillable Pdf

- Signed thisday of 20 at howardforums form

- Character bio template form

- Tax file number online form

- To download a tax form and instructions home decatur alabama

- Iowa statutory power of attorney form

- Convertible note agreement template form

- Convertible loan startup agreement template form

- Convertible note purchase agreement template form

Find out other Gst62 Fillable Pdf

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure