Form W8 November

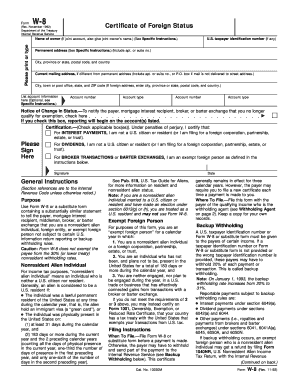

What is the Form W-8?

The IRS Form W-8 is a series of forms used by foreign individuals and entities to certify their foreign status for tax purposes. This form helps to establish that the individual or entity is not subject to certain U.S. tax withholding requirements. The most commonly used version is the Form W-8BEN, which is specifically for individuals, while the W-8BEN-E is for entities. These forms are essential for non-U.S. persons receiving income from U.S. sources, such as dividends, interest, or royalties.

Steps to Complete the Form W-8

Completing the Form W-8 involves several key steps to ensure accuracy and compliance:

- Identify the correct form: Determine whether you need the W-8BEN or W-8BEN-E based on your status as an individual or entity.

- Provide personal information: Fill in your name, country of citizenship, and address. For entities, include the legal name and address of the business.

- Claim tax treaty benefits: If applicable, indicate any tax treaty benefits you are claiming to reduce withholding tax rates.

- Sign and date the form: Ensure you sign and date the form to validate it. An unsigned form may not be accepted.

Legal Use of the Form W-8

The Form W-8 is legally binding when completed accurately and submitted to the appropriate withholding agent. By submitting this form, the individual or entity certifies their foreign status and claims any applicable benefits under U.S. tax treaties. It is crucial to keep this form updated, as any changes in circumstances may affect its validity. Failure to provide a valid W-8 form can result in higher withholding tax rates being applied to income received from U.S. sources.

How to Obtain the Form W-8

The IRS Form W-8 can be obtained directly from the IRS website. The forms are available in PDF format and can be printed for completion. It is important to ensure you are using the most current version of the form, as outdated forms may not be accepted. Additionally, many financial institutions and withholding agents may provide their own versions of the W-8 form, which can be used as well.

Filing Deadlines / Important Dates

There are no specific filing deadlines for the Form W-8 itself, but it must be submitted before any payments are made to ensure the correct withholding tax rate is applied. It is advisable to provide the form as soon as you know you will be receiving income from U.S. sources to avoid unnecessary withholding. Regular updates may be required, especially if there are changes in your status or the applicable tax treaty provisions.

Examples of Using the Form W-8

Here are some common scenarios where the Form W-8 is utilized:

- Foreign investors: A non-U.S. resident receiving dividends from a U.S. corporation would use the W-8BEN to claim reduced withholding tax rates.

- Foreign entities: A foreign company providing services to a U.S. client may need to submit the W-8BEN-E to certify its foreign status and claim treaty benefits.

- Royalties: A foreign author receiving royalties from a U.S. publisher would complete the W-8BEN to ensure the correct tax treatment of the income.

Quick guide on how to complete form w8 november

Complete Form W8 November effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed files, allowing you to access the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form W8 November on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to alter and eSign Form W8 November without any hassle

- Find Form W8 November and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, lengthy form searches, or errors that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Alter and eSign Form W8 November and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w8 november

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form W-8, and why do I need it?

The IRS Form W-8 is a tax form used by foreign individuals and entities to signNow their foreign status and claim a reduced rate or exemption from withholding taxes on income received in the U.S. If your business engages with international clients, you'll need this form to ensure compliance and avoid unnecessary withholdings.

-

How does airSlate SignNow simplify the completion of the IRS Form W-8?

airSlate SignNow provides a user-friendly platform that allows users to fill out and eSign the IRS Form W-8 quickly and easily. With templates and intuitive editing tools, businesses can streamline the process, ensuring accuracy and compliance without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for IRS Form W-8?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. These plans are designed to provide excellent value for those needing to manage documents like the IRS Form W-8, allowing you to save time and reduce operational costs.

-

Can I integrate airSlate SignNow with other applications for managing IRS Form W-8?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, including CRM and accounting software. This functionality allows you to manage the IRS Form W-8 seamlessly alongside your other business processes.

-

What features does airSlate SignNow offer for enhancing the IRS Form W-8 signing process?

airSlate SignNow includes features like eSignature, document templates, and real-time tracking, which enhance the signing process for the IRS Form W-8. These features help ensure that documents are completed accurately and efficiently, improving overall workflow.

-

How secure is my information when using airSlate SignNow for IRS Form W-8?

Your information is secure with airSlate SignNow, which utilizes industry-leading encryption and compliance practices to protect your data. When filling out and storing the IRS Form W-8, you can trust that your sensitive information is well-protected.

-

Can I access my completed IRS Form W-8 anytime using airSlate SignNow?

Yes, once you've completed and eSigned the IRS Form W-8 through airSlate SignNow, you can access your document anytime from any device. This flexibility ensures that you can retrieve important tax forms whenever needed.

Get more for Form W8 November

- The helmsman uscg u s coast guard uscg form

- Dr 0563 form

- Instructions for filing a wireless facilities form

- Sticky note form

- Legal invoice template form

- Health information departments h

- Registration form for college credit bethel college bethelcollege

- Instructions for permit application to import restricted form

Find out other Form W8 November

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template